GlobalData’s latest report, ‘Argentina Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Argentina and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

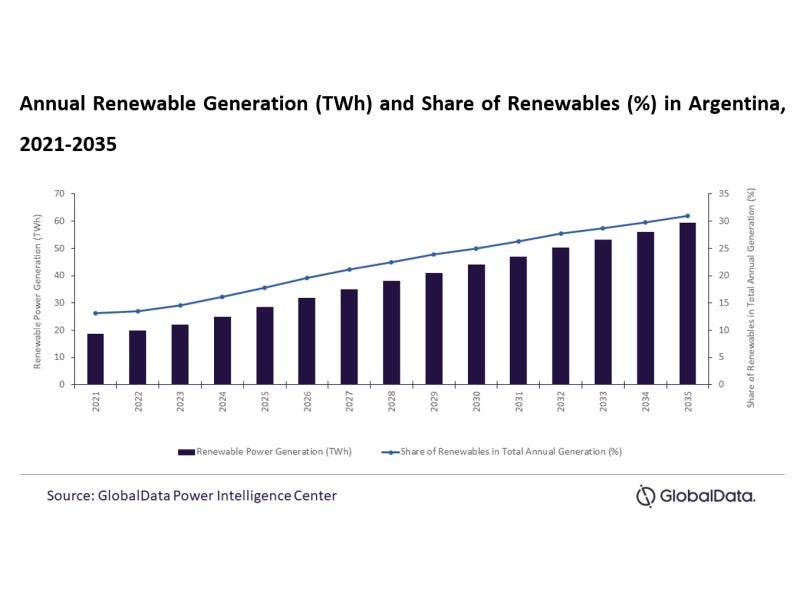

Despite Argentina having plenty of renewable energy potential, the country has fallen short of its renewable energy target compared to other Latin American countries. The recent Russia-Ukraine conflict may be an opportunity for the government to allocate funds towards the development of renewable power to secure supply security in the long term.

Argentina has previously relied on the RenovAr programme to achieve 20% renewable power by 2025. The programme received an overwhelming response in the first round, however, the fourth round has been stalled by the pandemic, with progress being stagnant.

The demand for non-Russian fossil fuels has benefitted Latin American countries, including Argentina, as European countries that have imposed sanctions on Russia are looking for another way to supply their energy grids.

Funding for renewable projects and grid constraints have been key constraints barring renewables from reaching its full potential in the country. Now is the right time for Argentina to invest in renewable power and upgrade its grid to avoid blackouts and secure more natural gas for exports. Currently, gas-based thermal accounts for nearly 60% of the country’s annual generation.

According to the current trend, renewables will account for only 17.8% of total annual generation, falling short of the 20% target set for 2025. The government should look to expedite the next round of auctions for the RenovAr programme to restore confidence among investors and stakeholders in the renewable industry. This could be done by expediting renewable project approvals, providing support in the form of incentives and tax breaks, and loans to make the sector more attractive.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataArgentina’s GDP (at constant prices) increased from $426.5bn in 2010 to $437.3bn in 2021, at a CAGR of 0.2%. Burdened by political turmoil and underperforming economy, the GDP of the country declined from 2014 and took a massive dip in 2020 due to lockdowns imposed to curb the Covid-19 pandemic. GDP declined by 9.9% in 2020 from 2019. In 2021, the GDP grew by 10.3% after the resumption of trade activities. Between 2021 and 2030, the economy is expected to grow at a CAGR of 1.3%, reaching $ 490.1bn in 2030.

Related Company Profiles

Renovar Inc