GlobalData’s latest report, Renewable Energy, is among the latest strategic intelligence reports from GlobalData, an industry analysis specialist. The report provides an industry analysis on the renewable energy market, its growing demand and how it is disrupting power utilities and the power sector. The report focuses on the trends related to renewable energy as a theme in technology, macroeconomic, and regulatory trends. The report provides a detailed analysis of the renewable energy value chain.

The report is built as a single theme offering in-depth research using data and information sourced from industry associations, company websites, government websites, and statutory bodies. The information is also sourced through other secondary research sources such as industry and trade magazines.

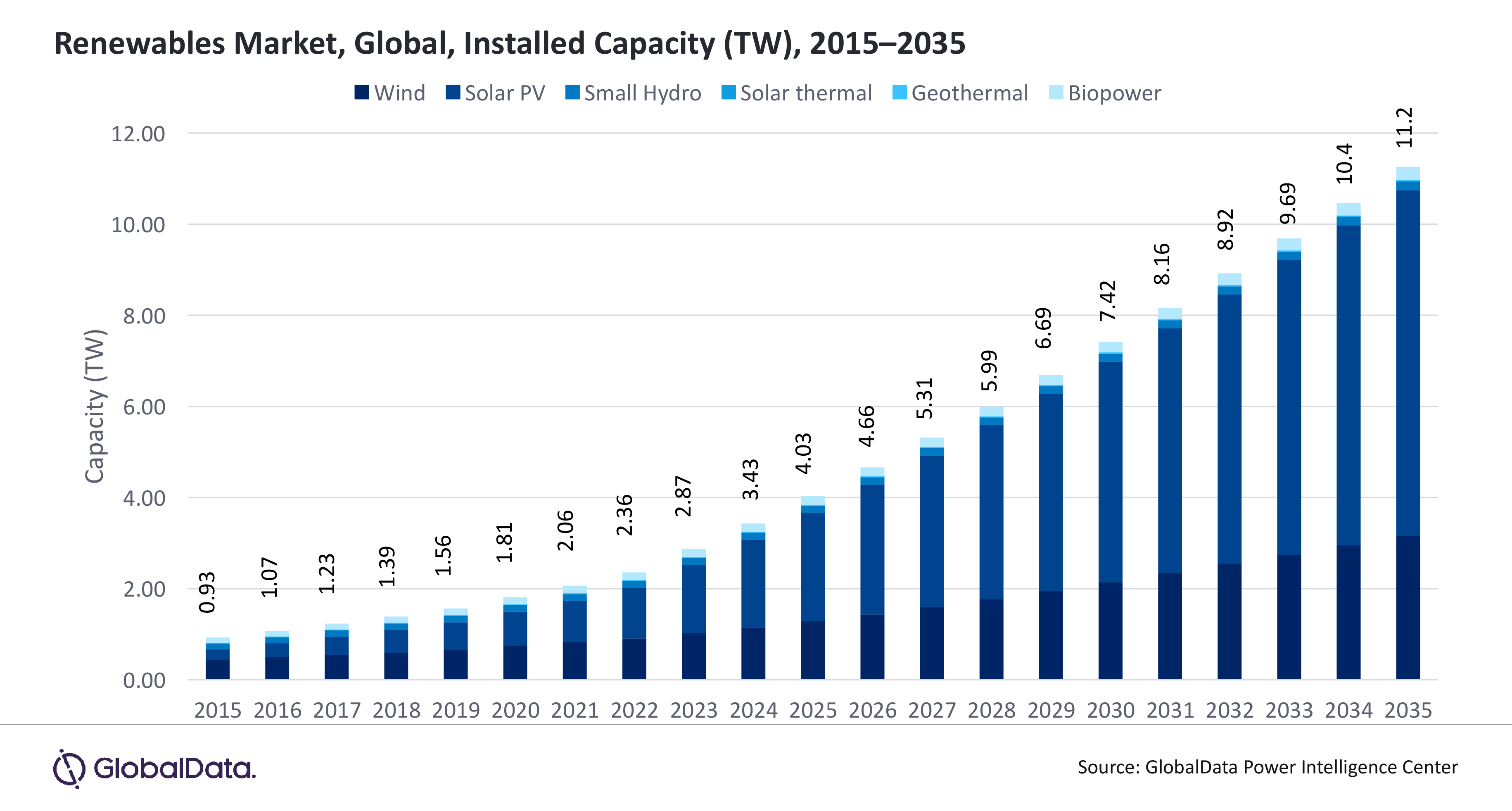

The power sector is experiencing a notable growth in renewable energy sources, propelled by an array of factors such as technological progress, policy incentives, and a heightened awareness of the imperative for sustainable energy solutions. Consequently, renewable resources, particularly solar photovoltaic (PV) and wind energy, are gaining a larger share in the energy portfolio. Driven primarily by declining costs and strong policy support, particularly for solar PV and wind energy, the global renewable power installed capacity is estimated to surge from 3.42TW in 2024 to 11.2TW by 2035.

