Business optimism declined in July 2022 compared to June 2022, amid concerns over inflation as the cost-of-living pressures on households continued to grow in countries such as the UK, revealed the analysis of an ongoing poll by Verdict.

Verdict has been conducting the poll to study the trends in business optimism during COVID-19 as reflected by the views of companies on their future growth prospects amid the pandemic.

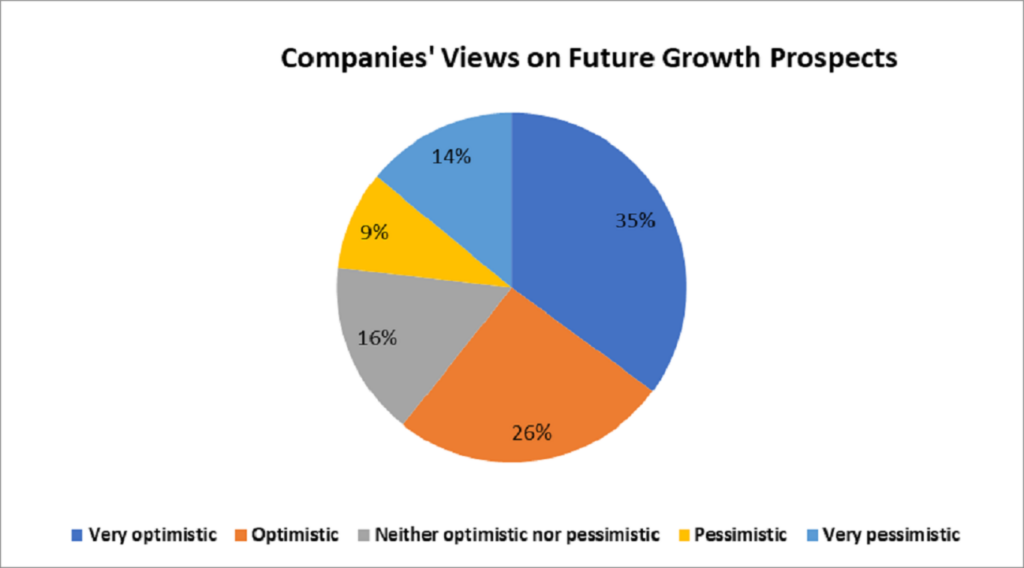

Analysis of the poll responses recorded in July 2022 shows that optimism regarding future growth prospects decreased by two percentage points to 61% from 63% in June 2022.

The respondents who were optimistic increased by four percentage points to 26% in July, while those very optimistic decreased by six percentage points to 35% from 41% in June.

The respondents who were pessimistic increased by one percentage point to 9% in July, whereas those who were very pessimistic remained unchanged at 14%.

The percentage of respondents who were neutral (neither optimistic nor pessimistic) increased by one percentage point to 16% from 15% in June.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe analysis is based on 328 responses received from the readers of Verdict network sites between 01 July and 31 July 2022.

Business confidence falls three points to 25% in the UK

The overall business confidence in the UK fell three points to 25% in July 2022, according to the Lloyds Bank Business Barometer. It fell below the long-term average of 28% for the first time since March 2021 when the economy was emerging from the impact of the COVID-19 pandemic.

The fall in business confidence is attributed to rising inflation, which is reaching the highest level in the last 40 years. Inflation was one of the primary concerns among 54% of the businesses, followed by economic slowdown (38%) and tightening labour markets (25%).

The ONS Business Insights and Conditions Survey for the two weeks ending 10 July 2022 further indicated that 19.7% of respondents in the UK believed that their business performance would improve over the next 12 months, while 13.2% believed it would decrease. The remaining respondents believed that business performance would remain the same.

Business confidence climate in Germany and Italy cooled significantly

The ifo Institute’s ifo Business Climate Index dropped noticeably to 88.6 points in July 2022, down from 92.2 points in June 2022, to reach its lowest level since June 2020 as organisations are expecting poor business performance in the months ahead. Higher energy prices and threat of a gas shortage are weighing on the economy with the possibility of a recession.

The index plummeted across sectors such as manufacturing, services, trade and construction. Pessimism regarding the months ahead reached its highest levels since April 2020 and across most industries in manufacturing. In the service sector, the business climate worsened even in tourism and hospitality, which reported recent optimism. Meanwhile, businesses remained less satisfied with their current performance in trade and were increasingly worried about the future.

In Italy, the business confidence climate dropped from 113.4 to 110.8 in July, according to the Istat Economic Sentiment Indicator (IESI) index. The business confidence index in manufacturing decreased from 109.5 to 106.7 and from 109 to 104.1 in market services. Meanwhile, business confidence index improved in construction from 159.7 to 164.4 and in retail trade from 107.2 to 108.1.

New Zealand businesses report an increase in confidence

Business confidence in New Zealand improved by six points in July to -56.7 from -62.6 in June, even though inflationary pressures remained intense, according to the ANZ Business Confidence Index and ANZ Own Activity Index. While most indicators changed marginally, residential construction intentions plunged again to fresh lows. New Zealand businesses believe that the Reserve Bank is working on reducing customer demand for their merchandise in an effort to reduce inflation. Meanwhile, supply-side factors such as higher costs and severe staff shortages continue to cause disruptions.