Earlier this month at Power Summit 2025, Europe’s energy leaders gathered in Brussels, Belgium, to discuss the pressing concerns pertaining to electricity. Among the priorities, one stood out: the urgent need to upgrade the EU grid.

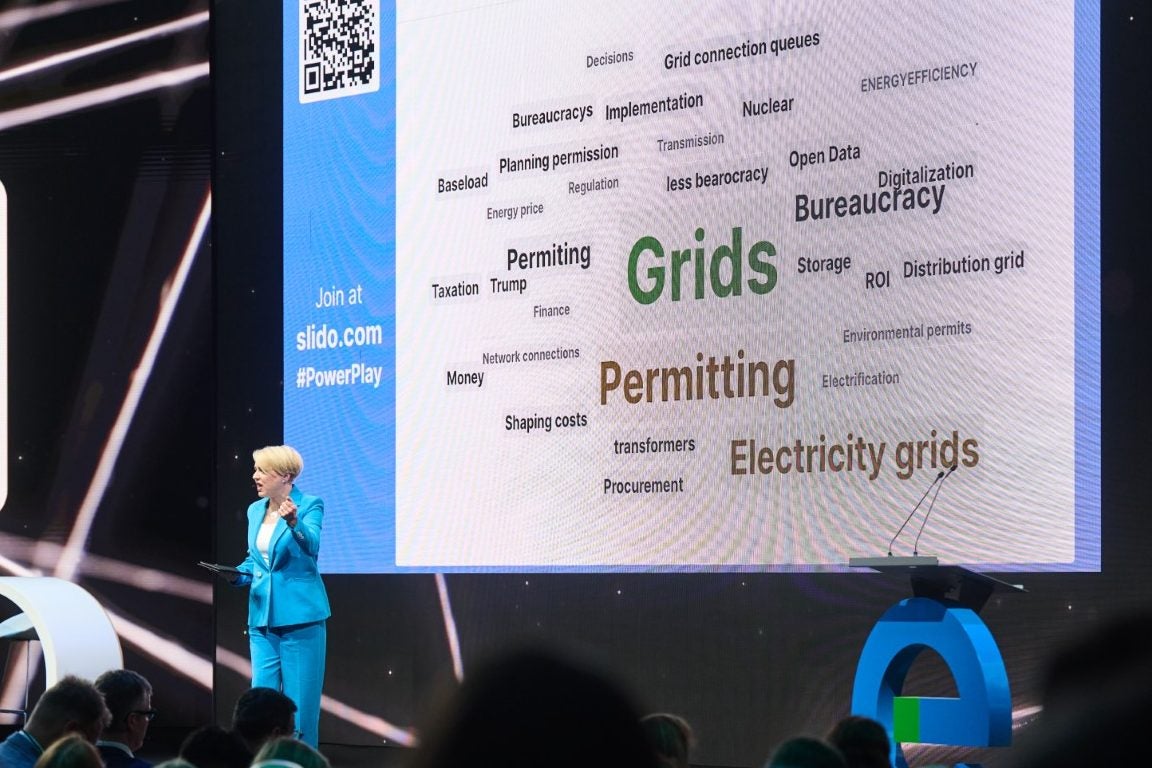

At the opening of the conference, hundreds of participants were asked: “In one word, what is a bottleneck to the EU energy transition?” The largest word recorded in the word cloud was none other than the grid.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“The grid at the centre of the cloud, the centre of problems, must disappear in a few years,” Shubbhronil Roy, VP of strategy & commercial transformation at Schneider Electric, told Power Technology. “There are so many other areas [of the transition] that need to be addressed, and the grid itself should not be a roadblock. It should become an opportunity for all those other issues to be resolved.”

As the bloc accelerates its energy transition, the infrastructure underpinning it has been strained under new demands. While renewables and electrification are expanding, the grid has been unable to manage the rapidly increasing load alongside the intermittency and fluctuation of renewables.

The summit’s collective focus thus reflected a sector-wide determination to reform the EU grid.

Upgrades must keep pace with electrification

Industry leaders agreed that electrification holds the key to Europe’s energy ambitions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Electrification will be a key driver – it drives decarbonisation, competitiveness and energy security,” said Ditte Juul Jørgensen, director-general for energy at the European Commission.

Yet, without the infrastructure to support it, electrification risks becoming more of a burden than a benefit.

The current EU grid is not built for what is coming. According to a joint analysis by EY and Eurelectric, electricity is expected to account for 60% of final energy consumption in Europe by 2050, and the EU grid will require €67bn ($77.94bn) in investments annually – more than double the €33bn annual average reported in 2024 – to upgrade and be able to manage this load.

While the EU has attempted to remove the grid bottleneck through reforms in planning and permitting, “still, more must be done”, noted Andrea Falciai, managing director and EMEA utilities industry lead at Accenture.

“We need to be equipped for the energy system of the future, which will differ significantly from today’s as electrification progresses.”

Uniper CEO Michael D. Lewis drew a historical parallel: “When the EU first built its road network, hardly anyone had a car, but it was built in anticipation of, and laid the foundations for, decades of demand growth – which came.

“Now, we need to do the same with our electricity grids. We must prepare for the future.”

As renewable energy takes centre stage, grid reliability and adaptability are becoming non-negotiable. But “as we electrify and see more renewables, grid optimisation will become more complex”, stressed president and CEO of Fortum Markus Rauramo, “so we will need ways to manage it much more effectively”.

