GlobalData’s latest report, ‘Germany Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035’, provides detailed insights into Germany’s power sector. The report covers installed capacity (GW), generation (TWh), technology shares, and policy developments for the historical period (2020–2024) and forecast period (2025–2035). It also analyses market drivers, restraints, investment opportunities, and profiles of leading companies. The research is based on GlobalData’s proprietary databases, primary and secondary research, and in-house expertise.

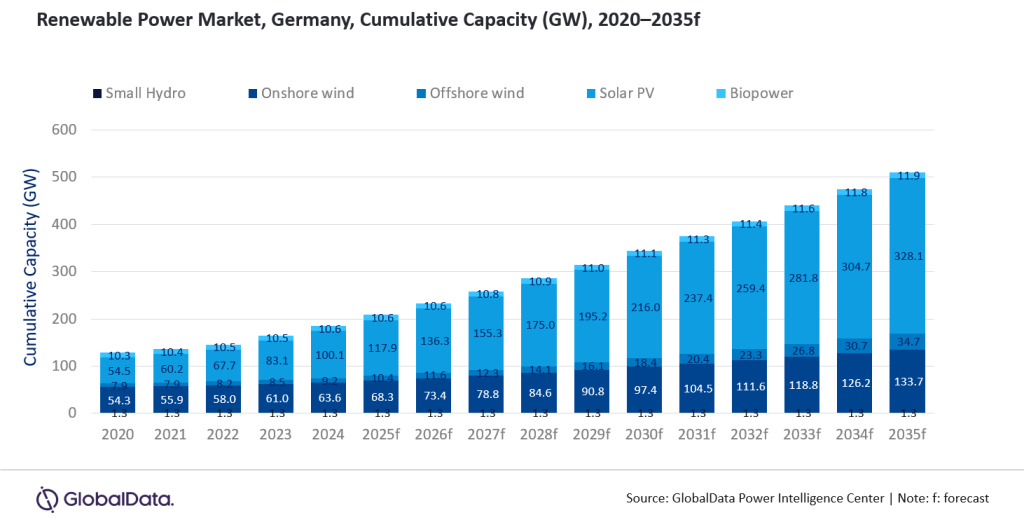

Germany is accelerating its clean energy transition with ambitious targets for renewables, hydrogen, and LNG diversification, underpinned by robust federal policies. The country has officially phased out nuclear power as of 2023 and is committed to phasing out coal-fired generation by 2038, with discussions underway to advance the deadline to 2030. Against this backdrop, Germany’s cumulative renewable power capacity is forecast to reach 509.9GW in 2035, growing at a compound annual growth rate (CAGR) of 9.7% during 2024–2035. The report reveals that in 2024, renewables accounted for 54.7% of electricity generation, led by wind and solar PV. By 2035, renewable generation is expected to reach 628TWh, accounting for 82.9% of the power mix, driven by large-scale solar PV expansion and onshore and offshore wind development.

Germany’s energy transition is supported by key policies such as the Renewable Energy Act (EEG), the National Hydrogen Strategy, and the Power Plant Security Act, alongside initiatives such as H2Global. The country targets 30GW of offshore wind capacity by 2030. Geopolitical developments are also shaping Germany’s energy strategy. The Russia–Ukraine war accelerated the end of Russian gas imports, leading to rapid expansion of LNG import capacity and diversification of suppliers, including Norway, the Netherlands, Belgium, and the US. Germany is also forging hydrogen partnerships with countries such as Canada, Norway, and Namibia to secure long-term supply resilience.

Despite strong progress, challenges remain in terms of grid congestion, Dunkelflaute (periods of low renewable output), slow rollout of dispatchable gas-fired capacity, and regulatory hurdles that delay wind deployment. Rising energy prices also add to the complexity. However, large-scale investments in hydrogen infrastructure, battery energy storage, and smart grids are expected to enhance long-term system stability.

Germany’s pathway to 80% renewable generation by 2030 and a fully decarbonised power sector by 2045 is ambitious but achievable. With solar, wind, and hydrogen driving the transition, complemented by investments in grid modernisation and storage, Germany is well positioned to remain at the forefront of Europe’s energy transition.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData