Leading data and analytics company GlobalData’s latest report, ‘UK Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035’, provides detailed insights into the UK’s power sector. The report covers installed capacity (gigawatts), generation (terawatt-hours), technology shares, and policy developments across the historical period (2020-24) and forecast period (2025-2035). It also evaluates market drivers, challenges, investment opportunities, and leading company profiles. The analysis draws on GlobalData’s proprietary databases, primary and secondary research, and in-house expertise.

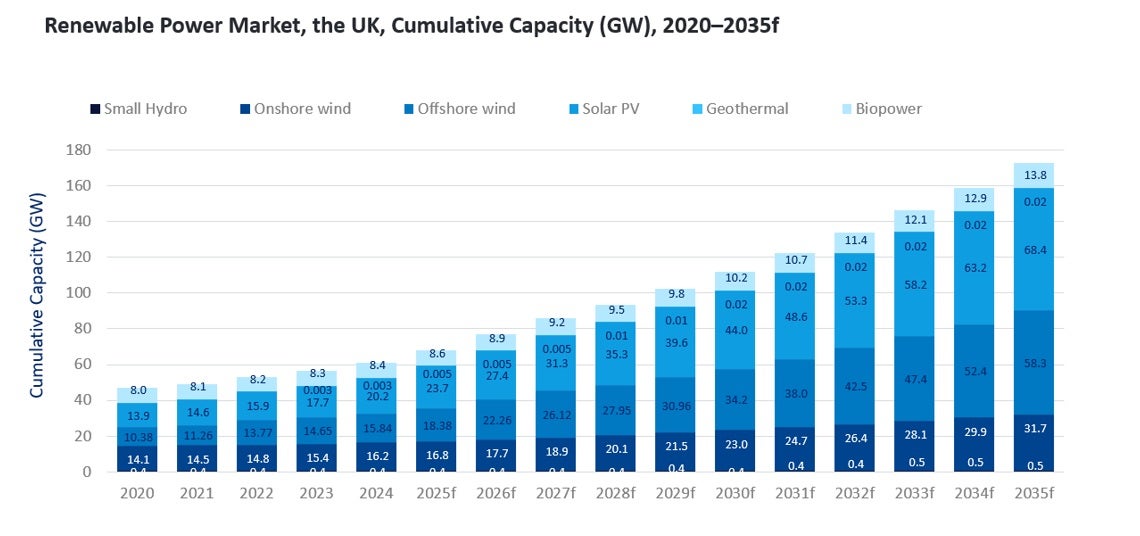

The UK is scaling up renewable energy deployment at an accelerated pace, driven by strong policy support, large-scale offshore wind expansion, and sustained investment in solar photovoltiac (PV) and biopower. The country’s cumulative renewable power capacity is forecast to reach 172.7GW by 2035, up from 61GW in 2024, registering a compound annual growth rate of 9.9% during 2024-2035, reveals GlobalData.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Wind power will remain the dominant growth driver within the renewable mix. Offshore wind capacity is projected to surge from 15.8GW in 2024 to nearly 58.3GW by 2035, supported by the Clean Power 2030 mission, successive contracts for difference (CfD) auction rounds, and large-scale grid expansion projects across the North Sea. The UK’s offshore wind pipeline is among the largest globally, strengthened by floating offshore wind projects, port infrastructure investment, and manufacturing localisation efforts in regions such as Teesside, Humber, and Scotland.

Onshore wind will also expand significantly, rising from 16.2GW in 2024 to 31.7GW in 2035, following the government’s decision to lift previous planning restrictions and accelerate approvals for repowering and hybridization. Solar PV is set to grow from 20.2GW to 68.4GW over the same period, supported by CfD-backed utility-scale projects, commercial rooftop installations, and community energy initiatives. Biopower will continue to play a stabilising role, increasing from 8.4GW to 13.8GW, leveraging the UK’s circular economy initiatives and sustainable waste-to-energy policies.

The UK’s clean energy growth is underpinned by a robust policy framework that includes the CfD mechanism, the Clean Power 2030 mission, and the Net Zero Strategy, all of which provide long-term investment certainty. Infrastructure programmes such as National Grid’s £35bn ($44.4bn) transmission upgrade plan and the Eastern Green Links offshore superhighway are enabling large-scale renewable integration and regional balancing.

While nuclear capacity growth is expected to slow in the near term, declining from 5.9GW in 2024 to around 4.1GW by 2035, thermal gas will continue to play a crucial role in maintaining system reliability and balancing renewable output. Gas-fired plants will remain an integral part of peak demand management and supply security until large-scale storage and hydrogen capacity mature. Government initiatives such as the £14.2bn investment in Sizewell C and the Great British Nuclear programme for small modular reactors will sustain low-carbon baseload generation and complement the rapid growth of renewables.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOffshore wind remains at the heart of the UK’s clean energy transformation, supported by record investment, clear policy direction, and modern grid infrastructure. With the combined momentum from solar, onshore wind, and biopower, the UK is well-positioned to sustain progress towards a low-carbon electricity system and achieve its 2050 net-zero goal.