GlobalData’s latest report, ‘Poland Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035’, provides a detailed assessment of Poland’s electricity sector. The report examines installed capacity (GW), electricity generation (TWh), technology mix, and regulatory developments across the historical period from 2020 to 2024 and the forecast period from 2025 to 2035. It also evaluates market drivers, policy frameworks, infrastructure investment, and the evolving generation mix, drawing on GlobalData’s proprietary databases, primary and secondary research, and in-house analytical expertise.

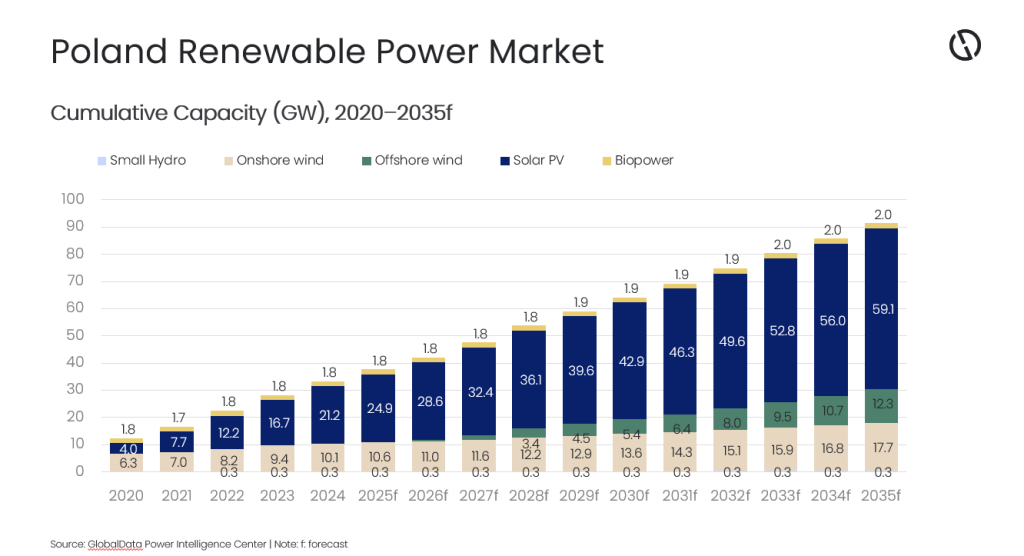

Poland’s electricity system is undergoing a gradual structural transition as ageing coal assets, rising electricity demand, and European Union decarbonisation requirements increasingly shape capacity planning and investment priorities. As coal-based generation declines, capacity additions are increasingly concentrated in renewable energy technologies. Against this backdrop, Poland’s renewable power capacity is forecast to exceed 91.5GW by 2035, up from around 33.3GW in 2024.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Growth in renewable capacity is supported by national energy policy frameworks, European Union funding mechanisms, and rising electricity demand from industry, services, and households over the forecast period. Long-term planning instruments, including the Energy Policy of Poland until 2040 and the updated National Energy and Climate Plan, provide visibility for renewable deployment and grid development.

Solar PV and wind power account for the majority of renewable capacity additions through 2035. Solar PV capacity stood at around 21.2GW in 2024 and is forecast to increase to approximately 59.1GW by 2035, supported by utility-scale project development, continued expansion of distributed generation, and auction-based support mechanisms under the Renewable Energy Sources Act. Onshore wind capacity is expected to rise from around 10.1GW in 2024 to about 17.7GW by 2035, driven by regulatory adjustments to siting rules and renewed investment activity. Offshore wind begins to enter Poland’s power system from 2026 and is projected to reach around 12.3GW by 2035. Development is driven by large-scale projects in the Baltic Sea under the Offshore Wind Act, supported by long-term contract frameworks and grid expansion to accommodate new capacity.

Coal continues to play a significant role in Poland’s power system, but a growing share of the coal fleet consists of ageing units facing rising operating costs and tightening environmental compliance requirements. Higher carbon costs under the EU Emissions Trading System, expiring capacity market contracts, and limited reinvestment in older plants are accelerating retirements. As a result, installed coal capacity is expected to decline from around 32.2GW in 2024 to approximately 20.5GW by 2035.

Natural gas is being expanded to support system flexibility as coal capacity declines. Gas-based power capacity is forecast to increase from around 5.6GW in 2024 to about 13.2GW by 2035, supported by expanded LNG import infrastructure, diversified pipeline supply, and strengthened regional interconnections.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOverall, Poland’s power sector is moving toward a more diversified generation mix, with renewables accounting for the majority of new capacity additions through 2035. Solar PV and wind power are reshaping the system alongside grid expansion and policy alignment, while gas provides transitional flexibility as coal capacity declines, supporting supply security and long-term decarbonisation objectives.