GlobalData’s latest report, ‘United States (US) Power Market Outlook to 2035: Market Trends, Regulations, and Competitive Landscape‘, provides a comprehensive assessment of the US electricity sector. The report analyses installed capacity (GW), electricity generation (TWh), technology mix, and regulatory developments across the historical period from 2020 to 2024 and the forecast period from 2025 to 2035. It also evaluates market drivers, policy frameworks, infrastructure investment, and competitive dynamics using GlobalData’s proprietary databases, primary and secondary research, and in-house analytical expertise.

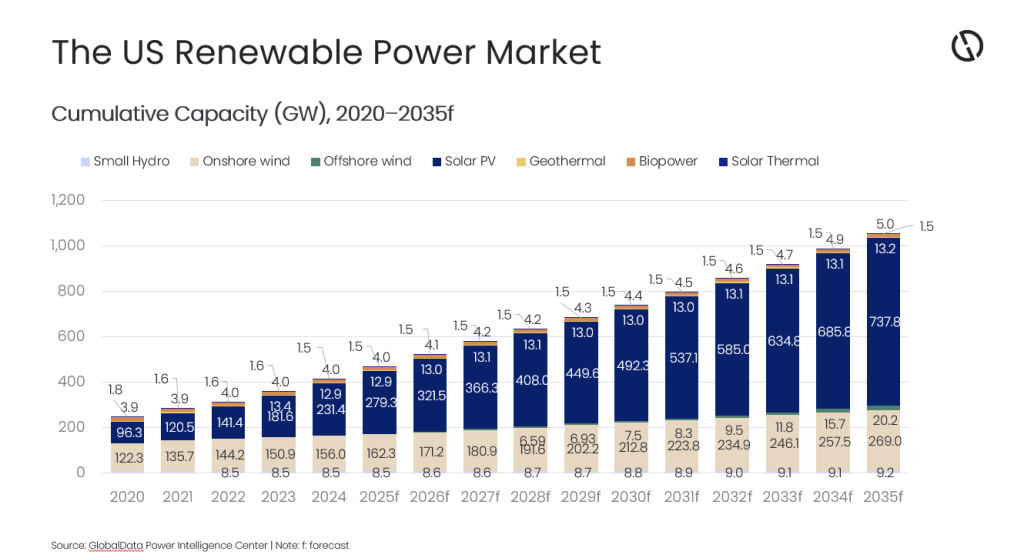

The US operates the world’s largest and most diversified electricity system, supported by abundant domestic energy resources, regional power markets, and a broad technology mix. While federal energy policy since 2025 has increasingly emphasised energy security, domestic manufacturing, and firm generation capacity, long-term power sector investment continues to be shaped by state-level clean energy mandates, utility procurement programs, and private sector demand. Within this framework, renewable energy remains the dominant source of new capacity additions, with total renewable capacity projected to more than double from around 414.5GW in 2024 to approximately 1.06TW by 2035.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Renewable capacity growth is supported by state renewable portfolio standards and clean electricity standards, long-term utility integrated resource plans, and sustained corporate power purchase agreement activity from technology, manufacturing, and data centre operators.

Solar and onshore wind account for the majority of renewable capacity additions through the forecast period. Installed solar capacity is projected to increase from around 231.4GW in 2024 to approximately 737.8GW by 2035, driven by state procurement targets, distributed generation policies, net billing and net metering frameworks, and large-scale utility contracting across key markets such as Texas, California, and the Midwest. Onshore wind capacity is expected to rise from about 156GW in 2024 to nearly 269GW by 2035, supported by long-term utility offtake agreements and state-level clean energy standards in high-resource regions.

Offshore wind development has faced repeated policy and regulatory disruptions since the start of 2025, contributing to sustained uncertainty across the project pipeline. In April 2025, federal authorities ordered a temporary halt to offshore construction activity at the Empire Wind 1 project off New York, despite the project having secured federal and state permits and entered construction. In August 2025, construction activity at the Revolution Wind project off Rhode Island and Connecticut was briefly suspended following federal intervention, before a court decision allowed work to resume. The operating environment tightened further that same month when the Department of Transportation canceled $679m in federal funding for offshore wind-related port and logistics infrastructure. This sequence of actions culminated on 22 December 2025, when the Trump administration announced the suspension of five offshore wind projects following the halt of federal leasing and project approvals over national security concerns, placing Atlantic coast developments, including Vineyard Wind, Revolution Wind, Coastal Virginia Offshore Wind, Sunrise Wind, and Empire Wind, on hold and delaying near-term capacity additions.

Coal- and oil-fired capacity continues to decline as ageing plants retire and economic pressures intensify, while natural gas and nuclear power remain integral to the US capacity mix. Natural gas capacity is projected to increase from around 573.1GW in 2024 to approximately 620.9GW by 2035, reflecting continued investment in high-efficiency combined-cycle and peaking plants supported by an abundant domestic gas supply and existing infrastructure. Nuclear capacity is expected to edge higher from about 97GW in 2024 to around 102GW by 2035, driven by plant life extensions, uprates, selected reactor restarts, and early-stage deployment of advanced nuclear technologies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTrade and tariff measures introduced in 2025 have added cost pressure and uncertainty across the power sector, particularly for renewable technologies reliant on imported components such as solar modules, wind turbines, batteries, steel, aluminium, and copper. Higher input costs have increased capital requirements, slowed procurement timelines, and contributed to project delays and cancellations across parts of the development pipeline, even as underlying demand for new generation capacity remains strong.

Looking ahead, renewable energy is expected to remain the primary driver of capacity expansion in the US power sector through 2035. Large-scale growth in solar and wind capacity, supported by state policies and private sector demand, alongside continued deployment of natural gas and nuclear capacity to meet broader system and industrial requirements, is reshaping the US electricity system into a more diversified and resilient market over the long term.