The Lungmen (Dragon Gate) nuclear project in Taiwan was expected to come online in July 2009 (unit 1) and July 2010 (unit 2), and was expected to be operational by 2011 (unit 1) and 2012 (unit 2).

But following the Fukushima Daiichi nuclear crisis in 2011, a new nuclear policy was announced in November 2011. According to the new policy, the Lungmen plant’s construction would be allowed only after safety evaluations by the government and international nuclear safety organisations. The operational date of the plant is expected to be decided in 2012.

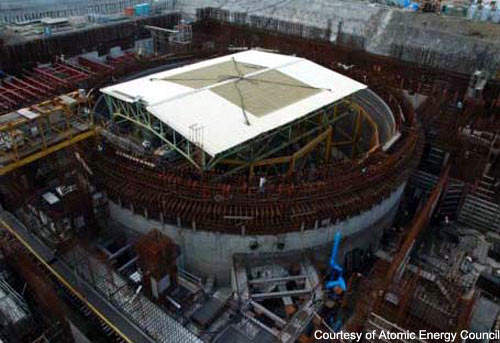

The project was earlier postponed due to additional fund requirements of $1.16-1.45bn, increasing the total cost of the project to $7.8-8.1bn. Although construction began in 1997, the plant has been delayed by political arguments and high material prices. The construction was temporarily halted in 2000 and resumed again in 2001. By December 2011, the project was more than 90% complete.

Lungmen is Taipower’s fourth and largest single investment in a broad building programme. Pressed by demand and the country’s uncomfortable exposure to foreign fossil fuel supply disruption risk, Taipower is determined to proceed. This is despite unprecedented protests against its plans and the total price tag of an initially estimated $6.5bn. Its opponents, mostly from the site area and opposition parties, were equally determined to stop what they saw as an unnecessary investment with very high risks.

Site construction is underway and it seems increasingly unlikely that it will be halted again. Taipower was issued a construction permit for Lungmen on 17 March 1999 and first concrete was poured in March 29. In October 2000, the Taiwanese Premier resigned. Nominally this was for health reasons, but commentators at the time suggested that disagreements over the huge Lungmen investment were more to be blamed.

Contract allocation for companies involved with the Lungmen project

GE won the contract to supply the reactors and steam generators in May 1996, with the lowest bid of $1.8bn. It was given final authority to proceed in October 1996, after pressuring the government to reverse the legislature’s freezing of funds. A substantial share of the order will be subcontracted to GE’s Japanese partners, Toshiba and Hitachi.

The three groups will use experience gained together on the Kashiwazaki-Kariwa ABWR project, on which Lungmen is modelled. Foxboro won the GE sub-contract to provide control and data acquisition systems, plus related engineering services.

GE won the reduced scope 1996 tender, which was subcontracted out to Black and Veatch. Other contenders were Combustion Engineering and an alliance between Westinghouse and UK generator Nuclear Electric (now British Energy), which proposed a project based on the UK Sizewell B plant.

Framatome did not bid, repeating its displeasure with the technical standards required by Taipower. SA Belgatom and Ebasco jointly provided engineering and evaluation services for bid evaluation through a $4m contract placed as early as 1992.

Mitsubishi Heavy Industries won a separate steam turbine and generator contract in October 1996. It also agreed an ‘offset’ contract reportedly worth $233m. Partnering its Japanese rivals and GE was an unusual exercise, but Mitsubishi was just as intent on building nuclear export successes, alone or in concert.

Another GE competitor to receive an albeit small benefit from the project was Daewoo Corporation’s construction division, which is providing the expertise to build nuclear power plants for Taiwan’s New Asia Construction and Development Corporation. Daewoo is providing technical consulting services to the Taiwanese construction firm, which also landed a contract to work on the first stage of nuclear power plant construction for a consulting fee of $5m.

Dragon Gate nuclear power plant make-up and design

The project involves a 2,700MW plant consisting of two 1,350MW units at Yenliao, on the north eastern tip of Taiwan, near the capital Taipei. The advanced boiling water reactor (ABWR) technology marks a departure from the utility’s three existing nuclear plants, which are smaller units completed in the late 1970s and early 1980s. US technology, however, will be a common thread from the first to the fourth plant. The units were initially planned to come on line in 2004 and 2005.

GE states that the ABWR has been designed to higher levels of safety, including being designed to prevent and mitigate consequences of a severe accident (e.g. a core melt). Licensing documents approved by the USNRC indicate that even in the event of a severe accident, there will be no release of radioactive material to the public.

Technology transferred to Taiwan as part of the Lungmen nuclear power project

The contract included technology transfer and local procurement requirements valued by Taiwanese sources at $360m, or 20% of the contract value.

