GlobalData, a leading data and analytics company, has revealed its league tables for top 10 financial and legal advisers by value and volume in power sector for Q1 2022.

A total of 671 merger and acquisition (M&A) deals worth $65.2bn were announced in the sector during Q1 2022.

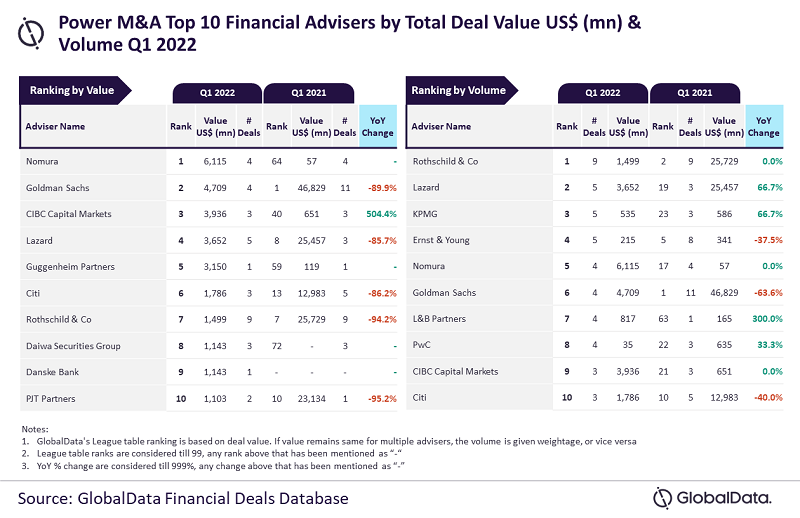

Top financial advisers by value and volume

According to GlobalData’s ‘Global and Power M&A Report Financial Adviser League Tables Q1 2022’, Nomura and Rothschild & Co have been identified as the top M&A financial advisers in the power sector in Q1 2022 by value and volume, respectively.

Nomura achieved the top ranking by value by advising on $6.1bn worth of M&A deals, while Rothschild & Co led by volume, having advised on a total of nine deals.

GlobalData lead analyst Aurojyoti Bose said: “Although Rothschild & Co led by volume, it lagged in terms of value due to its involvement in low-value transactions and settled for the seventh position by value as a result.

“Meanwhile, Nomura, despite advising on less than half the number of deals advised by Rothschild & Co, managed to top the ranking by value due to its involvement in big-ticket deals. The average size of deals advised by Nomura stood at $1.5 billion, while it was $166.6 million for Rothschild & Co.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to the financial deals database of GlobalData, the other high rankers by value included Goldman Sachs, with deals worth $4.7bn; CIBC Capital Markets, with $3.9bn; Lazard, with $3.7bn; and Guggenheim Partners, with $3.2bn.

In terms of volume, Lazard occupied the second position, with five deals; followed by KPMG, with five deals; Ernst & Young, with five deals; and Nomura with four deals.

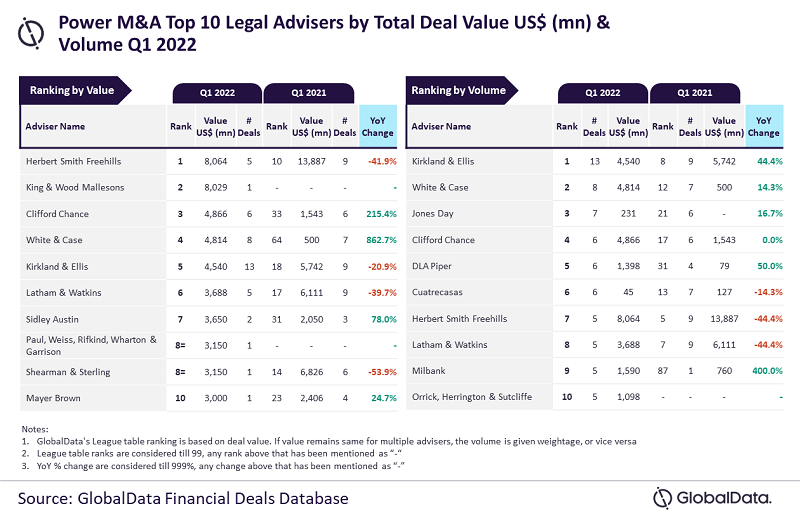

Top legal advisers by value and volume

Herbert Smith Freehills and Kirkland & Ellis have been identified as the top M&A legal advisers in the power sector in Q1 2022 by value and volume.

Herbert Smith Freehills secured the top ranking by value by advising on $8.1bn worth of M&A deals, while Kirkland & Ellis led by volume, having advised on a total of 13 deals, according to GlobalData’s ‘Global and Power M&A Report Legal Adviser League Tables Q1 2022’.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the only legal adviser to register double-digit deal volume in Q1 2022. It also occupied the fifth position by value. However, Herbert Smith Freehills, despite advising on a fewer number of deals, managed to top by value. While the average size of deals advised by Kirkland & Ellis stood at $349.2 million, it was $1.6 billion for Herbert Smith Freehills.”

According to the financial deals database, the other high rankers by value included King & Wood Mallesons, with deals worth $8bn; Clifford Chance, with $4.9bn; White & Case, with $4.8bn; and Kirkland & Ellis, with $4.5bn. By volume, White & Case occupied the second position, with eight deals; followed by Jones Day, with seven deals; Clifford Chance, with six deals; and DLA Piper with six deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.