Leading up to the UK’s Round 7 auction (AR7) of offshore wind allocations, it had been estimated that at least 8GW had to be secured to avoid an unrealistic burden on AR8, and therefore on the government’s Clean Power 2030 plan.

In the event, AR7 secured a record capacity of 8.4GW, as announced on 14 January when the UK Government released the results of AR7 for the contracts for difference (CfD) scheme. Each round determines how much offshore wind power is commissioned, by which developers and at what price.

This auction will impact the success of the Clean Power 2030 plan, which requires clean sources to produce at least 95% of the UK’s electricity by 2030. Offshore wind is considered to be the backbone of that target.

Download sample pages of selected reports

Explore a selection of report samples we have handpicked for you. Get a preview of the insights inside. Download your free copy today.

According to analysis by the National Energy System Operator (NESO), the UK must increase capacity from approximately 15GW today to 43–50GW by 2030. Therefore, in addition to the wind power already under construction, the government must contract 16–23GW across the next two auction rounds, AR7 and AR8, to stay on track because, owing to construction timelines, only AR7 and AR8 can deliver the projects needed for 2030.

This was why AR7 needed to secure at least 8GW to avoid an unrealistic burden on AR8. Anything below 5GW, says NESU’s analysis, would have put the 2030 target at serious risk.

The capacity of the new projects is crucial, and so is the agreed strike price in pounds per megawatt-hour (MWh). Wholesale electricity prices, which are mostly set by the high price of gas, are currently around £85 ($114)/MWh; however, recent analysis from Auroraer shows that if strike prices are at or below £94/MWh, there will be no additional cost to billpayers.

There are substantial economic and security benefits to the UK from having independent electricity generation, including the investment cost benefit – new offshore wind is still a cheaper and faster route to bring new energy online compared to the cost of new gas-fired plants – protection from price spikes (estimated to have saved the UK economy £104bn between 2010 and 2023) and the opportunity for economic growth. Greenpeace reports an estimate that the supply chain for floating offshore wind farms in the Celtic Sea alone could support 5,000 jobs and contribute £1.4bn to the economy, while Offshore Energies UK has estimated that there is a £12bn a year investment opportunity for offshore wind.

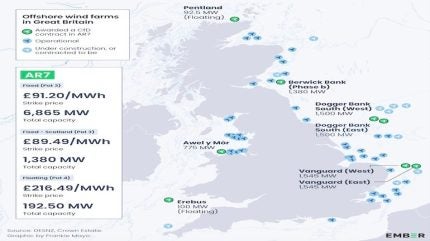

Location and size of AR7 developments

The map above shows the location and size of the new developments of fixed and floating offshore wind resulting from AR7. All the developments were agreed at a strike price of £91.20/MWh (2024 prices), except for Berwick Bank Phase b at £89.49/MWh, and Erebus and Pentland, both floating wind sites, each at £155.37/MWh.

Unlock up to 35% savings on GlobalData reports

Use the code at checkout in the report store

-

20% OFF

Buy 2 reports

Use code:

Bundle20

-

25% OFF

Buy 3 reports

Use code:

Bundle25

-

30% OFF

Buy 4 reports

Use code:

Bundle30

-

35% OFF

Buy 5+ reports

Use code:

Bundle35

Valid on all reports priced $995 and above. Cannot be combined with other offers.

Still deciding what will work best for your business?

Ask our experts for help.

Enquire before buying