GlobalData’s latest report, ‘Singapore Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035‘, provides a comprehensive assessment of the country’s power sector. The report examines installed capacity (GW), electricity generation (TWh), technology mix, and regulatory developments across the historical period from 2020 to 2024 and the forecast period from 2025 to 2035. It also evaluates market drivers, challenges, investment trends, and the evolving role of public and private stakeholders, drawing on GlobalData’s proprietary databases, primary and secondary research, and in-house analytical expertise.

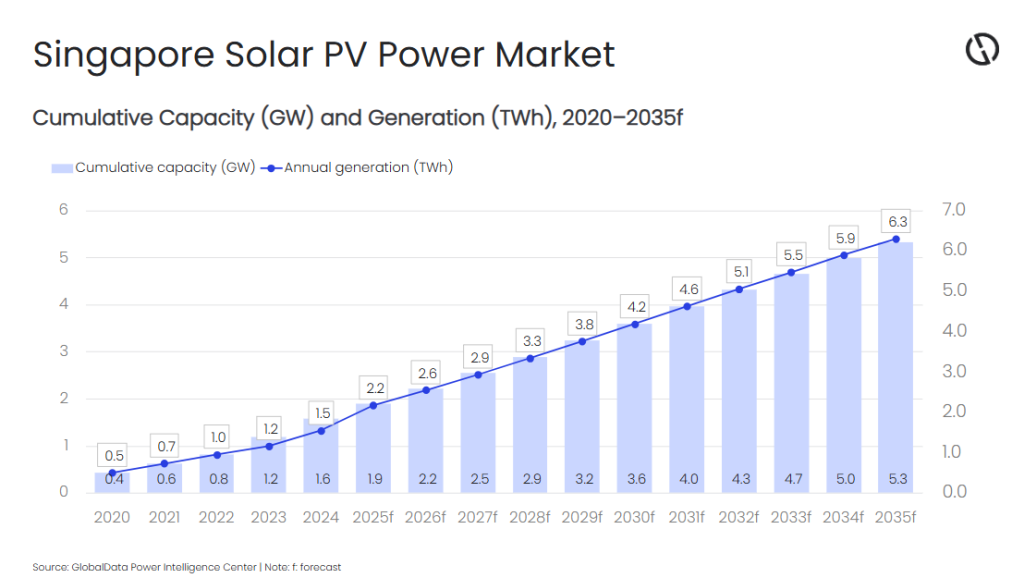

Singapore’s power system is shaped by long-standing structural constraints related to land availability, limited domestic energy resources, and rising electricity demand from cooling, electrification, and digital infrastructure. As a net energy importer with no interconnection-free alternatives, Singapore’s energy strategy is guided by the government’s “Four Switches” framework, which combines natural gas, solar PV, regional power grids, and emerging low-carbon alternatives. Within this framework, solar power represents the primary domestic renewable option supporting clean energy expansion. Against this backdrop, Singapore’s solar PV capacity is projected to increase to 5.33GW by 2035 from around 1.57GW in 2024.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Singapore’s solar PV capacity is projected to register a compound annual growth rate (CAGR) of approximately 11.7% during 2024–2035. This growth is supported by sustained deployment across rooftop, floating, and utility-scale installations, alongside government programmes that prioritise solar integration within urban and industrial environments.

Solar expansion is being enabled through policy instruments under the Singapore Green Plan 2030, which targets at least 2GW of solar capacity by 2030, and implementation mechanisms such as the SolarNova programme, the Simplified Credit Treatment (SCT) scheme, and the Enhanced Central Intermediary Scheme (ECIS). These frameworks facilitate both public-sector procurement and private participation by improving project bankability, enabling excess power monetisation, and reducing barriers for distributed solar deployment across residential, commercial, and industrial segments.

Singapore’s clean energy strategy reflects the constraints of a dense, import-dependent system. Solar PV is being scaled within physical limits through targeted policy mechanisms and urban deployment models, while parallel investment in storage, gas modernisation, and regional interconnections supports reliability and system balance.

Despite rising solar capacity, Singapore’s electricity system remains heavily reliant on natural gas, which continues to account for approximately 94–95% of power generation. Gas-fired generation provides dispatchable capacity and operational flexibility essential for maintaining grid stability in a system with limited storage and variable renewable output. Supported by diversified LNG imports, strategic storage, and hydrogen-ready repowering requirements, gas-based capacity increases gradually from around 10.38GW in 2024 to approximately 14.82GW by 2035, ensuring adequacy as electricity demand grows.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReports

Singapore Power Market Outlook to 2035: Market Trends, Regulations, and Competitive Landscape

Alongside domestic generation, Singapore is advancing regional diversification through conditional approvals for cross-border low-carbon electricity imports, with plans to import up to 6GW by 2035. In parallel, the National Hydrogen Strategy positions hydrogen as a longer-term decarbonization option, with hydrogen-compatible gas plants and pilot projects designed to preserve optionality beyond 2035.

Singapore’s power sector is evolving through a pragmatic pathway that prioritises reliability while gradually reducing emissions intensity. Solar PV remains the cornerstone of domestic renewable growth, supported by targeted policy mechanisms and urban deployment models, while natural gas, regional power imports, and hydrogen readiness collectively ensure system resilience through 2035.