Electric vehicles (EVs) are an established cornerstone of the energy transition, with their increasing global adoption chipping away at a significant share of oil demand.

Fuel demand from cars and vans accounted for more than 25% of the world’s oil use in 2023, according to a report by the International Energy Agency (IEA), which also predicts that EVs will displace more than five million barrels of road fuel per day by 2030. This is good news for the climate and for international carbon emissions targets, but for oil and gas companies, there is a serious call for diversification.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Several major players are already working to stay ahead of the curve and remain relevant in a clean energy future. As the transport sector becomes a diminishing custom base, companies including bp, Indian Oil, PetroChina, Shell, Sinopec and TotalEnergies are among those investing in EV charging infrastructure to meet a new gap in the market.

Not all markets are equal, however, and investors are prioritising the regions supporting the most economic potential. The Asia-Pacific (APAC) region is a particularly attractive investment opportunity, offering investors the benefits of growing populations, developing economies, and the need for affordable and reliable energy sources. Elsewhere, Europe is seeing a slowdown in investment as regulatory uncertainty and a recent period of slow sales have knocked investor confidence.

Oil demand will peak, forcing companies to diversify

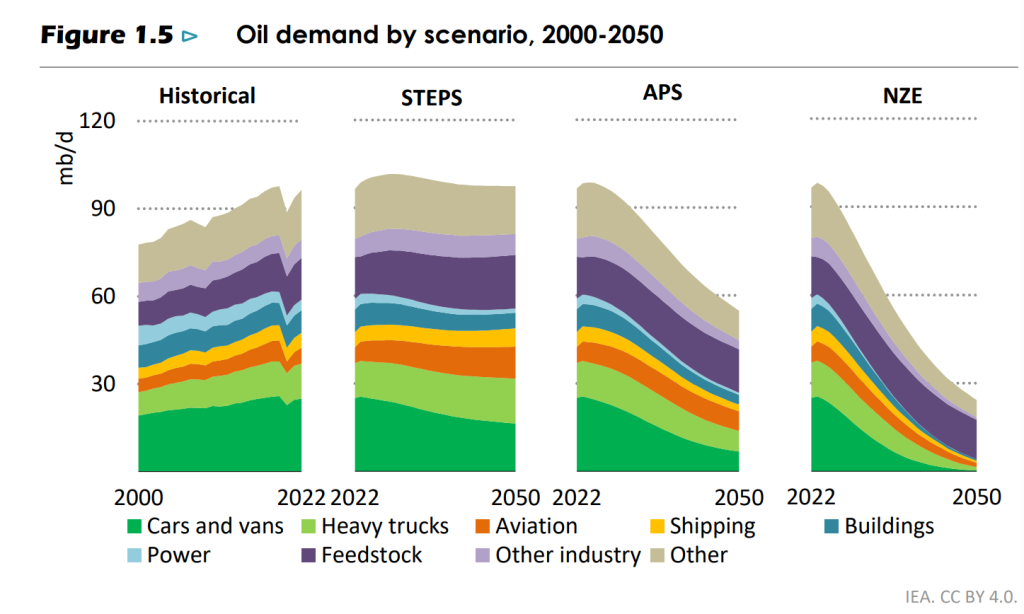

Cross-sector, global analysis indicates that while demand for oil and gas will eventually begin to fall, it hasn’t reached its peak yet, and portfolio diversification is still in the early stages. According to the IEA’s Stated Policies Scenario – which calculates the impact of already-enacted policies – oil and gas demand will peak in the next four years, before facing a steady decline. However, this decline could become more drastic if all currently announced government pledges are successfully enacted.

Ravindra Puranik, oil and gas analyst at GlobalData, explains that oil companies know they must adapt to electrification. “The oil and gas industry is undergoing notable transformation in response to the electrification of the transport sector… One of the most notable strategies is the investment in EV charging stations. This aligns well with existing assets, namely fuel stations, allowing companies to leverage their established infrastructure to support the transition to electric mobility,” he explains.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData is the parent company of Offshore Technology.

A spokesperson from Shell tells Offshore Technology: “As the EV charging industry is still nascent, we are continuously learning and adapting our EV growth strategy to market conditions. For example, we are focusing on our own retail sites in Europe where we can also leverage our convenience retail strengths.”

EV charging infrastructure appears a logical electrification strategy for oil companies, not only because of leverageable infrastructure but because the market is ripe too. GlobalData forecasts that EVs will account for nearly 50% of all global light vehicle sales by 2035 and that hybrid and electric vehicle sales will experience a compound annual growth rate of 6.7% between 2025 and 2037. With EVs comes a need for EV charging infrastructure and the market was already estimated to be worth $32.26bn in 2024, with this figure projected to grow to $125.39bn by 2030.

Noting that EV demand is already shaping the strategies of oil producers, Puranik says: “Several oil marketing companies have ventured into this market through acquisitions and collaborations with EV mobility providers. Oil majors Shell and TotalEnergies presently have the most diverse networks with more than 70,000 charge points installed around the world.”