Taipower will be GE’s lead partner in the transactions, which are divided 50/50 between nuclear power and other sectors. As in other heavy capital goods investments, such as aerospace deals, Taiwan has been careful to use these ‘offsets’ to limit the impact on its trade position, gradually reducing its technical dependence on foreign suppliers.

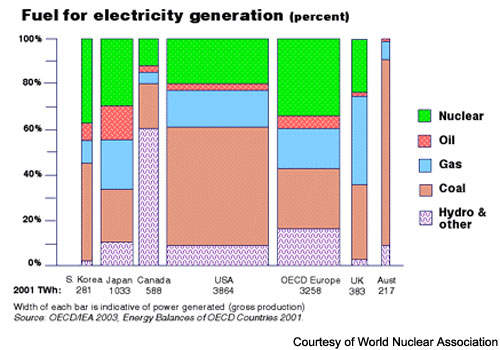

These conditions may be a small price to pay for the suppliers, who are intent on building solid nuclear equipment businesses in potentially enormous Asian export markets. Winning one of the few orders available, and on terms that were probably less onerous than those required in South Korea or China, was a major coup.

It was an especially important milestone for Toshiba and Hitachi, who had otherwise relied almost exclusively on their domestic nuclear market. GE already had deep roots in Taiwan – its longstanding joint venture with Taipower, United Asia Electric, is Taiwan’s only substantial power engineering group. But keeping the relationship active in the face of strong Taiwan challenges from Westinghouse, ABB and Siemens was an important defensive win.

Taiwanese power industry and Taipower’s importance

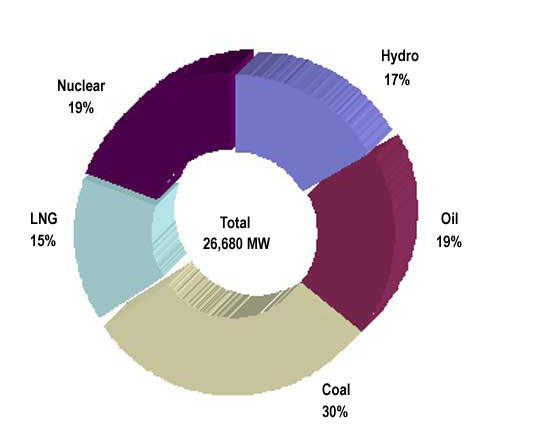

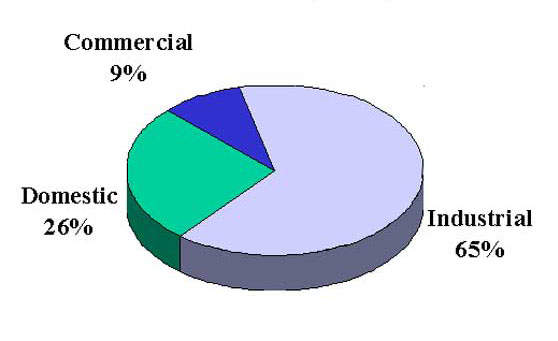

The state-run Taiwan Power Company (Taipower) is responsible for production and distribution of electric power in Taiwan. Around 70% of electricity in the country is produced through coal- and gas-fired plants, with ten percent from renewable sources such as hydro, wind, solar and biomass. More than 97% of the energy resources required are imported from other countries.

Taiwan has six nuclear units, out of which two are under construction. Installed capacity of nuclear power in Taiwan is 5,144MW. Nuclear power contributes 20% of the energy in Taiwan.

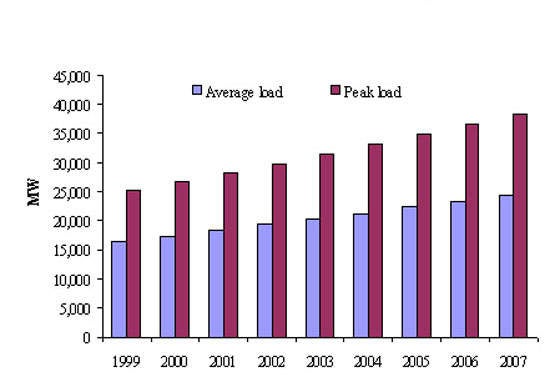

Electricity demand has been growing at a rate of five percent each year, but it has been reported that the growth will come down to 3.3% by 2013. Dependence on fossil fuel imports is increasing Taiwan’s expenditure and thermal generation is leading to greenhouse gas emissions and climate change. The government has made development of clean energy its top priority and has passed a legislative bill to produce 15% of installed capacity through a mix of renewable energy sources by 2025.

Though significant energy is contributed by nuclear power, it is not favoured by the public in Taiwan.