GlobalData’s latest report, ‘Mexico Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035‘, provides a comprehensive assessment of Mexico’s power sector. The report examines installed capacity (GW), electricity generation (TWh), technology mix, and regulatory developments across the historical period from 2020 to 2024 and the forecast period from 2025 to 2035. It also evaluates market drivers, challenges, investment trends, and the evolving role of public and private stakeholders, drawing on GlobalData’s proprietary databases, primary and secondary research, and in-house analytical expertise.

Mexico’s power sector is undergoing structural realignment under President Claudia Sheinbaum’s administration, driven by rising electricity demand, renewed regulatory reforms, and a stronger emphasis on energy sovereignty. The updated policy framework reinforces the central role of the Federal Electricity Commission (CFE) while enabling selective private investment to support capacity expansion and grid modernisation. Within this context, solar power has emerged as the primary focus of new clean energy deployment.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

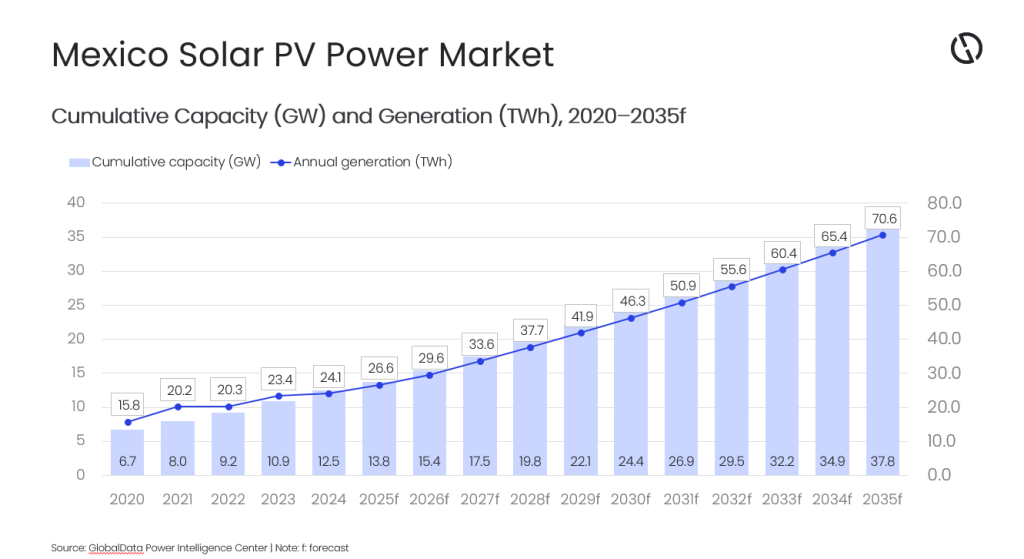

Solar PV capacity is projected to increase from around 12.4GW in 2024 to 37.8GW by 2035, registering a compound annual growth rate of approximately 10.7% over the forecast period. Growth is supported by Mexico’s strong solar resource base, continued development of utility-scale projects, and rapid expansion of distributed generation, aligned with national planning frameworks aimed at meeting rising electricity demand from industry, manufacturing, and urban centres.

Wind power is also expected to contribute meaningfully to clean energy growth. Onshore wind capacity is forecast to rise from 7.8GW in 2024 to around 16.5GW by 2035, driven by ongoing project development in high-resource regions such as Oaxaca and Tamaulipas. Together, solar and wind are expected to account for the majority of clean capacity additions, reshaping Mexico’s generation mix over the forecast period.

Policy support for clean energy expansion is anchored by long-term planning instruments, including the National Electricity Sector Strategy 2024–2030 and PLADESE 2025–2039, alongside the March 2025 reform of the Electricity Sector Law. These measures strengthen system planning for higher levels of variable renewable integration and reinforce investment incentives through revised eligibility criteria under the Clean Energy Certificates framework, favouring new clean capacity.

Natural gas continues to play a critical role in Mexico’s power system. Gas-fired capacity is projected to increase from 52.7GW in 2024 to 64GW by 2035, reflecting continued investment in combined-cycle plants, pipeline infrastructure, LNG terminals, and storage facilities. Gas remains the primary balancing fuel through 2035, supporting reliability and affordability as renewable capacity expands and electricity demand rises due to nearshoring, manufacturing growth, and digital infrastructure development.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOverall, Mexico’s power sector is evolving through sustained renewable expansion led by solar and wind, complemented by gas-based generation to support system balance. Continued alignment between policy frameworks, infrastructure investment, and capacity planning will be central to maintaining energy security while advancing low-carbon electricity growth through 2035.