Rising demand is reshaping how capacity is added

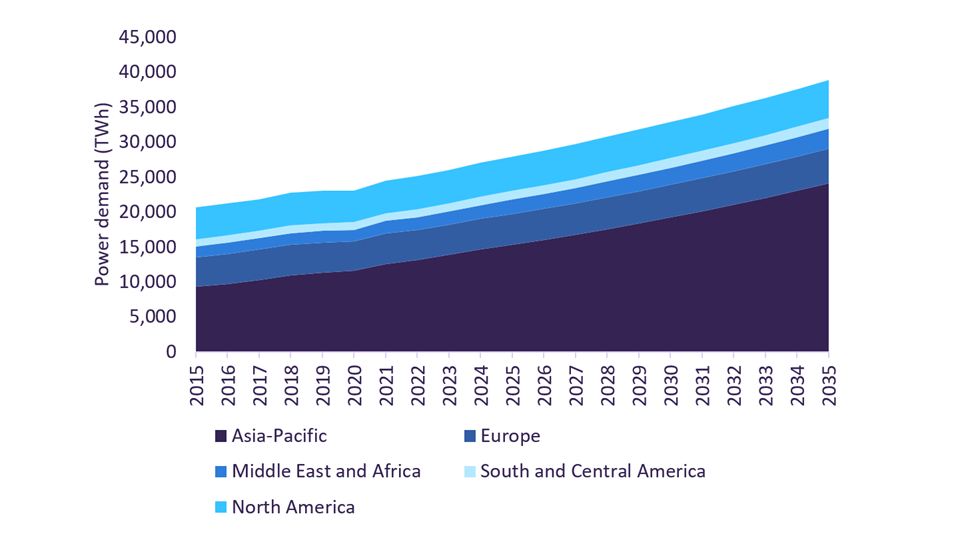

Global power demand is rising faster and in more unpredictable ways than at any point in recent decades. According to leading data and analytics company GlobalData, global power demand is set to increase at a compound annual growth rate (CAGR) of 3% between 2025 and 2035, reaching almost 40,000TWh in 2035. This growth will be significantly boosted by the industrial sector, which is expected to increase at a CAGR of 4% in the same period, reaching almost 20,000TWh by 2035. Electrification across transport, heating, and heavy industry, together with the proliferation of data centres, is reshaping electricity consumption patterns. The traditional model of adding capacity by building large, centralised power plants over many years is increasingly mismatched to the pace and volatility of these shifts. The way power systems are expanding is entering a period of qualitative change, where the ability to deliver capacity where and when it is needed is as important as nominal capacity.

Global power demand by region, 2015-2035

Renewables are transforming the global power mix and, in many cases, can be deployed more quickly than conventional thermal plants. While large renewable projects still face permitting and grid-connection challenges, utility-scale solar photovoltiac projects can be constructed within a matter of months, compared to the multiyear timelines for large coal or gas generation projects. However, the rapid build-out of renewables introduces its own set of challenges, most notably intermittency and the decentralised nature of generation, which increases strain on power grids. Outputs from solar and wind projects also fluctuate with weather conditions and daily patterns, which can lead to supply shortfalls even when installed capacity appears sufficient on paper. This variability strengthens the case for complementary, dispatchable power that can stabilise grids during periods of low renewable output or unexpected demand surges.

Power as a deployable service

This evolving landscape is creating space for a new category of solutions: a new wave of power generation models that treat capacity as a deployable service rather than a permanent asset. Instead of requiring governments or utilities to build and own new infrastructure outright, these approaches allow capacity to be deployed rapidly, and scaled as needs change. Floating power plants, containerised battery systems, and modular gas units exemplify this shift. They offer shorter deployment timelines, can be relocated as demand centres evolve, and provide more flexible contractual structures.

One of the most notable examples of this model is provided by Karpowership, a Turkish company that has built the world’s largest fleet of floating power plants. These vessels, known as ‘powerships’, are fully functional power stations installed on ships, capable of generating electricity from natural gas or fuel oil and connecting directly to onshore grids. Karpowership has deployed its fleet across a range of markets – from Ghana and Lebanon to Brazil and South Africa – often within months of signing contracts. This speed of deployment enables governments to address capacity shortfalls or grid instability far faster than conventional infrastructure would allow. The company’s business model also reflects the broader shift towards ‘power-as-a-service’: host countries can secure electricity on a contractual basis without incurring the capital expenditure or long-term lock-in associated with building new plants.

Emerging markets in particular have become the primary stage for such solutions. Rapid urbanisation, volatile demand growth, and weaker grid infrastructure in many parts of sub-Saharan Africa, South Asia, and South America make flexible capacity especially valuable. In these regions, financing, permitting, and construction challenges can delay large-scale projects by years. Mobile generation, by contrast, offers a pragmatic way to bridge supply gaps, support economic growth, and improve energy security while longer-term investments progress. For example, in May 2024, Karpowership signed a five-year power purchase agreement with Société d’Energie et d’Eau du Gabon to supply around 250MW of power – roughly a quarter of the country’s electricity demand – demonstrating how these solutions are increasingly being deployed to strengthen grid reliability, and how this flexible model is gaining traction in emerging markets.

The appeal of mobile power generation is also increasing in advanced economies. For example, GlobalData estimates a total of $1.5tn of spending across all data centre projects that are currently under construction globally. The rise of data centres, coupled with increasing electrification across industrial hubs, will introduce highly localised and rapidly escalating electricity demand in areas where grid capacity is already constrained. Temporary or relocatable power solutions can provide near-term relief while grid reinforcement, storage, and renewable capacity catch up during periods of rapid change.

Balancing flexibility with long-term goals

However, these solutions are not without tradeoffs. Most floating power plants still rely on fossil fuels, raising concerns about greenhouse gas emissions, as well as air pollution for urban centres located around ports. Their availability may also increase the risk of lock-in if short-term contracts are repeatedly extended, as well as reduce the urgency of investing in permanent low-carbon infrastructure such as grid upgrades, energy storage, and large-scale renewable projects. In addition, in some cases, the cost per unit of electricity from mobile generation can exceed that of conventional plants over the long term, particularly once fuel prices and ongoing leasing costs are factored in. Regulatory and policy frameworks, often designed for stationary assets, can also pose challenges to deployment and integration. These factors underline the need to ensure that mobile generation remains a strategic complement to, rather than a replacement for, structural decarbonisation efforts.

Looking ahead, the rapid expansion of Karpowership’s fleet, from roughly 6,000MW today to a targeted 10,000MW within the next three to five years, highlights how this model could play an increasing role within less secure energy systems. As demand patterns and supply dynamics continue to evolve, the ability to deploy generation quickly, relocate it, and contract it flexibly will grow increasingly important. Floating power plants offer an early glimpse of this future by being more agile, adaptable, and responsive. Their strategic value lies precisely in this flexibility, but ensuring that such solutions remain transitional and complementary will be essential to aligning this agility with the long-term goals of a net-zero energy system.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData