Hundreds of millions of dollars have been pledged to boost Africa’s carbon credits market 19-fold by 2030, as the first climate summit on the continent comes to a close in Nairobi.

Discussions have been focused on the African Carbon Markets Initiative (ACMI), which launched during COP27 last year in a bid to elevate carbon offsetting schemes on the continent. The ACMI aims to produce 300 million carbon credits annually by 2030 and 1.5 billion credits annually by 2050. It also hopes to support 30 million new jobs by the end of the decade and 100 million jobs by 2050. Leaders across the continent see the initiative as a much-needed way to unlock climate financing.

The United Arab Emirates (UAE) Carbon Alliance, a coalition of private sector players from the country, committed to buying $450m (Dh1.65bn) worth of carbon credits from the ACMI at the conference on Monday as African nations moved to galvanise climate finance. According to a report published last year by non-profit organisation Climate Policy Initiative, Africa has only received 12% of the funds needed to mitigate climate change and cope with the worst impacts of the crisis.

Climate Asset Management, a joint investment fund comprising HSBC Asset Management and specialist climate change advisory company Pollination, also pledged to invest $200m into ACMI projects. The UK said that projects worth up to $62m (£49.6m) would be announced of the course of the summit, with Germany announcing a £65m (€75.83m) debt swap with Kenya to aid the country in financing clean energy projects.

“There hasn’t been any success for an African country in attracting climate finance,” Bogolo Kenewendo, a UN climate adviser and former trade minister in Botswana, told Reuters.

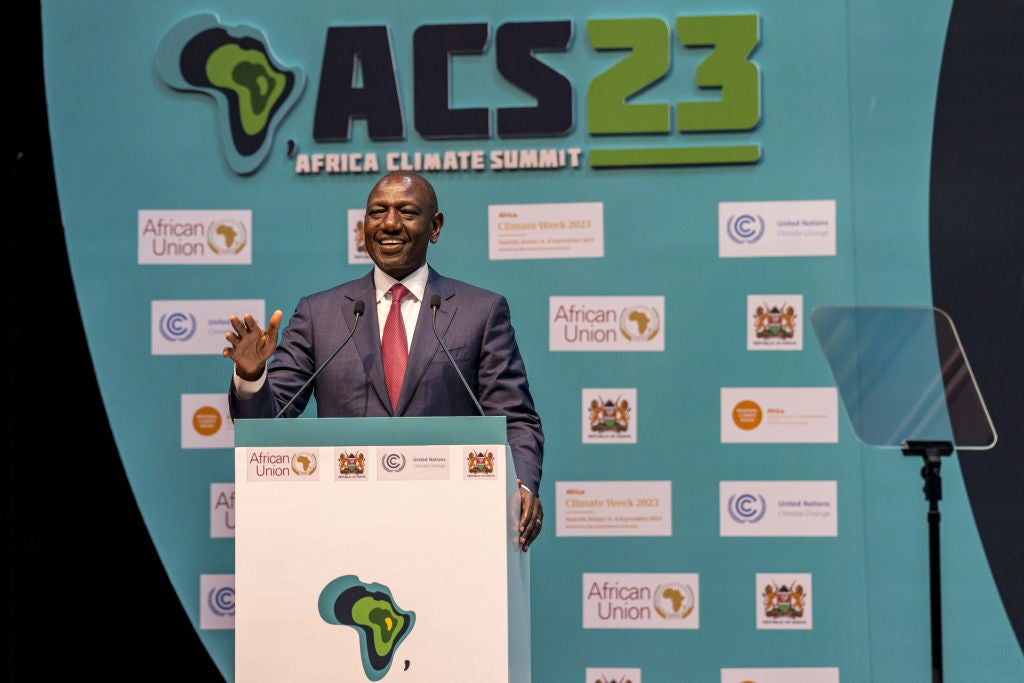

In his opening address, William Ruto, President of Kenya, said: “You have entered the future, a future driven by global partnerships committed to African prosperity, inclusive growth and a liveable planet for all of us. This is no ordinary summit,” Ruto said in his opening address.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“We must see in green growth, not just a climate imperative but also a fountain of multi-billion-dollar economic opportunities that Africa and the world is primed to capitalise,” he added.

Many African leaders are pushing market-based financing instruments to help meet global net-zero targets. Traditionally, carbon credits, which usually come in the form of green investment, are bought by companies to offset their carbon emissions.

However, in mid-July, the Voluntary Carbon Markets Integrity Initiative, an international non-profit organisation that defines standards for carbon credit trading, published an updated code of practice setting out rules on how to use carbon credits in ways that accelerate climate change mitigation.

Crucially, the new guidelines recommend that companies stop claiming that carbon credits offset, or “cancel out”, their own emissions, a move that shakes the core purpose of the voluntary carbon market.