Business optimism decreased in March 2022 compared to February 2022, according to an ongoing poll by Verdict, due to increased uncertainty arising out of inflationary pressures and the Ukraine-Russia conflict.

Verdict has been conducting the poll to study the trends in business optimism during COVID-19 as reflected by the views of companies on their future growth prospects amid the pandemic.

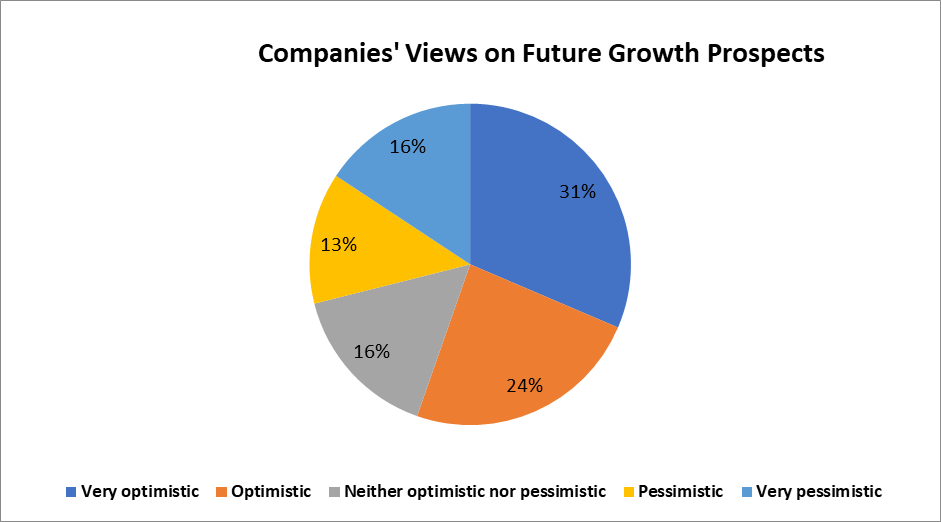

Analysis of the poll responses recorded in March 2022 shows that optimism regarding future growth prospects decreased by seven percentage points to 55% from 62% in February 2022.

The respondents who were optimistic decreased by three percentage points to 24% in March, while those very optimistic decreased to 31% from 35%.

The respondents who were pessimistic increased by four percentage points to 13%, whereas those who were very pessimistic remained unchanged at 16% in March.

The percentage of respondents who were neutral (neither optimistic nor pessimistic) increased by three percentage points to 16%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

The analysis is based on 401 responses received from the readers of Verdict network sites between 01 March and 31 March 2022.

Uncertainties over rising commodity prices and the Ukraine-Russia conflict

Business confidence dropped by 11 points to 33% in March in the UK, according to the Lloyds Bank Business Barometer, as uncertainties over inflationary prices and the Ukraine-Russia conflict continued to cloud business prospects, particularly in the manufacturing and retail sectors. The barometer also highlighted that the fall was much lower than the drop in confidence experienced during the initial two months of the COVID-19 pandemic.

Manufacturing and retail sectors reported drops in confidence of 19% each from the February highs of 35% and 28% respectively mainly due to the Ukraine conflict. In addition, confidence dropped in services by six percentage points to 32% and in construction by eight percentage points to 43%.

The Euro zone’s March factory growth also declined, with S&P Global’s final manufacturing Purchasing Managers’ Index (PMI) falling to a 14-month low of 56.5 in March compared to February’s 58.2. Intensity over Russia’s invasion of Ukraine and the escalating cost of living suggested that the bloc’s manufacturing could slip into a downturn at the end of the quarter.

In France, business confidence dropped to new lows of 106.1 in March compared to February’s 112.3, due to reduced expectations from demand and economic activity, and due to Russia’s invasion of Ukraine. Meanwhile, the ifo Business Climate Index plunged to 90.8 points in March, from 98.5 points in February, in Germany. The fall was mainly due to the decline in business expectations by 13.3 points, which is more than the 11.8-point decline recorded at the start of the COVID-19 outbreak. Dutch manufacturers also remained less positive about their future production and order positions, as companies rated their business outlook as extremely uncertain.

In the US, small business owners felt the impact of rising prices, but remained optimistic about the growth and expectations of their business, according to the MetLife and US Chamber of Commerce Small Business Index.

Colorado firms remained less optimistic about the economy, with 55% of the 195 local business leaders expecting wages to rise while 8% planned to cut down staff and 1% planned to cut working hours, according to Leeds Business Confidence Index. In addition, about 46% stated that they would increase prices or add costs to consumers due to inflationary pressures.

Additionally, Central Massachusetts business owners’ optimism also dropped in March to 55.1 from 58.1 in February, according to the Central Massachusetts Business Confidence Index. The fall was attributed to a tug and pull in confidence between high levels of expectations in the economy and concerns over geopolitical risks, costs, resources, and public health issues.

Similarly, India’s manufacturing sector activities moderated in March, with S&P Global India Manufacturing PMI falling to 54.0 in March, compared to 54.9 in February, indicating the weakest growth rate in production and sales since September 2021. Companies further reported reduced expansions in orders and production, as inflation concerns dampened business optimism. The seasonally adjusted S&P Global Malaysia Manufacturing PMI dropped to 49.6 in March from 50.9 in February, suggesting a slight weakening of the sector that stood first since September 2021. Manufacturers stated that the fall in optimism was due to a resurgence of COVID-19 infections, supply chain holdups, rising costs, and workers’ shortages, which were exacerbated by the uncertainty around the invasion of Ukraine.