GlobalData’s latest report, ‘Austria Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Austria and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure and competitive landscape are provided, as well as a list of major power plants. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. In addition, an analysis of the deals in the country’s power sector is included in the report.

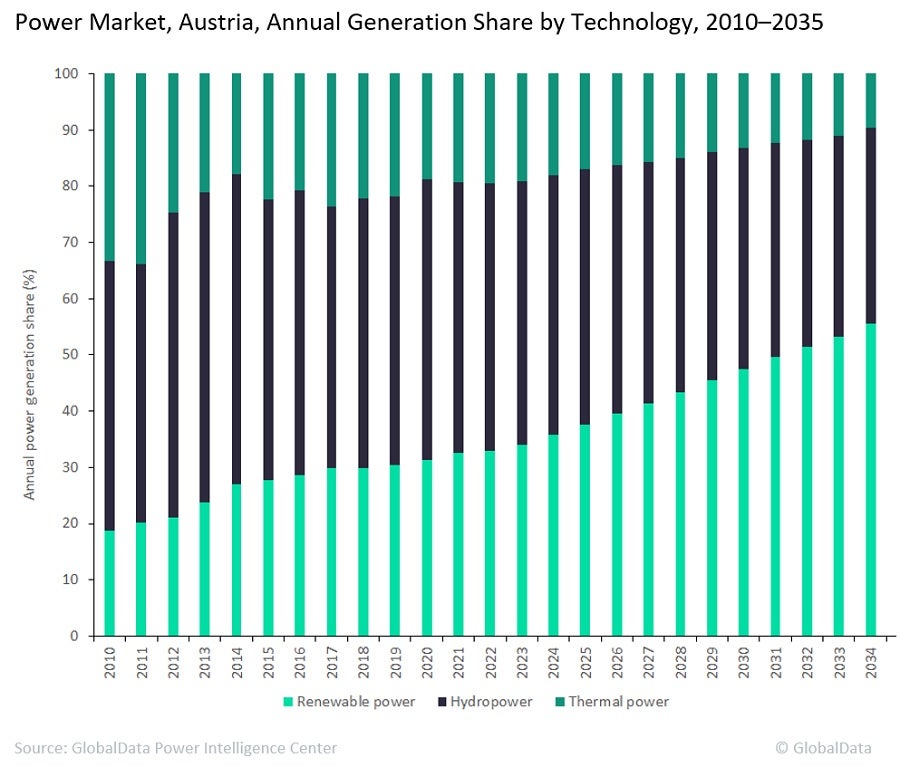

Austria submitted its National Energy and Climate Plan (NECP) 2021-2030 to the European Commission in 2019. The country’s NECP focuses on decarburisation and energy efficiency dimensions and related policies. The target for greenhouse gas emission reduction is set at 36% compared with 2005 levels. Austria’s NECP also points out the country’s sectorial objective of a 100% renewable electricity system by 2030. Despite this, electricity generation from renewables (including hydropower) accounted for 80.7% of Austria’s energy mix, and this is expected to increase to 86.8% in 2030.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGeneration from renewable power sources increased from 12TWh in 2010 to 20.4TWh last year at a combined annual growth rate (CAGR) of 4.9%. By 2035, generation from renewable energy sources is expected to increase to 51.3TWh at a CAGR of 6.8%. The government has been actively encouraging the use of renewable sources for energy generation to reduce dependence on fossil fuels. Solar photovoltaic (PV) and onshore wind constitute most of the installed renewable capacity.

Last month, the Austrian government presented its final version of the Renewable Energy Expansion Act – Erneuerbaren-Ausbau-Gesetz (EAG). The Act replaced previous subsidy mechanisms and EAG will provide market premiums for renewable power plants with the aim of developing the renewable sector for the next ten years. The country reiterated its renewable target under the new EAG to achieve a fully renewable electricity supply (national balance) by 2030. According to government sources, the country will need to generate an additional 27TWh from renewable sources by 2030. Of this, 11TWh is expected to be achieved from solar PV, 10TWh from wind, 5TWh from hydropower and 1TWh from biopower.

Austria’s proximity to severely Covid-impacted countries like France, Italy and Germany, as well as the incoming of large numbers of international tourists, led to the spread of the pandemic in the whole country. The country’s economy was strongly affected, with its gross domestic product (GDP) showing a 7.0% contraction in 2020. But by implementing early restrictive regulations and lockdowns in ‘hot zones’, the Austrian government tried to stop the spread of the pandemic. The economy of the country suffered a steep decline in March and early April, but recovered very fast after the restrictive measures were removed in May 2020.

Due to the slowing down of business activities across Austria, the country’s electricity demand declined. Many generation companies have shown a slight decline in first-quarter earnings because of the declined demand. The renewable power segment observed an increase in power generation compared with thermal and hydropower generation, which declined during this period. Many initiatives in the renewable segment, particularly in solar PV, were implemented by local associations with support from the government. This has helped local manufacturers and resellers cope and recover from the economic crises.

Related Company Profiles

EAG Inc.