The global renewables market expanded from a cumulative installed capacity of 0.93TW in 2015 to 3.42TW by the end of 2024, representing a compound annual growth rate (CAGR) of 16%. The total cumulative installed capacity is projected to record a CAGR of 11% during the period of 2024-2035.

Solar PV and wind power were significant contributors to the renewable energy sector, accounting for 56% and 33% of the total installed capacity in 2024, respectively. The Asia-Pacific region has emerged as the largest market for solar PV and wind installed capacity, boasting 1.18TW and 0.67TW in 2024, respectively.

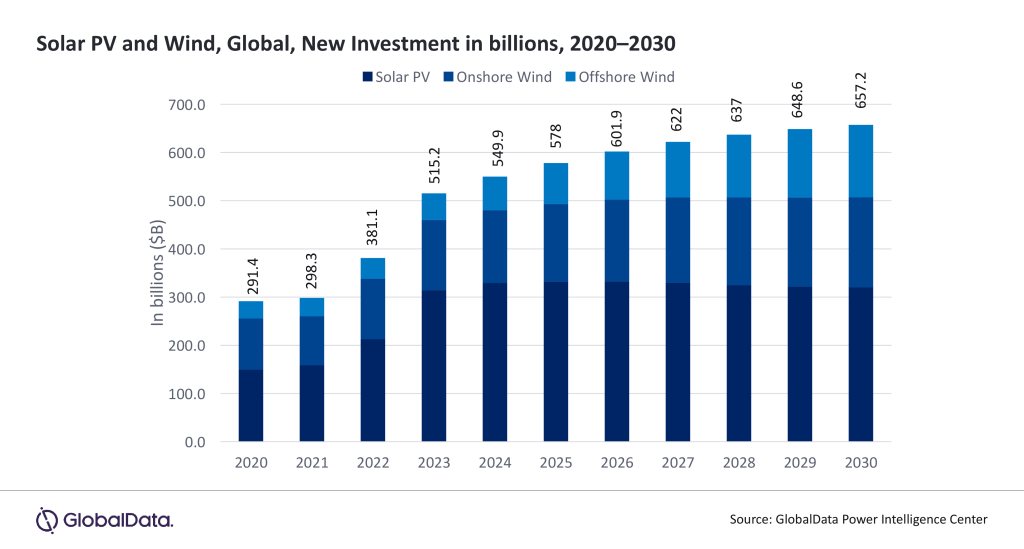

As the costs of solar PV and wind technologies continue to decline, these renewable energy sources are increasingly appealing to investors. Also, energy transition strategies, coupled with a rising demand for electricity – partly fuelled by the emergence of hydrogen energy and the advent of AI – will propel market growth for renewable energy sources.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAI is transforming the renewable energy sector by enhancing generation optimisation, advancing grid management, and increasing efficiency across multiple systems. AI algorithms possess the capability to forecast renewable energy production, oversee grid operations in real-time, and refine energy storage strategies. These advancements contribute to heightened reliability and efficiency, thereby rendering renewable energy more effective and economical.

Leading offshore wind developers such as TotalEnergies, Corio Generation, EnBW, RWE, and Statkraft are leveraging digital platforms to enhance the efficiency of wind farm project development. Similarly, solar power developers such as NextEra Energy, EDF, and ENGIE are employing machine learning models to enhance the efficiency of solar PV facilities.

The renewable energy sector stands on the cusp of substantial growth, with the solar PV and wind power industries at the forefront. Moreover, the worldwide pledge to curtail carbon emissions has cultivated a regulatory landscape conducive to investments in these sustainable energy alternatives.

Solar PV systems are poised to spearhead new investments, outpacing both the onshore and offshore wind sectors. In 2024, solar PV garnered $329.1bn in investments. In contrast, onshore wind investments stood at $151.2bn while offshore wind investments reached $69.6bn by the end of 2024. Looking ahead, the onshore wind sector is forecasted to grow to $186.9bn and the offshore wind sector to $150.4bn by 2030. These figures correspond to a CAGR of 4% for onshore wind and an impressive 14% for offshore wind, signalling robust growth trajectories for these renewable energy sources.

Solar and wind power stand at the vanguard of the renewable segment, rapidly becoming cost-competitive with traditional fossil fuels. They are anticipated to dominate electricity generation in the near future. While the global community is committing to the expansion of renewable energy sources, the US appears to be slowing the pace of renewables growth in favour of prioritising fossil fuels.

Tariffs and offshore wind lease restrictions policies by the Trump administration are significantly impacting the renewable energy industry. Nonetheless, the global commitment to reduce carbon emissions, technological advancements, and demand for cleaner energy solutions will accelerate the adoption of renewable energy across the globe.