Throughout the UK, an estimated 18 million people could save hundreds of pounds simply by switching energy supplier. But the process can be stressful and time consuming, and is often ignored by many busy Brits. Energy tech startup and IDEALondon alumni, Labrador, has come up with a solution in the form of an automatic switcher called the Retriever.

The Labrador Retriever can switch households to different utilities suppliers if they would benefit from deals better suited to their energy usage, using information gathered by a smart meter. As such, a household could gain the economic benefits of switching without any of the hassle.

In a recent investment round, the company successfully raised more than £1m from 30 different investors. This has funded a pilot project that saw savings of up to £1,700 in a year for some households, according to Labrador. As the government continues to roll-out smart meters, Labrador is hoping the Retriever will make some noise in 2018. Molly Lempriere learns more about the system from founder and CEO Jane Lucy.

Molly Lempriere (ML): Could you tell me how the Labrador Retriever works?

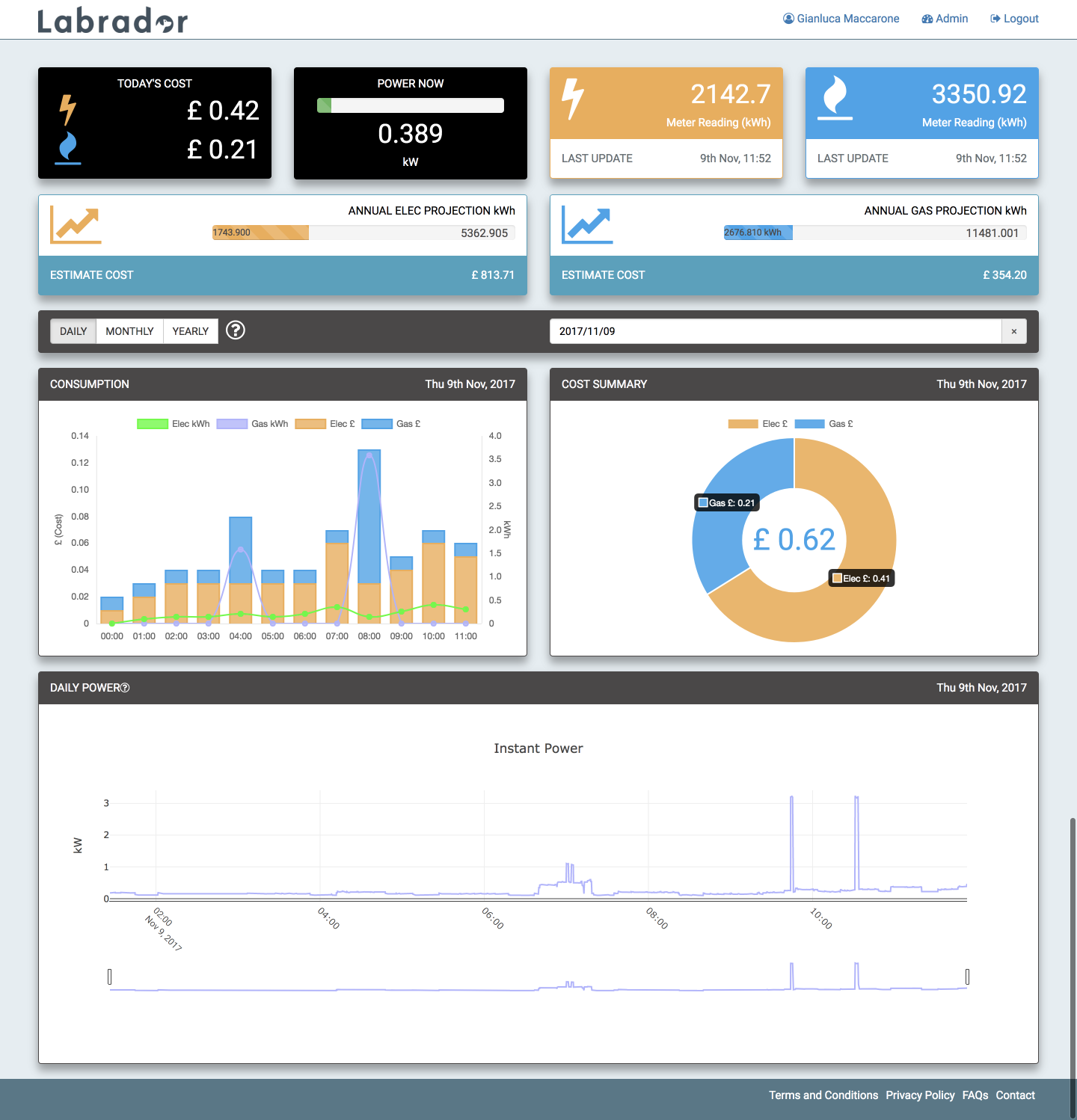

Jane Lucy (JL): The main device that we use is what the government calls a consumer access device (CAD). It’s not a piece of technology that we’ve come up with, there’s no IP in it. But, essentially, it is a gateway that pairs with smart meters – the household has a ZigBee home area network set up at installation which we use to pair to the meters and then we use the home broadband to send the data to our cloud.

The technology is unique in that it’s the only way to get granular data from smart meters in real-time. There are other routes to data through things like the Data Communications Company (DCC) or SMSO platforms, but they don’t provide access to the most granular data and access is not in real-time.

ML: How successful was your pilot project?

JL: Really successful. We’re intending to be a bit more visible in the market from Q1 of next year, so we’ve spent the time to date building up our technology. Whilst the CAD itself is not particularly complex in terms of the technology, the database the data is sent to is, in terms of being able to analyse and share that data in real-time.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSo we’ve built that platform, we’ve obtained ISO 27001 certification and we’ve built up a number of commercial relationships in order not just to bring our switching service to the market, but we’ve also discovered a number of other opportunities along the way in terms of the smart meter roll-out. Some of the issues and delays that have been involved can be solved by our technology at the same time.

ML: What sort of issues?

JL: Interoperability for instance. At the moment, a smart meter that’s installed by one supplier is often not able to be read by an inheriting supplier should a customer switch to them. So for instance, if you have a British Gas smart meter installed and you switch to Ovo energy, then Ovo doesn’t have the same SMSO platform as British Gas and the meter turns into what people call dumb mode – it’s no longer sending data to the energy supplier.

What we’ve done is a combination of things; we’ve integrated with the different SMSO platforms in the market and we’ve combined those platforms with our CAD technology to enable a service that can operate with a different business model. We can reduce comms charge costs in terms of using broadband over a sim card, and also provide an economy of scale in terms of us having done the integrations rather than requiring every single energy supplier to do their own – a model which particularly doesn’t work at low volumes.

So because we’ve done all the work, we can offer a pricing model that is just a simple flat fee per calendar month for as long as the energy supplier has that customer, to get the data to maintain smart services and without any upfront integration costs or the huge license fees associated with that.

ML: How secure is the data?

JL: We have ISO 27001 certification and aligned with that strategy, our database was originally designed by Thoughtworks, which is a global technology company with a strong reputation for this kind of thing. Then we’ve internalised that and brought in our CTO, who used to work for Thoughtworks and Equal Experts.

We’ve maintained a high standard within our technology team to ensure that we’re able to deliver a secure service.

ML: You mentioned that it’s not your technology, is there the possibility that there will be competitors trying to provide a similar service?

JL: Yes, in fact I’m surprised that we don’t already have them, so I’m sure they will come eventually. Whilst it might have made sense for people to focus on having a DCC strategy, given the delays with the DCC there will be a timeline before we see any scale with the DCC, and certainly it’s going to be some time before we see DCC enrolment with SMETS1. Again, I’m just still surprised that other people aren’t thinking that there’s an opportunity here.

ML: The benefits for the consumers are obvious, but what has the response from energy suppliers been like?

JL: Actually more positive than you think. Obviously people’s first reaction is ‘oh my god, churn is the last thing that the energy supplier wants’. But the reality is that the majority of them still get the bulk of their customer acquisition through price comparison services. So whilst there’s still a differential between the price they pay to acquire customers from services like us and the prices they pay for their own direct customer acquisition, then I think there will be a commercially beneficial relationship between switching services and suppliers.

I think, on top of that, if you talk to energy suppliers about their future strategies in terms of market differentiation and how they want to try to compete on things other than price alone, they tend to come back to requiring granular real-time data to support those types of strategies.

If a supplier decides to have a CAD put in, and then the customer churns away, that’s a stranded asset that they can’t use. Whereas our technology can survive that and therefore it’s got a different value proposition. So there are economies for suppliers to come to us for granular real-time data rather than deploy their own individual strategies in competition with each other.

ML: What do you think the energy sector will look like in the next ten to 15 years? Do you think there will be major changes in terms of digitisation and smart meters?

JL: I do, I think we’ll start to see change quicker than people think and I don’t think all suppliers will survive this transition. I think a number of them are not great with technology, there will be a steep learning curve, and I think when you throw things like the general data protection regulation (GDPR) into the mix that some companies are really going to struggle. So I suspect that we will see fewer energy suppliers in the future come out the other side.

In terms of how they diversify into additional added value propositions for customers, I’m not quite sure that suppliers have cracked the answer to that yet. Some people think that customers are going to be interested in data, they will be interested in things like gamification, they will want to input what appliances they have in their house and I fundamentally don’t believe in those ideas. I don’t think that energy will all of a sudden become exciting; I don’t think that people will become fascinated by data. I think they’re much more likely to respond to things that provide hassle-free, frictionless ways of doing things better, and services that are doing things for them – rather than requiring the customer to engage and change their behaviour to drive something at every step forwards.