The diverging global picture: Why APAC is more appealing than the West

Speaking to Offshore Technology, Frankie Mayo, senior UK analyst at global energy think tank Ember, explains that the needs of each region are different.

“The electrification of the global economy is just around the corner but requires abundant clean power and electricity networks ready for the challenge,” he says. “The transition is place-specific; for example, it will look different in developing countries, which can avoid decades of fossil fuel infrastructure and instead jump ahead to electrified alternatives.”

GlobalData figures identify diverging regional trends in EV sales figures, forecasting that the disparity will increase between APAC and the West. EVs currently make up 42% of auto sales in APAC, but this figure will reach 77% by 2037, with continued growth expected. Meanwhile, in Europe, EVs currently make up around 58% of auto sales, and this will jump to 99% by 2037. Set to reach 91% by 2030, the future of the European EV market future is defined by a plateau.

Of the expected development of the APAC market, GlobalData energy transition analyst Clarice Brambilla explains: “I expect to see continued growth in EV production volume, especially in China, India, South East Asia and possibly Oceania. I also expect to see increasing affordability, including smaller, lower-cost EV models targeting mass market consumers, rather than just premium segments.”

She says of the Western market: “There is evidence of a modest rollback or at least slowing of EV investment in parts of the Western market such as Europe and the US, although it is less a reversal than a cooling from peak expectations. In Europe in particular, battery giga-factory plans have been delayed or scaled back, in part because of high costs, competition (often from lower-cost Asian producers), supply chain constraints and weaker-than-expected consumer uptake in some segments. However, battery-electric vehicle sales are still projected to grow strongly across the EU, driven by ambitious targets and strong policy support.

“On the other hand, in the US, regulatory uncertainty under the Trump administration and changing incentive regimes are dampening investment momentum.”

While the US looks a less reliable investment destination for diversifying oil companies, the APAC market needs EV charging infrastructure and, as a region, offers investors a series of advantages including emerging economies and governments looking to secure affordable and reliable energy sources for growing populations.

Significantly, populations in the APAC region are experiencing some of the most rapidly increasing disposable incomes in the world, with cities in India and South East Asia leading growth in household incomes. Brian Peers, global head of sustainable transport and fuels at HSBC, previously commented on the opportunity this presents, noting that “as incomes rise across Asia-Pacific over the coming decades, car ownership is set to increase, with Asia forecasted to account for over 60% of the 115 million EVs sold worldwide over the next five years”.

“The increased sale and production of EVs may present many opportunities across the value chain, including battery manufacturing, the roll-out of charging infrastructure and financing solutions for consumers.”

Oil companies’ EV infrastructure investments are not linear

APAC-based oil companies are investing in EV infrastructure, with Chinese companies leading the charge. Beijing-based Sinopec reported it had built 3,874 charging stations in 2023 and Chinese media outlet CNR reported that the country had 16.7 million EV charging units at the end of July.

Figures from December 2024 showed that Sinopec, Indian Oil and Shell owned the largest number of EV charging stations globally, with 9,051, 7,863 and 3,063 each, respectively, (based on the number of retail forecourts, rather than charge points). Elsewhere in APAC, Indian oil marketing companies Indian Oil Corporation, Bharat Petroleum and Hindustan Petroleum have also invested heavily in EV charging infrastructure. Reports for the 2023–24 period detailed 15,797 EV charging stations installed across the three.

Oil companies undoubtedly have a strong APAC presence, but the story is not so linear among European players.

European oil companies are reducing investment in EV charging infrastructure but retain that Western markets are central to their strategies around electrification preparedness. For example, London-based Shell transferred its Shell Recharge Solutions’ home and workplace chargers to 50five in December 2024 and discontinued its Shell Sky software a month later. The company also lowered its emissions reduction target for 2030 from 20% to 15–20% and dropped its 2035 emissions goal.

Yet a spokesperson explains: “The majority of Shell’s investment in EV charging is currently prioritised towards seven leading markets for EV adoption – China, Germany, the Netherlands, Singapore, Switzerland, the UK and the US. This is because these seven markets represent the most material opportunities from the context of advanced pace of electrification, existing competitive advantages and mobility value pool.”

Ultimately, Brambilla concludes that, while the picture is complex, EV investment is leaning in favour of APAC. “APAC continues to show strong momentum,” she says. “In many APAC markets subsidies, regulatory backing, and cost advantages make investment more attractive, so there remains a relative shift in attention toward the region.”

Elsewhere, bp has increased its oil and gas investment, while reducing its annual investment in its EV charging arm BP Pulse, cutting 10% of jobs and withdrawing from eight of the 12 countries it was operating in. What survives still retains a Western focus and bp says: “Our aim is to provide high-powered on-the-go charging in markets with the strongest growth in EVs: China, the UK, Germany and the US.”