Leading data and analytics company GlobalData’s latest report, ‘Solar PV Modules and Inverters Market Size, Share and Trends Analysis by Technology, Installed Capacity, Generation, Key Players and Forecast, 2024-2030’, offers comprehensive insights into the solar photovoltaic (PV) modules and inverters market. The report examines the capacity and market value of the PV modules market, categorised by technology, for both historical (2020-24) and forecast (2025-2030) periods. It also analyses the capacity and value of the PV inverters market based on consumer segments and outlines the overall market value.

Additionally, the report includes market overviews, drivers, and restraints affecting the market, key policies and initiatives, major upcoming projects, and recent contracts signed at key country levels. It also provides information on global market share. The analysis is based on GlobalData’s proprietary data bases, as well as primary and secondary research, and in-house expertise.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

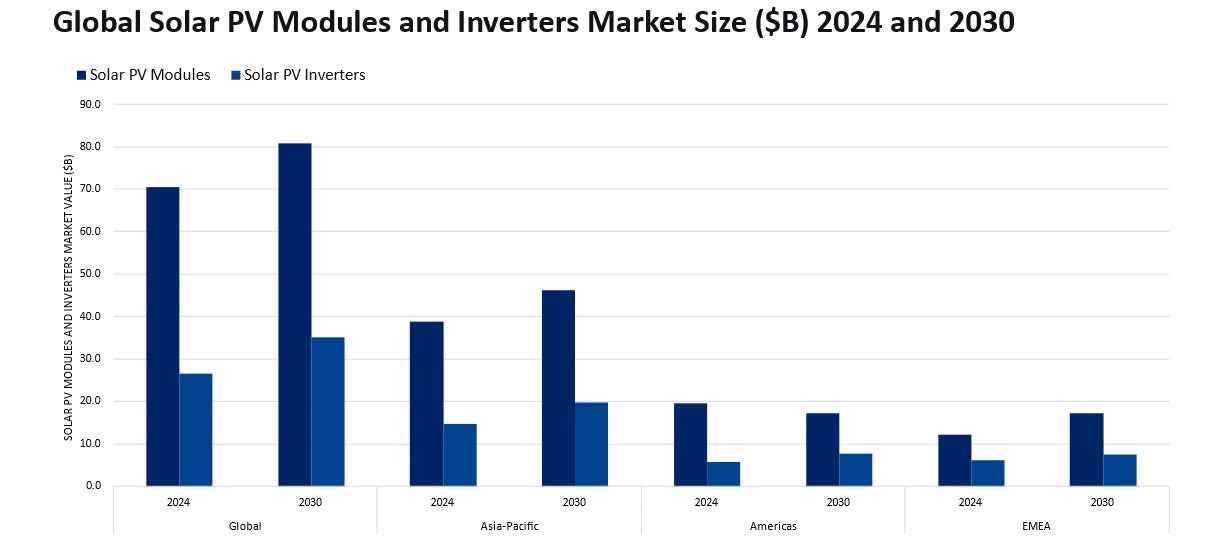

The global solar PV modules and inverters market is forecast to reach $115.8bn by 2030, largely driven by the Asia-Pacific (APAC) region with its strong policy initiatives, ambitious renewable energy targets, large-scale investments, rapid urbanisation, declining technology costs, and expanding solar manufacturing and innovation in major economies.

The APAC solar PV modules market reached $38.8bn in 2024 and is estimated to reach $46.2bn in 2030. Recent changes in trade policy, including US tariffs, are reshaping supply chains and accelerating localisation efforts across the region. In Europe, the Middle East, and Africa (EMEA), module markets are being shaped by policy initiatives focused on quality, domestic industrial capacity, and strategic procurement, particularly in the Middle East.

In the Americas, especially in the US, recent policy measures have strongly encouraged module manufacturing to relocate closer to home. Tariff adjustments and antidumping/countervailing duties on modules and cells from certain Southeast Asian countries have significantly altered supply chains and increased module prices in the US market. The anticipated decline in the value of solar modules in the Americas, despite ongoing installation growth, is primarily due to significant price erosion driven by oversupply and decreasing production costs.

The global solar PV inverter market is rapidly evolving, fuelled by the increasing demand for utility-scale projects, hybrid solar-plus-storage systems, and stricter grid compliance and cybersecurity regulations, particularly in Europe and the US. The APAC region remains the primary production hub while the Middle East and Africa are emerging as growth areas that require high-capacity and storage-ready inverters for large-scale projects and weak-grid integration. The global solar PV inverter market value is led by the APAC region at $19.8bn, followed by the Americas at $7.7bn and the EMEA at $7.6bn. Global market dynamics are being influenced by national industrial policies, regulatory reforms, and changes in procurement practices. Different regions are responding in various ways: APAC is expanding capacity and local manufacturing; EMEA is concentrating on quality, domestic production, and strategic procurement; and the US is adjusting incentives and trade policies while sustaining deployment momentum. These developments will continue to impact supply chains, technology adoption, and investment flows throughout the solar PV sector.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData