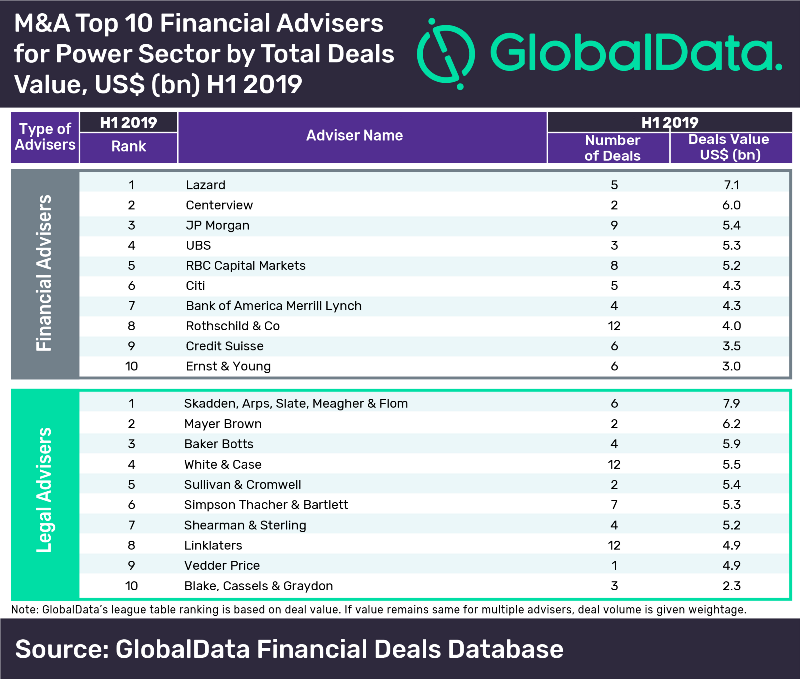

Lazard was the leading financial adviser globally for mergers and acquisitions (M&A) in H1 2019 in the power sector, according to GlobalData.

The financial advisory and asset management firm advised on five deals worth $7.1bn, including the big-ticket deal of Infrastructure Investments Fund’s acquisition of El Paso Electric for $4.3bn.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Centerview stood at the second position with just two deals, but worth $6bn, while JP Morgan finished at third with nine deals worth $5.4bn.

GlobalData has published a top ten league table of financial advisers ranked according to the value of announced M&A deals globally. If the value remains the same for multiple advisers, deal volume is given weighting.

Lazard, which topped the power league table of M&A financial advisers, finished at thirteenth position in the global league table of top 20 M&A financial advisers by GlobalData. Goldman Sachs topped the global rankings chart, followed by JP Morgan.

Tokala Ravi, financial deals analyst at GlobalData, says: “Infrastructure Investments Fund’s acquisition of El Paso Electric helped Lazard and Skadden to lead the tables of financial and legal categories, respectively. Despite advising on 12 transactions each, Rothschild & Co in the financial category and Linklaters in the legal category settled at eighth position due to low-value transactions.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe total deal value in the power sector plunged by 48.5% from $278.0bn in H1 2018 to $143.1bn in H1 2019. The sector saw 1,362 deals in H1 2019, an increase of 11.5% from 1,222 deals in H1 2018.

US-based law firm Skadden, Arps, Slate, Meagher & Flom led the top ten legal advisers list in terms of deal value. The firm provided legal services to six deals worth $7.9bn. Mayer Brown secured second position with two deals worth $6.2bn.

In the global league table of top 20 M&A legal advisers, Skadden, Arps, Slate, Meagher & Flom secured tenth position. The global table was led by Wachtell, Lipton, Rosen & Katz.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.