GlobalData’s latest report, ‘Switchgears for Power Transmission, Market Size, Share and Trends Analysis by Technology, Installed Capacity, Generation, Key Players and Forecast, 2022–2027,’ reveals that the global switchgear market is likely to grow due to the increasing global demand for electricity.

Urbanisation and industrialisation are two factors contributing to the rising power demand. Environmental concerns, fuel resource challenges and a changing technology landscape are influencing changes within the power sector.

The growing demand for electricity is giving rise to the need for new power plants, particularly modes of generation that have minimal environmental impact. Several countries have begun to address deployment barriers, making efforts to create a conducive market for increasing the use of renewable energy technologies and gas-based generation. The falling capital cost and low gas prices increased the development of renewables and gas power plants. This contributed to the switchgear market, which is expected to continue as countries seek to increase the share of renewables and gas in their generation mix.

Renewables and gas are being preferred for new capacity construction due to the need to reduce emissions and coal supply constraints. Unlike coal or gas, renewable power generation is site-specific, with deployment based on potential resource sites, which are typically remote with no significant power transmission assets. The intermittent nature of renewable power generation would require the enhancement of the grid to support effective technology integration.

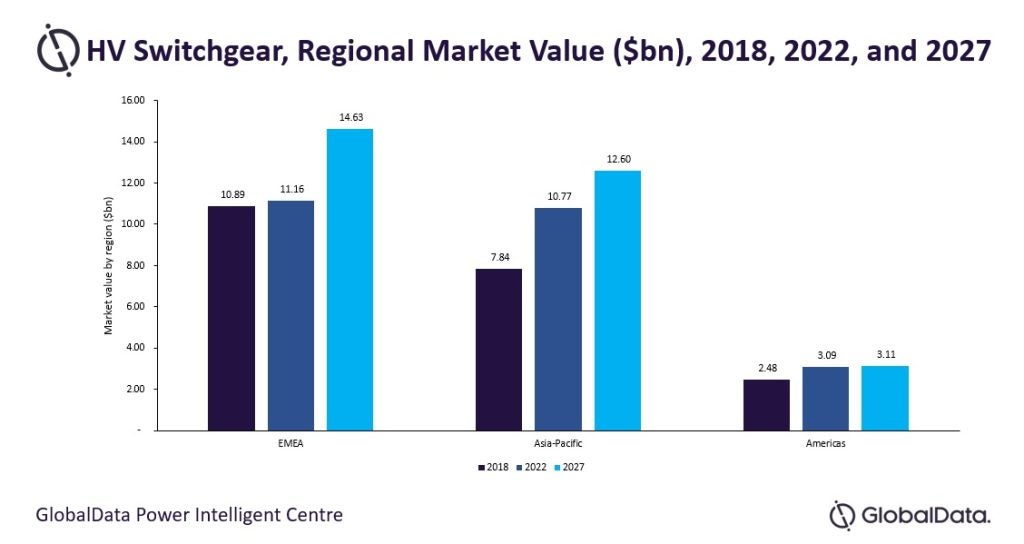

Improving grid reliability and energy security are two major driving forces in well-established power markets. Ageing infrastructure in these markets induces safety concerns, leading to significant downtimes and increasing operations and maintenance costs, impacting the credibility of utilities and grid operators. Developing or under-developed markets have huge potential for grid expansion to sustain the power demand from growing population and industrial activity. The global market for high-voltage (HV) switchgear was valued at $25.02bn in 2022 and is estimated to grow to $30.34bn in 2027 at a compound annual growth rate (CAGR) of 3.54% during 2023–27.

See Also:

GlobalData’s report finds that policies established to address environmental challenges and capitalise on market opportunities afforded by technologies would notably impact the switchgear market by the end of the forecast period. In 2022, EMEA led the global HV switchgear market, with a regional share of 44.60%, registering a market value of $11.16bn. Saudi Arabia, Russia, Germany and the UK are the largest markets in the region, contributing close to 15.2% of the HV switchgear market value in the region.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataEMEA comprises countries with diverse economies and geography. Other major geographies include GCC countries such as Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE). Turkey, Spain and South Africa are also major markets in the region. Pan-European regional interconnection and extensive addition of offshore wind farms are propelling the switchgear market in the UK and Germany.

The GCC countries registered a high growth rate and market value due to their growing population and the rising electricity demand resulting from the diversification of the economy away from oil. The EMEA market is expected to grow during the forecast period to reach $14.63bn in 2027.

Asia-Pacific was the second-largest market in 2022 in the HV switchgear market after EMEA. It registered a market value of $10.77bn, with a share of 43.05% of the global market in 2022. China, India and Japan are the three largest markets in the region, contributing more than 88% of the HV switchgear market value in Asia-Pacific. Traditionally, Asia-Pacific is one of the largest contributors to the GIS market, more than that of AIS. Non-OECD countries face various issues, including load stress and congestion. This has attracted investments and propelled the HV switchgear market. China and India are the top countries for HV switchgear, displaying rapid capacity additions in the generation and transmission sector.

Other countries, such as Japan and the Republic of Korea, also have high market potential for GIS in the region. Grid reliability and space constraints are the major factors contributing to GIS installations in the region. The other major countries include Vietnam and Indonesia, the switchgear manufacturing hubs in Asia-Pacific.

The Americas was the third-largest market in the global HV switchgear market in 2022, with a value of $3.09bn and a share of 12.35%. The US, Canada and Brazil are the three biggest markets in the region, contributing more than 90% of the HV switchgear market value. AIS is extensively used in the region, with a market share of 69%. However, the share of GIS is less. GIS is used only in urban load centres where substations face space and environmental constraints.

The US is the largest market for HV switchgear, with a value of $1.92bn in 2022, followed by Brazil and Canada, with a market share of $606.11m and $290.54m, respectively. The market is mainly propelled by the growing economy. However, the uncertain political and economic climate poses challenges to investments in the T&D sector.

Despite the uncertainties, the HV switchgear market is expected to grow due to the increase in power consumption owing to increased economic activities.

Source: GlobalData Thematic Research

Related Company Profiles

AIS Ltd.

Generation Company

UOP Asia Pacific Pte Ltd

GCC

KeyPlayers Inc