As the US pushes to reduce its reliance on Chinese-made vehicles, the EV market finds itself at the centre of a deepening trade policy divide. With rising tariffs and a renewed focus on internal combustion engine vehicles, the American EV sector faces mounting headwinds and intensifying global competition.

Two presidents, two visions for EVs

The Biden and Trump administrations have shared a common objective: reducing the United States’ dependence on foreign-made vehicles, particularly from China, to protect domestic manufacturers and bolster local production. In 2024, the Biden administration imposed a 100% tariff on Chinese EVs and a 25% tariff on lithium-ion EV batteries. The aim was to safeguard US manufacturing while accelerating the decoupling from Chinese supply chains. Biden’s vision was not only about reducing foreign reliance but also ensuring that the US could continue to manufacture EVs at scale.

Biden’s administration set an ambitious goal that 50% of all new vehicles sold in the US by 2030 would be battery electric vehicles (BEVs). To achieve this target, the Biden Administration focused on infrastructure development, allocating US$5 billion under the National Electric Vehicle Infrastructure (NEVI) Formula Program to build a nationwide network of 500,000 high-speed EV charging stations by 2030, but also strengthening the domestic battery manufacturing sector. In September 2024, the US Department of Energy (DoE) announced more than US$3 billion in funding for 25 projects across 14 states, aiming to enhance the production of advanced batteries and battery materials, with recipients including major companies such as Honeywell.

Trump’s tariff surge: EV industry under pressure

This plan has faced significant setbacks under the new Trump administration. While continuing the decoupling from Chinese supply chains, President Trump recently imposed a 145% tariff on Chinese goods – which includes EV components such as lithium-ion batteries. Unlike his predecessor, Trump has shown little interest in protecting the EV supply chain and the new tariffs are expected to sharply increase the cost of battery cells, drive up EV prices and dampen domestic sales. This is particularly concerning given that China currently holds between 75% and 85% of global lithium-ion battery cell production capacity.

Adding to the uncertainty, China announced in April 2025 that it would restrict exports of seven heavy rare earth elements (REEs), including dysprosium and terbium, which are currently used in many EV motors. With China controlling around 60% of global REE mining and 90% of its processing, the US remains highly exposed in the event of prolonged trade escalation. US-built vehicles rely heavily on international supply chains – Tesla, for example, imports between 20% and 25% of its components from other countries.

Tesla, tariffs and the rising cost of going electric

This creates a complicated dynamic for Tesla. While Elon Musk has generally aligned with President Trump on several issues, recent developments around tariff policy have exposed some friction. Musk has repeatedly expressed opposition to sweeping tariffs, which have disrupted global markets and hit Tesla especially hard, given its dependence on Chinese-made components. Tesla’s stock has since fallen almost 50% from its December 2024 peak, underscoring the company’s exposure to rising costs and shaken investor confidence.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataChinese automakers were already outpacing their US counterparts in terms of cost competitiveness. In particular, BYD’s aggressive pricing and domestic supply chain advantages have enabled it to offer EVs at significantly lower prices. As a result, in the fourth quarter of 2024, BYD officially surpassed Tesla in global EV sales, delivering 594,839 units, versus Tesla’s 491,062 – the first time Tesla lost its quarterly global sales lead in the electric vehicle market since 2018. Moreover, the imposition of these tariffs has led to diplomatic friction, retaliatory tariffs and many consumers resisting purchasing US goods as a form of protest, which could further shrink the global market for American EVs.

In response to growing industry concerns, the Trump administration has granted temporary exemptions for certain automakers, particularly those relying on supply chains that run through Canada and Mexico. In March 2025, it issued a one-month reprieve from tariffs for companies including Ford, General Motors and Stellantis, following backlash from major car manufacturers. Additionally, on 29 April, Trump suggested he would ease tariffs affecting car production costs after pressure from US-based automakers, stating that he wanted to “take care of our car companies” in light of rising input costs and industry complaints. While this could offer some short-term relief for international combustion engine vehicles, it does little to address the long-term challenges of EV supply chain localisation.

A race to rebuild: can the US catch up in battery production?

Shifting the US EV production supply chain away from China to other critical material-rich sources is an ongoing process. For example, while Tesla has made major investments in lithium-ion battery production at its gigafactory in Nevada, most of the lithium originates from overseas, including from China, South America and Australia. US domestic lithium extraction projects, such as those in Nevada’s Thacker Pass or North Carolina’s Piedmont lithium project, are only a couple of years away from large-scale production, but permitting, environmental concerns and infrastructure challenges may cause significant delays.

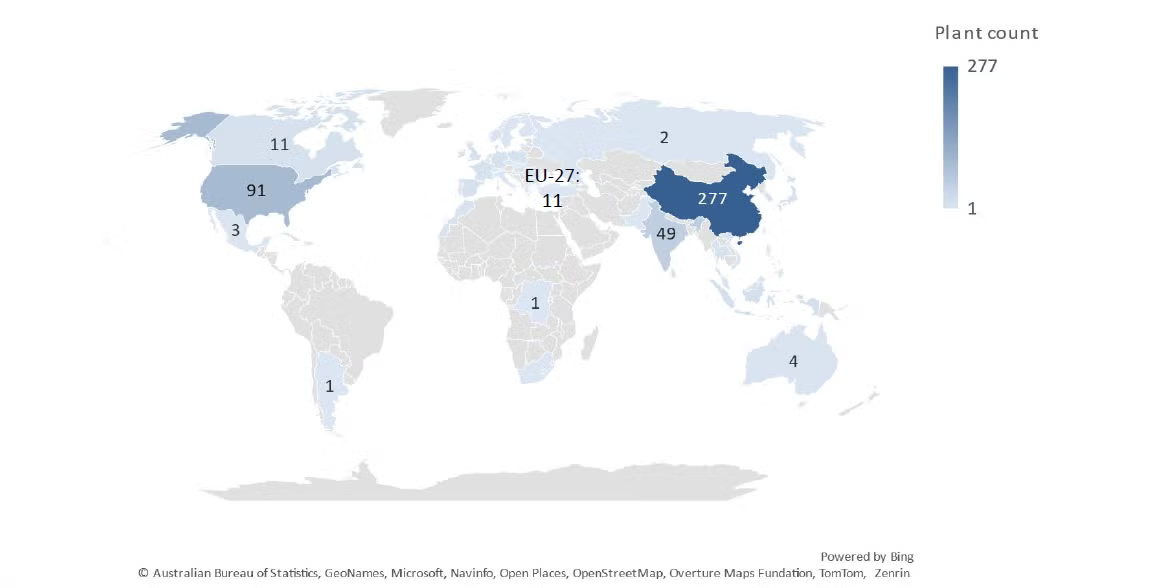

The US is ramping up domestic battery production, globally ranking second with a total of 91 lithium-ion EV battery plants due to come online between 2025 and 2032. These plants include both public and private projects, such as the US DoE’s Blue Oval EV Battery Plant Development Program, with a project value of US$9.2bn, and General Motors’ EV Transition Program, with a project value of US$7.2bn. Yet the gap remains vast: in addition to its existing manufacturing capability, China currently has 277 upcoming lithium-ion battery plants set to reach completion between 2025 and 2032 – more than triple the US total. This not only underscores the continued dominance of Chinese battery manufacturing despite growing US momentum but also highlights how the US is unlikely to be able to offset near-term supply chain disruptions and rising costs with its domestic production alone.

Why tariff relief isn’t a win for EVs

Beyond tariffs, the Trump administration’s broader policy shifts are poised to significantly impact the US EV market. Notably, plans to ease fuel economy and CO₂ reduction targets would reduce the pressure on automakers to invest in expensive electrification technologies or increase BEV sales, allowing them to focus on higher-profit combustion engine vehicles. Additionally, the administration’s intent to eliminate the US$7,500 federal EV tax credit – a move supported by Tesla but opposed by other automakers – could drastically reduce EV demand. These impending policy changes have already led to tangible setbacks in the industry. Several battery investments have already been delayed or cancelled, including LG’s Queen Creek plant in Arizona, planned for EV and energy storage batteries, and the HL-GA Battery Company plant in Georgia, set to supply Hyundai and Kia EVs, as companies reassess the viability of their EV strategies in the face of policy uncertainty.

As the situation continues to evolve amid ongoing trade negotiations and shifting tariff policies, there have been temporary exemptions granted for certain categories, for example, consumer electronics such as smartphones and laptops. Although examples like the above suggest Trump is willing to ease tariffs in specific sectors – including cars – these moves are not aimed at supporting EV supply chains in particular. As such, while traditional car manufacturers may benefit from short-term relief, the US EV market still faces significant obstacles. Trump’s broader anti-EV stance, combined with policy rollbacks and the recent halting of domestic battery projects, will continue to present major headwinds to growth in this sector.