French state-owned utility EDF is considering selling off its entire US renewable energy division to focus on its domestic nuclear operation, CEO Bernard Fontana told Reuters.

The company previously booked a $1bn (€857.54m) impairment on its Atlantic Shores offshore wind farm joint venture with Shell off the coast of New Jersey after US President Donald Trump issued a moratorium on new wind development.

Fontana said EDF is contemplating selling “anywhere from 50 to 100%” of its US renewable energy portfolio, a change to the previous strategy, which envisaged divesting a minority interest. A 50% share is estimated by Bloomberg to be worth around $2.3bn. EDF has appointed investment bank Nomura to identify potential buyers for up to 49%, Reuters said, citing two sources familiar with the discussions.

Download sample pages of selected reports

Explore a selection of report samples we have handpicked for you. Get a preview of the insights inside. Download your free copy today.

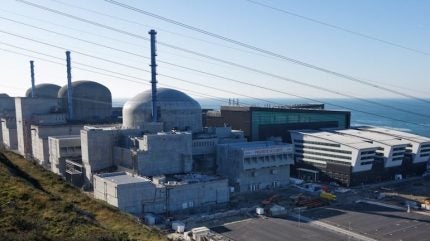

EDF has been looking to generate revenue to support the construction of six additional nuclear reactors in France as it faces a net debt of €50bn. EDF’s nuclear fleet of 57 reactors accounts for around 70% of France’s electricity generation.

In November, the Cour des Comptes (French Court of Auditors) issued a 120-page report, The Maintenance of EDF’s Nuclear Fleet in France. It said EDF’s Grand Carénage (large-scale industrial maintenance policy), which began in 2014, is expected to continue with a view to extending the lifespan of reactors up to 60 years and beyond. The report “analysed the progress made and the persistent difficulties in the implementation of this policy”.

It highlighted in particular “the difficulties encountered by the operator in maintaining the level of operational performance of the park, the need to clarify the strategy for re-internalising critical skills, to secure the quality of subcontracting and continue the efforts undertaken to guarantee the safety and availability of the fleet”.

In particular, the Court established the following findings:

- Maintenance activities carried out on the 56 reactors of the EDF fleet in operation (excluding Flamanville EPR) have intensified since 2014. The annual cost exceeds €6bn due to the effect of the ageing of the fleet; the strengthening of safety requirements, particularly after the Fukushima-Daichi accident; and the preparation of ten-year inspections linked to the reactor life-extension programme.

- The availability of the nuclear fleet fell to 74% on average over the period 2014–24, compared with 80% during the previous decade. This was due to: the increased duration of unit outages during which maintenance work is carried out and the fuel recharged; the treatment of anomalies linked to stress corrosion; and the consequences of the Covid crisis.

- Although EDF has been able to respond to major industrial crises in recent years, structural constraints persist in the planning, coordination and execution of maintenance operations, which continue to weigh on the industrial performance of the fleet and the duration of unit outages.

- The START 2025 Plan, which began in 2019, aims to increase the availability of the reactor fleet by reducing the duration of unit outages and restart delays. It continues to be gradually deployed across the entire fleet.

- The Grand Carénage industrial programme, intended to extend the lifespan and modernise the reactors, estimated at more than €100bn between 2014 and 2035, requires financial monitoring and reinforced management.

- Continuing to operate the nuclear fleet for up to 50 or 60 years is an advantageous option for the French electricity system since it should prove profitable for EDF. Its cost appears competitive in relation to the construction of new production capacities, provided that production forecasts are actually achieved and that the conditions and sales prices of electricity are not degraded.

The court made the following recommendations:

- By 2027, EDF and the Authority for Nuclear Safety & Radiation Protection (ASNR – L’Autorité de Sûreté Nucléaire et de Radioprotection) should finalise the principles for the overall revision of the operating framework and complete the project to simplify the general operating rules for nuclear facilities.

- In 2026, EDF and ASNR should jointly examine cases where improved detection techniques that reveal pre-existing imperfections make it appropriate to adapt the regulations and/or the operator’s safety rules and, if necessary, implement these adaptations.

- In 2026, EDF should define an effective follow-up to the START 2025 reactor outage improvement plan.

- In 2026, EDF should identify the critical activities and skills that need to be brought back in-house.

- In 2026, EDF, with the State Holdings Agency (APE- Agence des participations de l’État) and the Directorate General for Energy & Climat (DGEC – Direction Générale de l’Énergie et du Climat) should break down the financial monitoring of the Grand Carénage programme more precisely at the level of deployed projects, in order to ensure better control of their deadlines and costs. [The APE and DGEC jointly audit costs, define strategy and manage the state’s relationship with entities such as EDF].

Unlock up to 35% savings on GlobalData reports

Use the code at checkout in the report store

-

20% OFF

Buy 2 reports

Use code:

Bundle20

-

25% OFF

Buy 3 reports

Use code:

Bundle25

-

30% OFF

Buy 4 reports

Use code:

Bundle30

-

35% OFF

Buy 5+ reports

Use code:

Bundle35

Valid on all reports priced $995 and above. Cannot be combined with other offers.

Still deciding what will work best for your business?

Ask our experts for help.

Enquire before buying