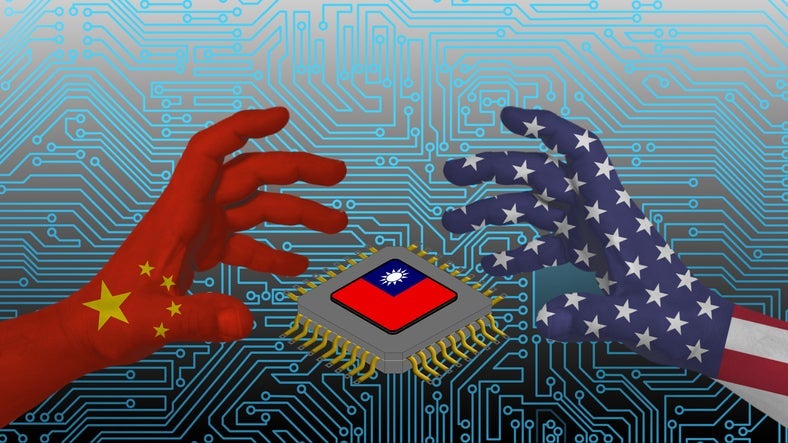

A sign of the rise of a self-reliant China that is aiming to assert global dominance in the semiconductor industry, came when Huawei surprised the world by unveiling its new 5G-capable smartphone, despite US sanctions on advanced microchip production.

China’s microchip breakthrough, if confirmed, will propel the country’s economy further and establish it as a key chip producer globally.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe announcement of Huawei’s new Mate 60 Pro, its first 5G-capable smartphone in nearly three years, defied the US sanction (imposed in October 2022) that was designed to limit the company’s production without Western help.

The October 2022 sanctions were reminiscent of the US sanctions imposed on ZTE in 2018, which pushed ZTE to the brink of bankruptcy.

According to a 2023 report by the Center for Strategic and International Studies (CSIS), this was a turning point in China’s strategic thinking when it came to the semiconductor industry. The 2018 sanctions highlighted China’s technological dependence on the US and its allies, with this being reinforced following the recent wave of sanctions in 2022. The need for technological independence seems to have been years in the making.

See Also:

How sanctions have influenced semiconductors

China has been a long-time and prominent player in the semiconductor industry, with giant companies such as Alibaba, Baidu, and Semiconductor Manufacturing International Corporation (SMIC). Investment in semiconductors has allowed China to ascertain global leadership in themes like 5G, artificial intelligence (AI), and e-commerce.

However, the US announced sanctions that would limit China’s access to Western semiconductor technology and curb its development of advanced microchips. “The sanctions were expected to pull back China’s progress by several years,” says Josep Bori, Director of GlobalData’s Thematic Intelligence.

The global chip shortage

The onset of the Covid-19 pandemic in 2020 disrupted the semiconductor supply chain, leading to a global chip shortage. The supply chain crumbled under the demand for remote work-enabling computer equipment and the increase in interest in 5G and cloud-based services.

China was not immune to this, and things got worse in October of 2022 when the US sanctions rolled in. The US sought to cripple China’s ability to purchase and produce advanced chips, fearing that the chip-integrated AI systems would welcome a new era of surveillance equipment and weapons. Japan and the Netherlands allied with the US in December 2022, with industry-leading suppliers such as ASML prohibited from selling its most advanced technology to China.

The semiconductor export ban posed a risk to the future of the Chinese economy. The China Semiconductor Industry Association (CSIA) opposes the US-led alliance, arguing that the sanctions will harm the domestic and global semiconductor industry. Chinese advanced chip giants such as SMIC and Yangtze Memory Technologies were starting to feel the effects of this. UNISOC, a Chinese firm specialising in mobile chipsets, pivoted to focus on the production of less advanced chips to combat the effects of the sanctions.

A light at the end of the tunnel

Huawei’s Mate 60 Pro, released in August 2023, utilises a Kirin 9000S 7 nanometer (nm) microchip, reportedly made by SMIC.

This raises several questions. First, whether China broke US sanctions or made a breakthrough in domestic chip production? Second, what level of government subsidies were required to compensate SMIC for manufacturing a 7 nm chip using legacy ASML’s deep ultraviolet (DUV) lithography systems, which can only achieve prohibitively low yields at that level of miniaturization? In other words, how economically sustainable is the engineering feat achieved by SMIC?

While the US investigates how this happened; it may be that the US sanctions served as a catalyst for self-reliance within the Chinese semiconductor industry. If China can successfully produce chips domestically, free from Western help, it could have profound implications for the future of the Chinese economy and the ongoing US-China tech war. China would not only reduce spending on semiconductor imports but speed up the progress of its domestic industries, from automobiles to consumer electronics.

With that said, China’s microchip is reportedly not as advanced as those produced by the likes of Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics, which produce 3nm and 4nm chips. A breakthrough like this will enable it to bridge the technological gap that the US is determined to maintain, positioning China as a world leader in chip production.

Related Company Profiles

Samsung Electronics Co Ltd

Taiwan Semiconductor Manufacturing Co Ltd

Baidu Inc

ZTE Corp

Semiconductor Manufacturing International Corp