Leading data and analytics company GlobalData has published its league tables for the top ten financial advisers by value and volume in the power sector for Q1 2023.

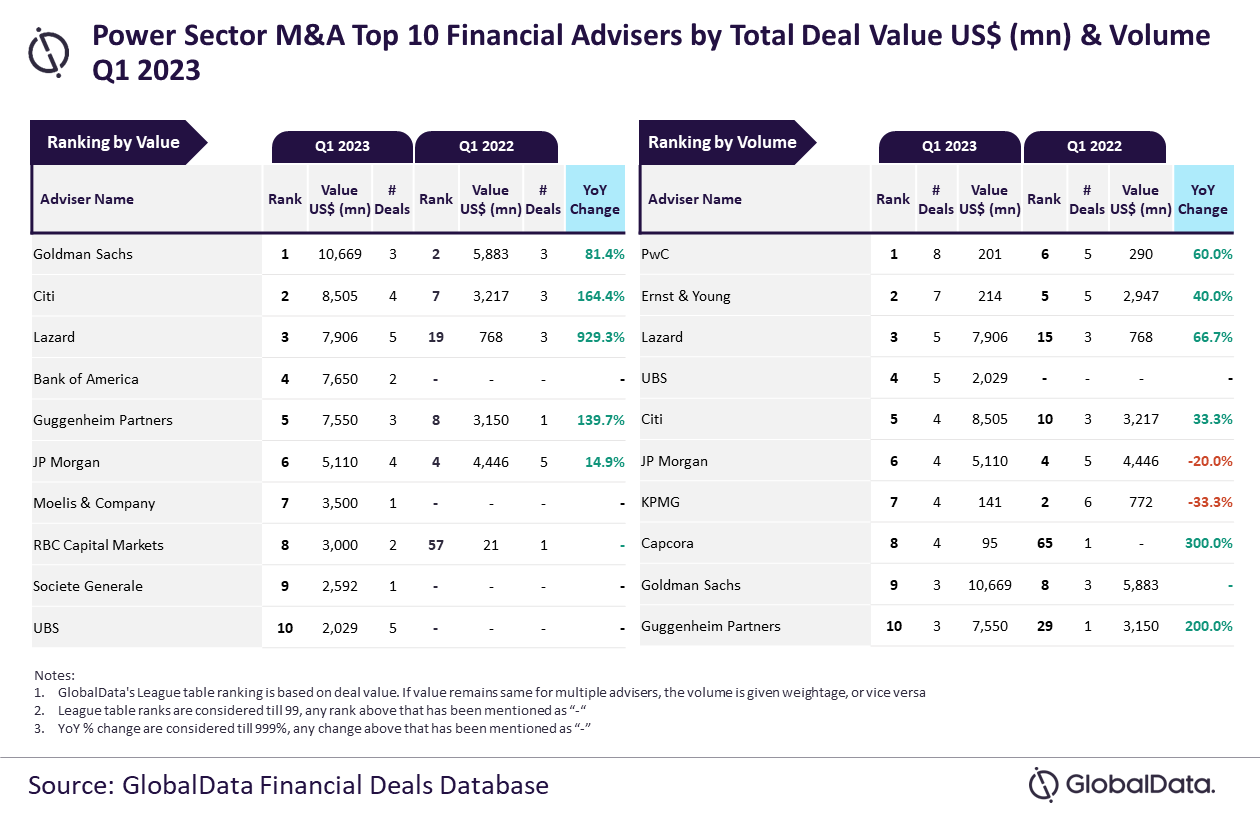

Goldman Sachs and PwC emerged as the sector’s top mergers and acquisitions (M&A) financial advisers by value and volume, respectively.

Goldman Sachs advised on $10.7bn worth of deals while PwC was the adviser for a total of eight deals.

GlobalData lead analyst Aurojyoti Bose said: “Goldman Sachs was the clear winner by value as it was the only adviser that managed to surpass the $10bn mark during Q1 2023. It also occupied the ninth position by volume.

“Meanwhile, PwC, despite topping the chart by volume, did not feature among the top ten by value due to its involvement in low-value deals. The average size of deals advised by PwC in Q1 2023 was $25.2m, which is much lesser compared to Goldman Sachs’ average deal size of $3.6bn.”

According to GlobalData’s financial deals database, Citi secured the second place in terms of value, by advising on $8.5bn worth of deals, followed by Lazard with $7.9bn, Bank of America with $7.7bn, and Guggenheim Partners with $7.6bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the volume table, Ernst & Young took the second spot in the volume table with seven deals, followed by Lazard with five deals, UBS with five deals, and Citi with four deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain.

A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To improve the reliability of the data, the company also seeks submissions from leading advisers through adviser submission forms on its website.