GlobalData’s latest report, Canada Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035, provides a detailed assessment of Canada’s power sector. The report analyses installed capacity (GW), electricity generation (terawatt hours or TWh), and technology shares across the historical period (2020–2024) and forecast period (2025–2035). It also examines key policies, market drivers and challenges, infrastructure developments and the competitive landscape. The analysis is based on GlobalData’s proprietary databases, primary and secondary research, and in-house expertise.

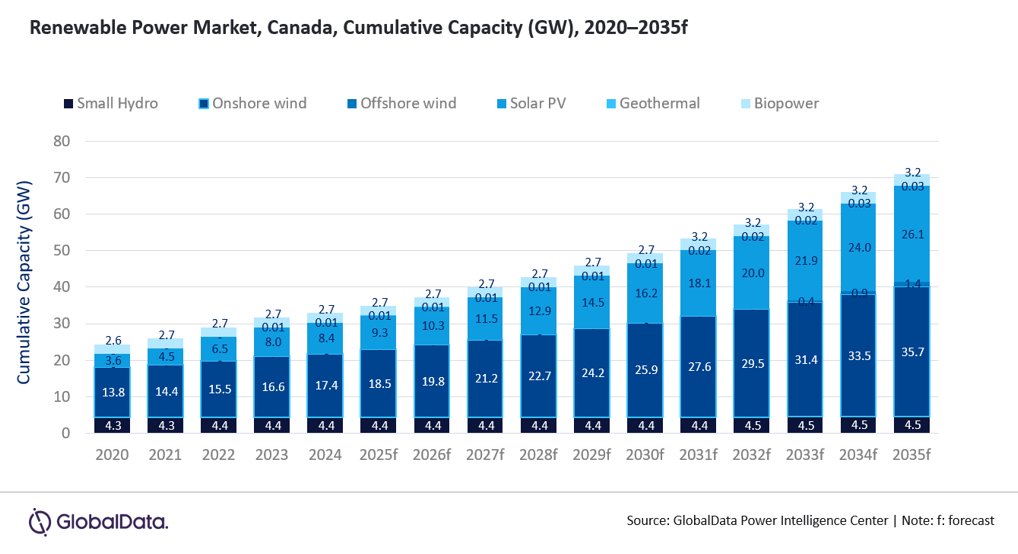

Canada is advancing its clean energy transition with a strong focus on hydropower, wind and solar, supported by federal and provincial policies aimed at achieving a net-zero electricity grid by 2050. The country has committed to phasing out unabated coal-fired generation by 2030, while accelerating deployment of non-emitting sources such as hydropower, nuclear and renewables. Against this backdrop, Canada’s cumulative renewable capacity is projected to reach 70.9GW by 2035, growing at a compound annual growth rate (CAGR) of 7.2% between 2024 and 2035. Renewable generation is forecast to increase from 86.8TWh in 2024 to 154.5TWh in 2035, recording a CAGR of 5.4%.

Large hydropower remains the backbone of the Canadian system, accounting for 48.5% of the total installed capacity in 2024. Wind and solar are emerging as the fastest-growing technologies, with solar photovoltaic expected to reach 26.1GW and onshore wind 35.7GW by 2035. Nuclear power also plays a central role, with refurbishment of the Darlington and Bruce reactors securing more than 10GW of baseload capacity into the 2050s, while new small modular reactors are under development.

Canada’s clean energy growth is reinforced by policies such as the Smart Renewables and Electrification Pathways Program, the Clean Electricity Regulations, and the Net-Zero Emissions Accountability Act, alongside financial support from initiatives such as the 30% Clean Technology Investment Tax Credit and the Canada Infrastructure Bank’s CAD10 billion ($7.4 billion) Clean Power stream. These measures are accelerating the deployment of wind, solar and energy storage projects across provinces.

Looking ahead, opportunities extend to offshore wind and hydrogen. Atlantic provinces such as Nova Scotia and Newfoundland and Labrador are pursuing offshore wind projects, while federal investments, including tax credits and grants, support hydrogen production for domestic decarbonisation and exports to global markets. However, challenges remain, including ageing transmission infrastructure, regional disparities in resource and policy alignment, and continued dependence on fossil fuel exports, particularly crude oil and natural gas.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData