The policy of additional funding to local authorities has been designed to incentivise them to grant planning permission and support exploration. As well as fracking, where a mixture of water, sand and chemicals is used to fracture underground rocks to release gas, councils will also receive the entire business rate pot for renewable energy projects, such as wind farms or solar parks.

With around 176 licenses for exploration already awarded, and more due when the winners from round 14 are announced later this year, the government is keen to quicken the pace of development of UK shale.

Announcing the increased share for communities, UK Prime Minister David Cameron, made his position quite clear. "A key part of our long-term economic plan to secure Britain’s future is to back businesses with better infrastructure," Cameron said. "That’s why we’re going all out for shale. It will mean more jobs and opportunities for people, and economic security for our country."

The government claim that fracking is vital for easing economic strain, bringing an estimated 74,000 jobs, economic growth and lower gas bills to the public, particularly those closest to sites. But whether the public will be swayed by this remains to be seen.

See Also:

The licenses that are granted to site operators constitute only a small part of the preparations before ground is broken. Health and safety reviews, consent from authorities and a number of permits are also needed. But most important of all is receiving planning permission, which requires the backing of both the people and their local representatives.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNick Butler, chair of King’s Policy Institute and a former vice-president of strategy and policy at BP, raised doubts on whether a simple cash incentive would allay concerns. Speaking to the BBC, he said: "The challenge is public opinion in the areas where shale gas exists. I don’t think that just giving them a little bit more of the revenue is going to change the minds of those people."

Blackpool rocked public confidence

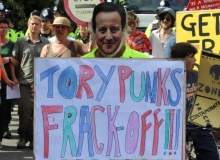

Fears over fracking increased in 2011 after extraction at the Preese Hall well in Blackpool was cited as a direct cause of a number of earthquakes in the area. In its own report on the incident, the government concluded that ‘the earthquake activity was caused by direct fluid injection into an adjacent fault zone’. Following this finding, public opposition to such activities has intensified and a series of protest groups have campaigned against companies awarded exploration licenses.

With such strong opposition and concern, Lawrence Carter, climate change campaigner at Greenpeace, believes the latest offer from government is nothing more than an attempt to buy off councils. "[Energy and business minister Michael Fallon] is effectively telling councils to ignore the risks and threat of large-scale industrialisation in exchange for cold hard cash," Carter said. "But the proposal reveals just how worried the government is about planning applications being turned down."

The Local Government Association, which acts on behalf of councils, welcomed the government announcement, but called for firmer action to govern the contribution made by industry. In addition to the business rate revenues, companies operating sites have committed to providing a one-off payment of £100,000 when testing begins, and a 1% share of any revenues generated from gas that is extracted.

The LGA would like these commitments to be formalised. An LGA spokeman said: "The community benefits of fracking should be enshrined in law, so companies cannot withdraw them to the detriment of local people. The LGA is encouraging the development of models, which will ensure the money would go into a charitable sovereign fund for community purposes and used to support local priorities."

Big oil dips toe into UK wells

One party that appears to be backing the government to succeed in developing the industry is French oil giant Total. The company, which is barred from extracting shale gas from its native land over environmental laws, has acquired a 40% stake in two shale gas exploration licences for Gainsborough Trough in the East Midlands.

The deal, which will see the company invest at least $21m (£12.7m), will see Total partner with site operator Island Gas (IGas), GP Energy, Egdon Resources and eCorp Oil & Gas. IGas will operate the site during the initial exploration stage, with Total taking over if a commercially viable amount of gas is found.

The entrance of Total marks the first time that one of the major international oil & gas companies has invested in the UK shale gas market and could spark an influx of new competition to the sector. Patrice de Viviès, Total’s senior vice-president for Northern Europe, said "This opportunity is an important milestone for Total E&P UK and opens a new chapter for the subsidiary in a promising onshore play."

Whether those against fracking can be bought remains to be seen, though it is unlikely that the business rate offering will suffice. But the simple fact that the government is making the offer, plus the going ‘all out for shale gas’ sound bite suggests that Cameron and Co are determined to push ahead. And if more of big oil follows Total into the UK shale gas market, the anti-fracking movement may well be brushed-aside.

Related content

Shale gas and fracking: the environmental impact

Shale gas fracking is set to resume in the UK, after a new report gave the controversial process the go-ahead.

US shale gas: game-changer or gameover?

Shale gas is on the rise in the US, projected to account for 46% of the country’s gas output by 2035.

.gif)