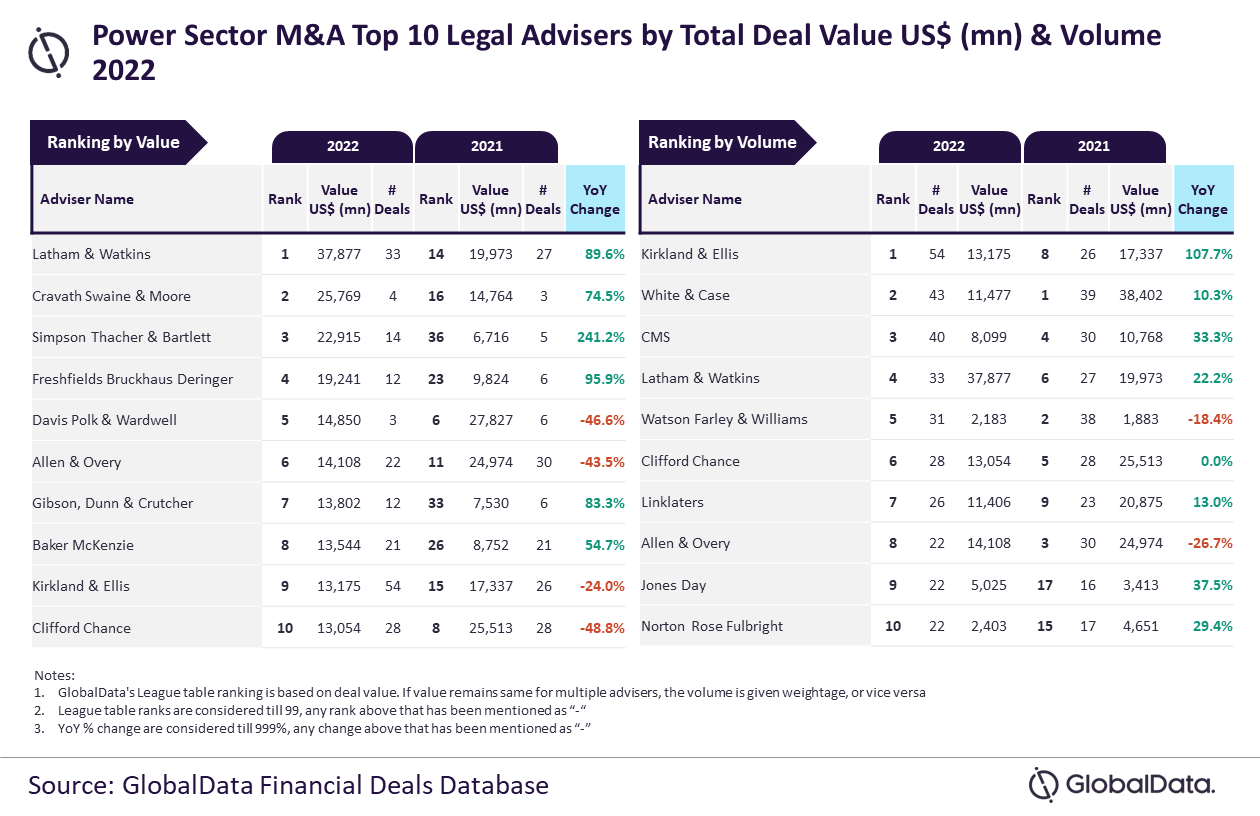

Leading data and analytics company GlobalData has published its league tables for the top ten legal advisers by value and volume in the power sector for 2022.

Latham & Watkins and Kirkland & Ellis were the sector’s top mergers and acquisitions (M&A) legal advisers by deal value and volume, respectively.

Latham & Watkins advised on $37.9bn worth of deals, while Kirkland & Ellis served as adviser for a total of 54 deals.

GlobalData lead analyst Aurojyoti Bose said: “Both Latham & Watkins and Kirkland & Ellis witnessed significant growth in total deals volume and value as well as improvement in respective rankings by these metrics.

“While Kirkland & Ellis was the only firm to advise on more than 50 deals in 2022, Latham & Watkins was also the adviser that managed to surpass $30bn in total deal value.”

According to GlobalData’s financial deals database, other high rankers by value included Cravath Swaine & Moore in second place, advising on $25.8bn worth of deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis was followed by Simpson Thacher & Bartlett with $22.9bn worth of deals, Freshfields Bruckhaus Deringer with $19.2bn, and Davis Polk & Wardwell with $14.9bn.

In terms of volume, White & Case secured second place with 43 deals, followed by CMS with 40 deals, Latham & Watkins with 33, and Watson Farley & Williams with 31.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain.

A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To improve the reliability of the data, GlobalData also seeks submissions from leading advisers through adviser submission forms on its website.