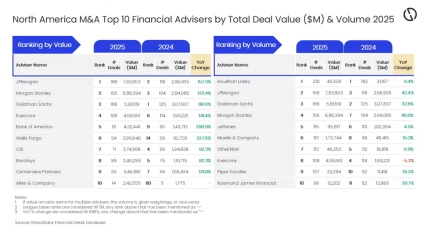

JPMorgan and Houlihan Lokey have emerged as the leading mergers and acquisitions (M&A) financial advisers in North America for 2025, topping GlobalData’s latest regional league tables by deal value and deal volume, respectively.

Data from GlobalData’s Financial Deals Database shows that JPMorgan secured first place by aggregate transaction value, advising on deals worth $763.9bn across the year.

Houlihan Lokey ranked first by number of transactions, with mandates on 210 deals.

Download sample pages of selected reports

Explore a selection of report samples we have handpicked for you. Get a preview of the insights inside. Download your free copy today.

GlobalData lead analyst Aurojyoti Bose said: “Houlihan Lokey and JPMorgan were the clear winners, having outpaced their peers by a significant margin in terms of volume and value in 2025. Houlihan Lokey was also the top adviser by volume in 2024.

“Meanwhile, JPMorgan improved its ranking by value from the second position in 2024, at there was more than a double-fold jump in the total value of deals advised by it due to involvement in big-ticket deals. During 2025, JPMorgan advised on 90 billion-dollar deals that also included 17 mega deals valued more than $10bn. It also held the second position by volume in 2025 with 168 deals.”

GlobalData’s database indicates that Goldman Sachs took third place by deal count with 166 transactions, followed by Morgan Stanley with 155 and Jefferies with 115.

On a value basis, Morgan Stanley placed second behind JPMorgan, advising on transactions worth a combined $686.4bn.

Goldman Sachs followed with $581.5bn in deal value, while Evercore and Bank of America recorded totals of $459.2bn and $432.4bn, respectively.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.

Unlock up to 35% savings on GlobalData reports

Use the code at checkout in the report store

-

20% OFF

Buy 2 reports

Use code:

Bundle20

-

25% OFF

Buy 3 reports

Use code:

Bundle25

-

30% OFF

Buy 4 reports

Use code:

Bundle30

-

35% OFF

Buy 5+ reports

Use code:

Bundle35

Valid on all reports priced $995 and above. Cannot be combined with other offers.

Still deciding what will work best for your business?

Ask our experts for help.

Enquire before buying