Even while being responsible for 30% of global emissions, China is a powerhouse of the technologies that are instrumental to the energy transition. However, as the US pursues a technology decoupling from China, can homegrown renewable technology fill the gap, or will recent political developments pose an inevitable setback on the road to net zero?

Chinese clean tech and the US

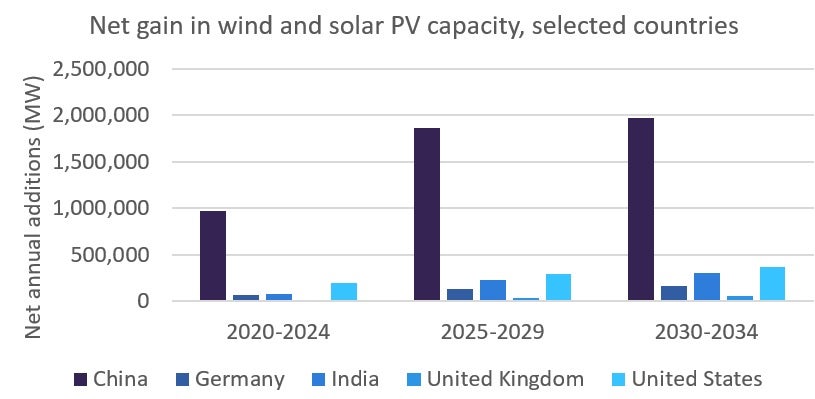

The above graph, produced using the GlobalData capacity and generation database, contradicts Trump’s recent claim that China has “very, very few” wind turbines. Looking at net annual capacity additions for wind and solar photovoltaic (PV) power, we see that China is forecast to continue to lead by a strong margin, even amongst countries commonly seen as major international players. Developing these new sources of energy is particularly important at a time when data centres, with their vast energy consumption needs, are rising in prominence. This suggests that China’s high capacity for renewables may become even more valuable with time.

What political developments could mean for the US energy transition

Meanwhile, dramatic policy shifts are heavily influencing the US’ transition to renewables, with solar panels, batteries, and wind turbines predicted to become more expensive. There are also likely to be lasting effects of the Reconciliation Bill, with its “material assistance” rules surrounding ‘Foreign Entities of Concern’ (countries such as China, Russia, Iran, and North Korea). Projects with participation from companies emanating from these countries are no longer eligible for some tax credits. In addition, projects reliant on components or materials from these countries can also be excluded from clean energy tax credits. So, even if tariff tensions were to fully subside, the US is still moving towards decoupling its renewable energy from China. In the long term, if the US wants to increase its solar power independently of China, it will need to scale up domestic manufacturing. The US is currently the fifth-largest manufacturer of solar panels globally, but this represents only 1.9% of global production, so output would need to increase substantially to accelerate US independence. Even if this did occur, China still produces nearly 80% of the silicon that is used for solar panels, so a total decoupling will pose a challenge.

Wind is potentially a more workable option for increasing clean energy independence, as according to GlobalData, the US already has 163,701MW of installed wind turbine capacity (significant even when compared with China’s 599,830MW), as well as several domestic manufacturers. However, multiple executive orders halting offshore wind leasing and onshore projects on federal lands will severely impact capacity additions over the coming years, with growth largely being limited to projects that are already under construction.

Meanwhile, US nuclear power is experiencing something of a revival due to a combination of executive orders that aim to accelerate the development of new plants. The chart above shows that (subject to current announcements) the majority of the total capacity of all nuclear plants that came online from 1995 will be taken up by plants that were active from 2025. Although it is not predicted to be a majority component of the power mix anytime soon, only forming 16% of the forecasted power generation in the US by 2030, nuclear power is re-emerging as a growth sector. The alternative to developing renewable sources of energy is to increase emission abatement capability through carbon capture, utilisation, and storage (CCUS). The US is already a leader in this, with 275 active and upcoming projects compared to the rest of the world’s 526 as of August 2025. The chart below illustrates how this dominance is projected to continue into 2030.

Far-reaching consequences

Overall, the US’ recent approach to clean tech has ramifications for itself and the rest of the world. It is difficult to see how this approach will not slow progress to net zero – with solar PV developments predicted to become more expensive and increases in nuclear power still in their infancy, completing the energy transition independently of China would likely have to involve the foregrounding of CCUS technology. However, while incentives such as the 45Q tax credit remain largely intact, White House communications describing “beautiful clean coal” suggest that minimising carbon emissions remains a low priority item for the current administration’s agenda.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData