GlobalData’s latest report, ‘South Korea Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations and Competitive Landscape’, discusses the power market structure of South Korea and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape, and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario and future potential, as well as an analysis of deals in the country’s power sector.

Earlier this year, South Korea introduced its Ninth Basic Plan for Long-Term Electricity Demand and Supply 2020-2034, with a goal to increase the share of renewable energy in its energy mix from the current 15.1% to 40% by 2034. Against this backdrop, offshore wind power and solar photovoltaic (PV) will play a crucial role in reducing dependency on fuel imports for thermal power generation and achieving its climate goals.

Thermal power accounted for 64.4% of South Korea’s total electricity last year, while nuclear accounted for 26.2%. A total of around 24 nuclear reactors were used to meet approximately one-third of the country’s electricity consumption, with demand at its peak during midsummer, when residential customers tended to use home-cooling devices.

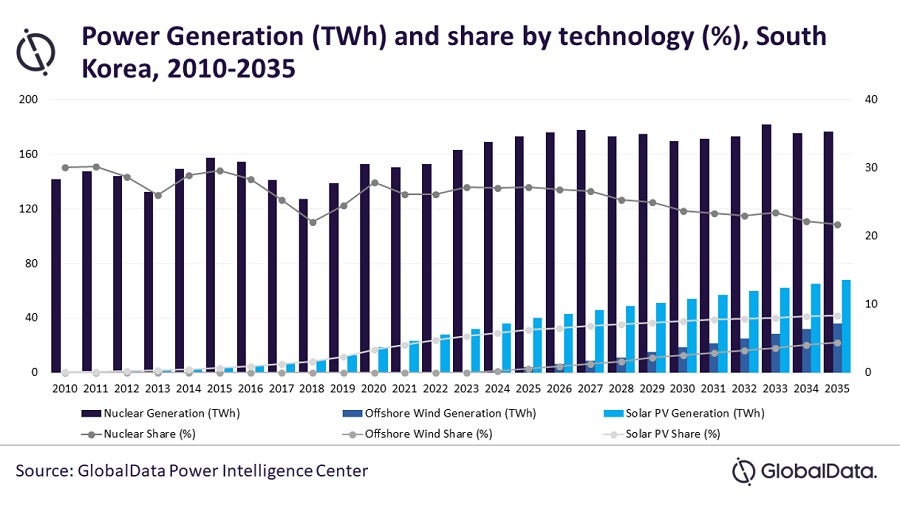

South Korea’s ability to handle domestic electricity demand effectively stems from its large thermal and nuclear power generation. Nuclear power is expected to continue to meet around 21.8% of the country’s electricity requirements (in terms of annual generation) until 2035. Growth opportunities for the nuclear power sector will come in the form of technology exports. South Korea has recently been awarded a nuclear power project in the United Arab Emirates (UAE), which, if successful, could see it grow into a leading exporter of nuclear power generation technology.

Other growth opportunities in the renewable sector are specifically available in solar PV and offshore wind. Nearly 40% of the projects in the pipeline are in the offshore wind segment.

South Korea has laid out plans to build the world’s largest offshore wind farm by 2030 with an estimated capacity of 8.2GW. The country aims to be a leader in this field and has already started to adapt the technology to suit its needs and economics.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe share of solar PV in South Korea’s total power generation is expected to increase from 4.1% in 2021 to 8.4% in 2035. In October 2020, the country announced its goal to achieve net-zero emissions by 2050. In line with this goal, the government aims to build 12GW of offshore wind capacity and 34GW of solar PV capacity by 2030.

South Korea’s real gross domestic product (GDP), calculated in US dollars according to 2010 prices, grew from $1,144.1bn in 2010 to $1,528.8bn last year at a combined annual growth rate (CAGR) of 2.7%. GDP growth slowed in 2009 owing to the financial crisis, which led to a major fall in global economic activities. Its economy rebounded in 2010 with a 6.8% growth rate and has shown annual growth of around 2.5% between 2011 and 2020.

In 2020, South Korea’s economy saw a slow growth, with GDP falling 1.0% due to reduced demand and supply chain constraints owing to the Covid-19 pandemic. Between 2021 and 2030, the economy is expected to grow at a CAGR of 2.4%, reaching $1,892.1bn in 2030.