“It’s not a business issue anymore. It’s an issue of morality. I think, in future, business decisions will not be at the top of the discussion; morality issues will.”

This quote begins in Part One, where we speak to Ukraine’s largest private power company about keeping employees safe in three months of war.

On the night of 23 February, Ukraine disconnected its power grid from Russia amid increasing tension on the countries’ border. Whatever happened next, Ukraine’s power companies had to move away from their relationship with Russia. Perhaps movement toward Europe was certain from this point. Regardless, nobody was given an opportunity to contemplate this.

At 11pm that night, DTEK Group CEO Maxim Timchenko messaged friends to say he had a bad feeling about the situation. The next morning, he woke to explosions, as Russia’s invasion of Ukraine began. He said: “Today we live in a new reality. This is the biggest war in Europe since World War II. Like never before, a common goal unites Ukrainian society. Everyone is working for Ukraine’s victory over the aggressor. DTEK is no exception.”

In the months that followed, Ukraine has integrated its power grid with Europe and Ukraine’s power companies have united to condemn European trade with Russia. However, they now suffer the double frustration of being unable to integrate more closely with the European market, as well as seeing big players in that market put significant effort into circumnavigating sanctions in order to do business with Russia.

DTEK press secretary Antonina Antosha told me that European trade funded the bullets killing Ukrainians, and that as the importance of ESG investing grows, companies will be marked on their ethics over their business decisions.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“This is a good point to start showing morality,” she told me via video call from her home in Ukraine. In the past three months of war, this is the message that Ukraine’s largest power companies have sought to put in front of European eyes.

“Stop Bloody Energy”

Alongside two state-owned companies, grid operator Ukrenergo and oil and gas company Naftogaz, DTEK has lobbied other European companies to stop paying Russia for energy, indirectly funding its invasion of Ukraine.

Their campaign, titled Stop Bloody Energy, seeks to apply pressure to European companies that continue to pay Russian companies for energy. At the Davos Summit, the campaign organised a series of protests, drawing the attention of European financiers. One of their largest targets, French energy giant Engie, recently announced it would set up payment accounts with Russian banks to pay for energy. However, the company will stop short of paying in roubles, as demanded by Russia’s Government.

The EU has clarified that these actions do not breach its current sanctions on Russia, allowing several companies to do the same. Austria’s OMV, Germany’s EnBW, and Sweden’s Alfa Laval are among those maintaining business relationships with Russian energy companies. Some still hope to escape contracts keeping them there, but others do not see divesting from Russia as viable.

The future power relationship between Ukraine and the EU

This view on corporate morality runs parallel to the move towards ESG consciousness and environmentalism seen in EU legislation. In 2009, the EU officially declared that Ukraine “shares European values” and that it could become a member. But for this to happen, Ukraine would need to make significant changes in its government, markets, and trade with the bloc. So far, the war has moved Ukraine much closer to the EU, including in the energy business.

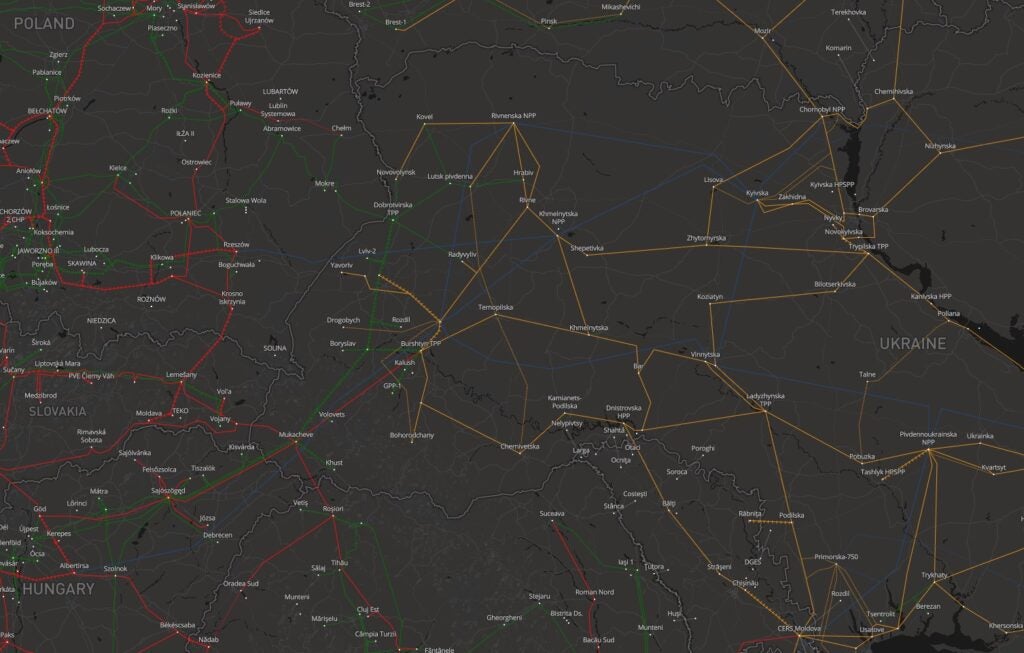

The day before the invasion, Ukraine disconnected its power grid from Russia. Exactly three weeks later, it joined the Europe-wide ENTSO-E grid along with Moldova. The rapid emergency synchronisation of the grids is technically a trial, and Ukrainian network operator Ukrenergo only has observer status in the organisation.

One of DTEK’s nuclear plants helped cover the power gap as Ukraine synchronised its grid. For years, Timchenko and DTEK have pushed for greater integration between the Ukrainian and European grids. This forms an important part of the long-term plans of Ukraine’s power companies, but in the present, the immediate effect of integration has been stability and reliability.

Antosha says: “Integration with ENTSO-E basically saved all of Ukraine from possible blackouts. We can be sure that if something bad happens to critical infrastructure, we can receive emergency help from any European country. Plus, we can now start a conversation about commercial exports. In general, Ukraine is already trying to negotiate exports, and there is a dire need for this.”

On 12 May, Ukraine started exporting power to Moldova, but the flow of power remains relatively small. DTEK has said that larger exports would need more focussed European political will, limiting Russian imports to favour Ukraine. These potential exports would, in part, cover the massive, growing, and looming financial hole the war has left in the country’s power industry.

The financial cost of war to energy companies

Timchenko has previously said that, at its current rate of losses, DTEK “has about 6-9 months” left before financial ruin. Following Russia’s invasion, DTEK suspended all capital investment. Mass worker layoffs are not an option, although management has seen cutbacks and labour relations have been suspended.

“It is important for us to mothball the construction in such a way that we can restore it after the end of the war,” he said. “In addition to investments in construction, we have suspended the development of IT projects, as well as a massive oil and gas drilling program.”

Ultimately, the business fundamentals have changed, and the number of areas where business is actually done has shrunk. He told me: “We are incurring losses due to falling consumption and electricity bills. Today, the entire Ukrainian energy sector generates monthly losses of more than $250m.

“However, this is a war. We are supplying free electricity to medical institutions, military and law enforcement agencies, as well as bread producers in Kyiv and in the Donetsk and Dnipropetrovsk regions.”

At the same time, Ukrainians watch EU companies carefully navigate sanctions while Ukrainian exports remain limited by regulation. This is why these companies previously advocated for the integration that only now seems to have started arriving.

After years of advocating greater integration with the European grid, Timchenko has had his wish granted with a sick twist of fate. However, in this time of war, the ambition of all of Ukraine’s power companies has only grown.

Ukraine’s future – power in Europe?

At this year’s Davos Summit, financiers, economists, and lawmakers have focused on Russia’s invasion and the future potential of Ukraine. Alongside other Ukrainian energy companies, Timchenko has pushed the idea of building Ukraine to be a new European renewable powerhouse.

In one panel discussion, he said: “On 16 March, amid the war, Ukraine joined the EU energy network. This was a critical practical step for our European integration. We have been preparing for this for several years, with the final steps accelerated by the war.

“One of Russia’s key miscalculations is that, by trying to conquer Ukraine, it has pushed us closer to Europe. The next stage in the process will be the beginning of commercial electricity exports to the EU.

“Europe needs the energy. And we need the income to start the process of rebuilding; we want trade not charity. This is a win-win for the EU and Ukraine.”

Antosha summarised this: “Instead of agreeing a loan to save our energy system, just let us have full-scale commercial export [to the ENTSO-E grid] and let us save it ourselves.”

Ukraine’s solar irradiation is not particularly high, but is greater than in most of Europe. Its wind capacity lies approximately in line with the rest of the continent. But crucially, the country’s large size and low population density allow for cheaper land use than in most of Europe.

The company has proposed a “Ukrainian Marshall Plan”, named after the US’s programme to help Western Europe rebuild following World War II.

Antosha says: “This plan needs to be in development now, so we’re not late; so we don’t have to wait another three years after the war is over. The energy sector should play a crucial role in this, because we now understand that Europe trapped itself by being so dependent on Russian energy resources. The system of European energy should be reconsidered, and Ukraine can replace Russia’s energy production.

“After Norway, Ukraine has the largest gas deposits in Europe, as well as gas storage to help with the EU plan of creating a strategic gas reserve. We currently produce 9GW of renewable energy, and this could accelerate up to 20GW in the mid-term.”

The war in Ukraine has not destroyed the country, and many of its institutions remain, both for better and worse. European countries agree: for Ukraine to further integrate into Europe, President Volodymyr Zelenskyy would need to push forward one of his main election promises and tackle corruption in the country’s markets.

Timchenko has said that this new market would need to build from fundamental anti-corruption reform and liberalise. Antosha tells me that “without anti-corruption reform, changing the market will not be possible”. But in this hypothetical ideal market, Ukraine would be a new renewable powerhouse of Europe.

Despite being in public relations, Antosha told me that she doesn’t consider her job to be to give people hope. However, she tells me, with certainty: “We do look forward. We are pretty positive that this war will end, and that Ukraine will win. That will be our zero-point from which we will be… we don’t like the word ‘rebuilding’, we like to say that we will be building a new Ukraine.”