GlobalData’s latest report, Spain Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035, provides detailed insights into Spain’s power sector. The report covers installed capacity (in GW), generation (in terawatt hours or TWh), technology shares and policy developments for the historical period 2020 to 2024 and the forecast period 2025 to 2035. It also analyses market drivers, restraints, investment opportunities and the profiles of leading companies. The research is based on GlobalData’s proprietary databases, primary and secondary research, and in-house expertise.

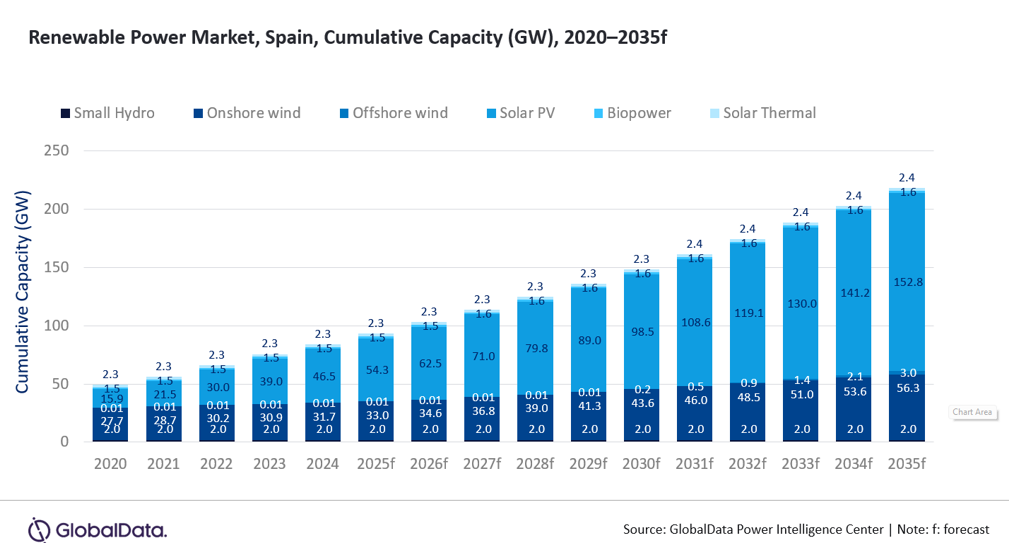

Spain is reinforcing its clean energy transition with ambitious targets for solar, wind and hydrogen, backed by strong European Union (EU) alignment and national reforms. The country aims to achieve 81% renewable electricity generation by 2030 and carbon neutrality by 2050 under its updated National Energy and Climate Plan (PNIEC). Against this backdrop, Spain’s cumulative renewable capacity is projected to reach 218.1GW in 2035, growing at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2035.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The report reveals that renewable generation is expected to increase from 131.2TWh in 2024 to 313.6TWh in 2035, at a compound annual growth rate of 8.2%. Solar PV will remain the driving force, with capacity surging from 21.5GW in 2021 to 152.8GW by 2035, while onshore wind is forecast to rise from 28.7GW in 2021 to 56.3GW in 2035.

Spain’s updated PNIEC and policies such as the Renewable Energy Economic Regime (REER) and the Climate Change and Energy Transition Law are ensuring strong investor confidence. The competitive auction framework under REER and distributed generation incentives such as the Self-Consumption Law are accelerating both utility-scale and rooftop solar deployment. Offshore wind and green hydrogen are also emerging as new growth pillars, supported by EU and national funding.

Spain’s clean energy strategy is reinforced by its limited reliance on Russian gas and diversified liquified natural gas imports, while new interconnections with France and Portugal, including the Bay of Biscay and Trans-Pyrenean projects, will enhance supply security and grid flexibility. However, challenges remain around permitting delays, curtailments due to grid constraint and low cross-border interconnection levels that restrict efficient market integration.

Spain’s rapid solar photovoltaic expansion, strong wind pipeline and growing green hydrogen sector are setting the stage for long-term decarbonisation. With grid modernisation and cross-border upgrades, the country is on track to achieve its 2030 and 2050 targets.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData