Middle East utilities are seeking public-private partnership models for power and water projects as part of efforts to cut capital expenditure.

The shift towards various forms of public-private partnership (PPP) models to develop utility projects in the Middle East is well underway.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAdopting PPP to deliver power and water projects in the region is nothing new, with the first independent power producer project dating back to 1994 in Oman.

Abu Dhabi, Kuwait, Dubai and Saudi Arabia

In the following years, Abu Dhabi emerged as the region’s hot spot for the model, establishing a blueprint for others to follow.

Markets such as Kuwait and Dubai adopted the model much later – both have only pushed ahead with PPP utility projects in the past five years.

Saudi Arabia, the region’s largest utility market, awarded a handful of contracts for independent water and power projects between 2007 and 2010, but it reverted to standard engineering, procurement and construction models as the price of oil recovered after the financial crisis.

The sharp drop in oil prices in 2014, however, had a profound impact on government spending and economic planning for infrastructure projects and has prompted another rethink.

The tried-and-tested model for developing utility plants is the best place to start. Handing over the reins to the private sector will also help meet increased efficiency goals and reduce fuel bills for the lifecycle of the projects.

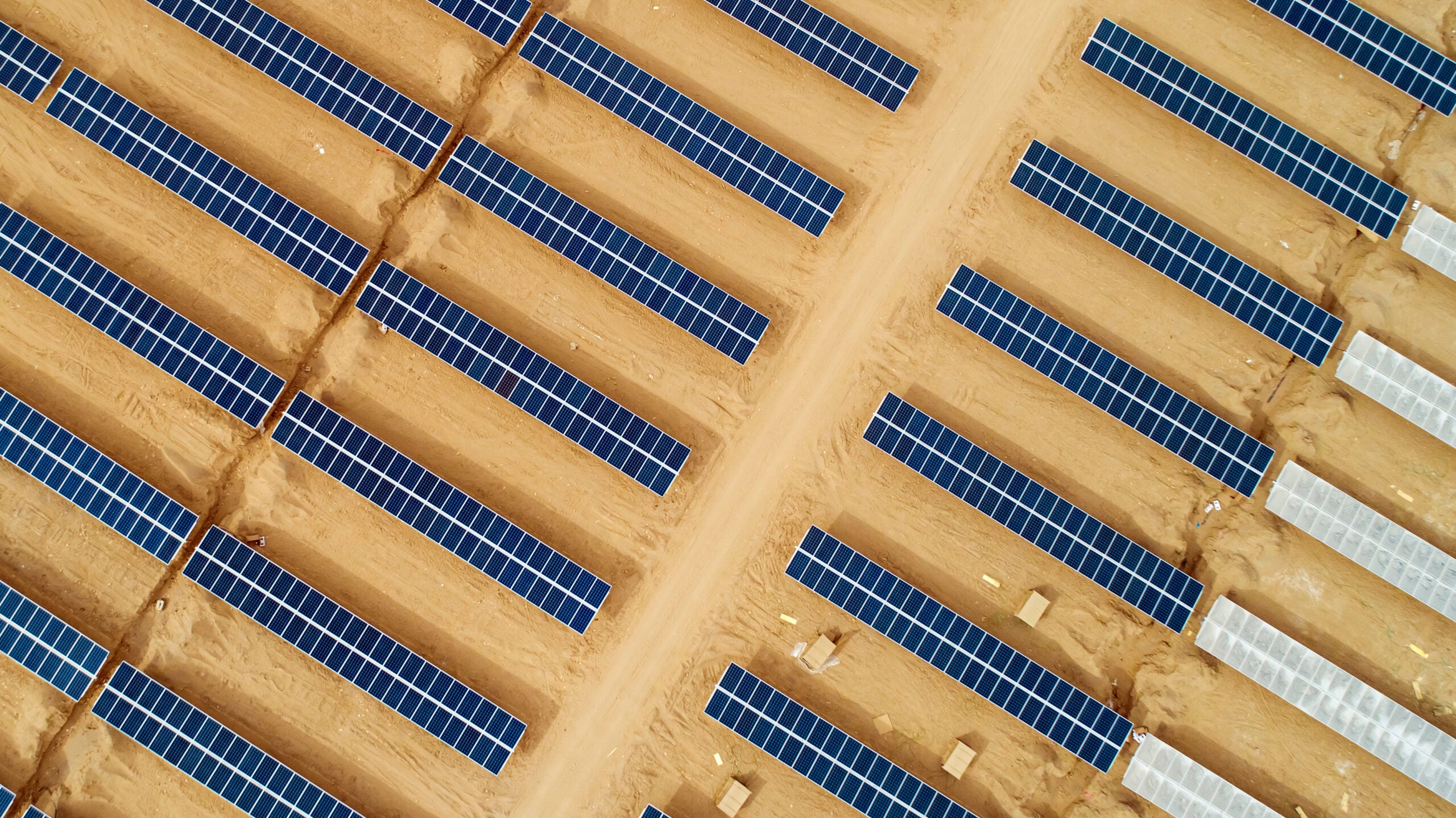

With the rise of renewable energy capacity and the decoupling of power and water assets, there is set to be a greater number of lower-value financed transactions in the utility sphere.

An increased number of smaller PPP projects in the region’s power and water sector will please lenders and offer more opportunities for aspiring developers in an increasingly competitive market.

This article is sourced from Power Technology sister publication www.meed.com, a leading source of high-value business intelligence and economic analysis about the Middle East and North Africa. To access more MEED content register for the 30-day Free Guest User Programme. https://www.meed.com/registration/

Related Company Profiles

Power Technology Inc