Total power industry deals for Q2 2019 worth $31.13bn were announced globally, according to GlobalData.

The value marked an increase of 85.2% over the previous quarter and a drop of 24.05% when compared with the last four-quarter average of $40.99bn.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAlfonso Zuloaga, Head of Energy M&A, and Luca Matrone, Head of Energy, Corporate & Investment Banking Division, at top ten financial adviser Intesa Sanpaolo shed some light on the trends around recent M&As in the power industry.

Rachel Cordery (RC) What makes a company a target for takeover?

AZ and LM: In our view the main characteristics are as follows: firstly, the existence of a disruptive technology or business model in the context of the energy transition, and secondly, a sub-optimal scale. Thirdly, different strategic views of shareholders in the current evolution of the energy sector.

Subsequently, the need for financial resources to implement the company’s strategy, and finally, the possibility of vertical integration or of an expansion of the customer base.

(RC) What are the common themes behind the deals already done in the sector in recent months/quarters?

AZ and LM: The main themes of the past months were:

- Consolidation in the local utilities space

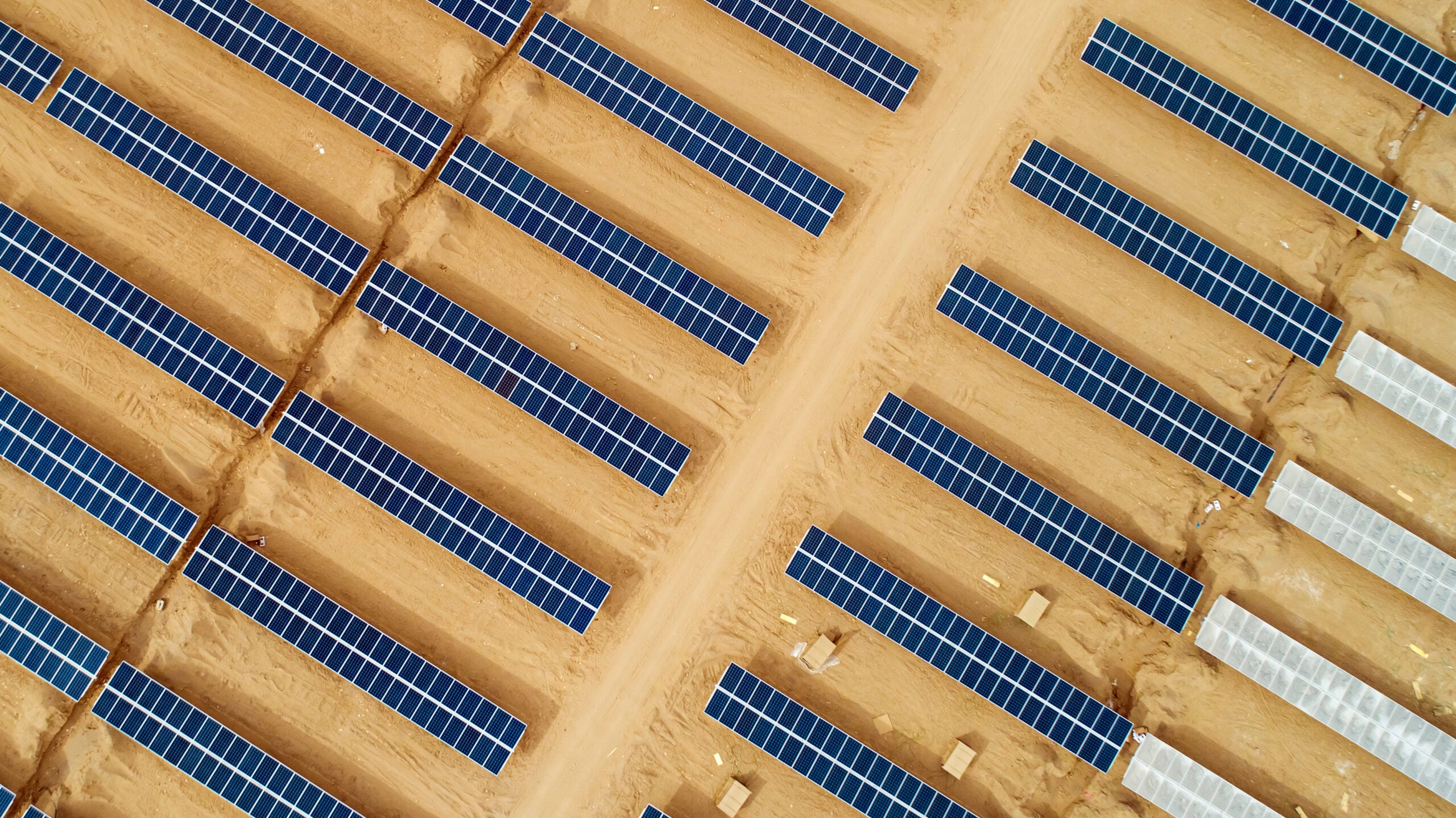

- Acquisitions of operating renewables portfolios

- Acquisition of clients’ portfolios

- And finally, JVs between financial investors and industrial players in the renewables sector and in the energy efficiency sector.

(RC) Where do you see the big opportunities for mergers and acquisitions activity in the future?

AZ and LM: We see that the above-mentioned trends will continue. In addition, we see an increased interest of financial investors that with abundant liquidity in the market are trying to find opportunities in the context of the significant market disruption coming from the energy transition.

We start also to see a greater interest in cross border deals from industrial players willing to expand or consolidate their positions in other geographical markets.