Russia has a total installed capacity of 225.5GW, with a nuclear capacity of 22GW. The country has 31 operating nuclear reactors, varying between pressurised water reactor (PWR), fast breeder reactor (FBR) and light water-cooled graphite-moderated reactor (LWGR) types.

Nuclear generation was about 153bn kilo Watt hours (BkWh) in 2009. Energoatom Concern OJSC is the key player in Russia’s nuclear power industry. The nuclear power contribution is about 15% of total electricity production. The electricity sector in the country is largely based on thermal and hydro sources.

The Russian Federal Supervision of Nuclear and Radiological Safety (Gosatomnadzor) is the nuclear regulatory authority of Russia. The nuclear policy of the country mainly focuses on the safe use of nuclear energy, and the Russian nuclear energy industry is planning to build reactors with advanced features to ensure low capital and power costs, higher service life and a higher rate of utilisation.

Trends and developments

The key drivers for nuclear energy in Russia are an increasing demand for power, improved power plant performance, strong public support for nuclear energy, a target to reduce natural gas usage and the depletion of natural gas reserves in the Western Siberian gas fields. Although Russia is a world leader in the nuclear industry, it needs to address concerns about its ageing power plants and a lack of funds to further develop nuclear energy in the country.

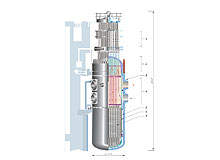

The key trends in reactor technologies include developing an advanced VK-300 boiling water reactor (BWR). The country is also planning to build a prototype SVBR modular lead-bismuth cooled fast neutron reactor. Improving the performance of power plants and developing the necessary infrastructure for increasing the productivity of its uranium mines continue to be Russia’s prime areas of improvement.

Russia is planning to increase the share of nuclear energy in the country’s power sector. It aims to at least double its current installed capacity by 2020, and the country’s share of nuclear energy is expected to grow to 25% by 2030. It is planning to establish international centres for nuclear fuel enrichment, reprocessing and the training of personnel.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe Russian government is seeking investments in the nuclear power generation sector to enable the involvement of more players. Nuclear exports continue to be the country’s primary focus. It has implemented the advanced reactor designs of VVER-1000 in China and India. Russia also has plans to build a VK-300 BWR and a prototype lead-bismuth fast reactor (SVBR).

The Russian government is planning to privatise its power sector. Currently, about 25% of the power supplied in the country is sold on the competitive market. By 2011, the entire power market in Russia is expected to be privatised, opening opportunities for investments in the Russian power sector.