The key solution highlighted by summit speakers was digitalisation.

“AI and digital solutions will be essential in managing the complexities to come with more electrified, decarbonised and decentralised energy systems,” said Georgios Stassis, chairman and CEO of PPC Group. “AI will have a significant impact on energy efficiency and, eventually, emission reductions.”

Indeed, the International Energy Agency (IEA) estimates that AI applications could lead to emission reductions of up to 20% from current levels.

At the same time, AI represents a double-edged sword for power grids. While it offers the power to optimise grid operations and enhance efficiency, it is rapidly becoming one of the most significant sources of strain, due to its immense energy requirements. The IEA projects AI data centres will drive more than 20% of power demand growth between now and 2030.

Nevertheless, Stassis sees “digitalisation and AI not as side projects, but as core enablers for the energy transition – and vice versa”.

Security means more than just supply

Although industry leaders agree that digitalisation is critical, the mission comes with major challenges. As Europe becomes more digitalised, so the risks multiply.

“The more we electrify, the more we rely on digital tools and connected systems, the greater the need for reliable, secure infrastructure,” said Birgitte Ringstad Vartdal, CEO of Statkraft.

Energy security – more often than not broached in the context of the availability of energy supply – has taken on a new meaning in the wake of geopolitical tensions and threats.

Energy infrastructure has emerged as a strategic target in modern warfare. This reality was starkly illustrated by Russia’s coordinated attacks on Ukraine’s energy systems in recent years.

However, the threats facing Europe’s energy system are no longer limited to physical strikes. As Danish Minister for Climate, Energy and Utilities Lars Aagaard described: “Back in the day, the biggest threat was something as simple as a chainsaw attempting to break energy installations.

“Times have changed,” he warned. “Resilient digital infrastructure has become just as important as physical infrastructure,” Stassis summarised.

Cyberattacks on energy infrastructure have increased dramatically over the past decade. The rising integration of renewables and distributed energy resources, alongside new digital tools, means increased attack surfaces for hackers; the speed of deployment, meanwhile, often means less robust cybersecurity measures are implemented.

“This is especially concerning to regions such as Europe, which is rapidly deploying and relying on renewables,” said NATO Assistant Secretary General for Innovation, Hybrid and Cyber Jean-Charles Ellermann-Kingombe, referencing the 2022 cyberattacks against European wind companies.

“Coordinated cyberattacks could undermine not only Europe’s energy security but military security, raising questions not only about the dependency on a single supply but vulnerabilities in the systems themselves,” he declared. “Thus, this type of energy security is of critical importance for national defence.”

The convergence of physical and digital threat vectors means energy companies must rethink infrastructure design from the ground up. “Moving forward, digital and energy infrastructure must be plugged in together, not in isolation. Resilience must be built into every layer, from sensors in the physical world to algorithms in the cloud,” Stassis said. “We must design policy and infrastructure with impact in mind.”

Accordingly, cybersecurity initiatives have ramped up in Europe, as exemplified by the launch of the EU-NATO task force on building resilience of critical infrastructure, comprising the energy, transport, digital and space sectors.

A study published during Power Summit 2024 revealed that the cybersecurity domain of European distribution system operators ranked relatively higher in digital maturity than other aspects of their business.

Yet, experts claim the industry remains unprepared to manage the increasing threats.

“We [NATO] launched the task force to manage threats and governments are putting in similar effort – but this is not enough,” said Ellermann-Kingombe. “Industry also needs to invest more in cybersecurity.”

Expediting cybersecurity measures to keep pace with the energy transition requires not only governments to provide supportive policies and funding but energy companies themselves to put their money where their mouth is.

“We [industry] must invest significantly more in cybersecurity,” Aagard stressed, noting that “it is likely that these costs will eventually be reflected in energy prices”.

“But security – ensuring a resilient energy system – comes at a cost, and it is essential. So, it is important that we are honest with consumers and clearly communicate this reality.”

The European market’s next steps: collaboration, reform, deliver

While technology and infrastructure dominated the technical conversations at the summit, policy was highlighted as of equal importance.

Jørgensen emphasised the EU Government’s role in facilitating investments for grid reform. “A stable regulatory framework can significantly de-risk these investments, while a predictable and stable market strongly incentivises investment,” she said.

“Thus, we must safeguard this, ensure it continues to operate effectively and improve its functionality wherever possible.”

Meanwhile, Catherine MacGregor, CEO of ENGIE, highlighted another aspect of the market that can aid the EU grid: “The varied generation mixes across the EU when and as they are tied together with interconnection capacity will be very important in strengthening energy security and bettering resilience. All of this can be done through a revised electricity market design.

“We don’t need to reinvent the wheel. The toolbox is already quite full.”

Stassis concluded: “The digital transformation of energy must be efficient so that we can serve growing demand without compromises.”

In the face of electrification, surging power demand and emerging security threats, Power Summit 2025 made clear that Europe’s energy future hinges on a resilient, intelligent and future-ready grid. Policymakers and C-suite executives of energy industries alike agreed that the grid can no longer remain the bottleneck of the energy transition but instead become its backbone.

The technologies are available, the policy tools largely in place or forthcoming, and the investment case for grid upgrades clearer than ever. What remains is action – or as Eurelectric secretary-general Kristian Ruby puts it: “The power to play, and the will to win.”

If Europe can deliver on that ambition, the grid will not just keep up with change – it will power it.