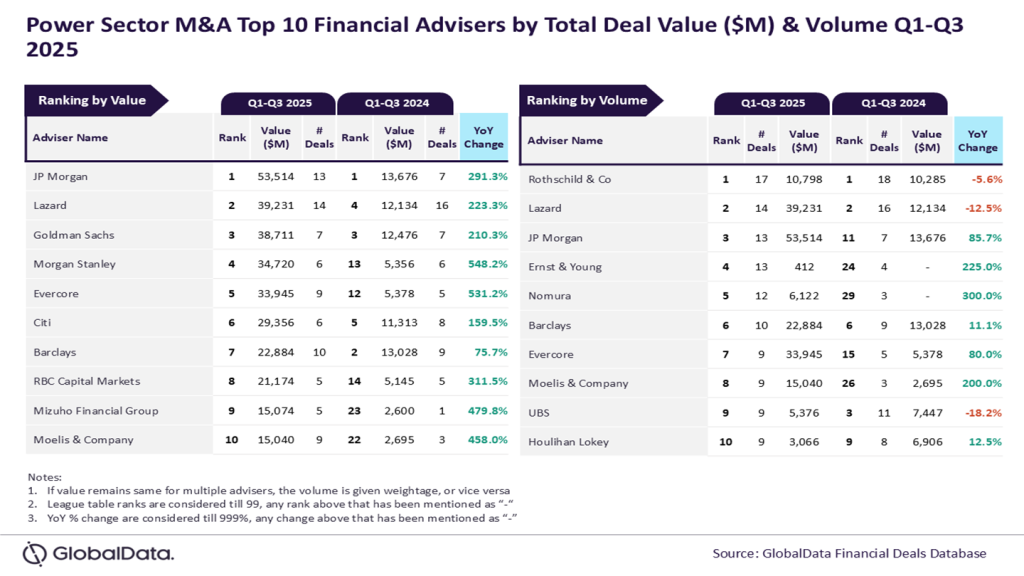

JP Morgan and Rothschild & Co emerged as the top mergers and acquisitions (M&A) financial advisers in the power sector during the first three quarters (Q1 to Q3) of 2025 in terms of value and volume respectively.

According to the latest financial advisers league table by GlobalData, a data and analytics company, JP Morgan took the leading spot in terms of value by advising on deals worth a total of $53.5bn.

In terms of volume, Rothschild & Co led the volume table by advising on a total of 17 deals.

GlobalData lead analyst Aurojyoti Bose stated: “JP Morgan and Rothschild & Co were the top advisers by value and volume, respectively, during Q1 to Q3 2024 as well.

“While the total number of deals advised by Rothschild & Co remained relatively stable during Q1 to Q3 2025 compared to Q1 to Q3 2024, JP Morgan registered more than a three-fold year-on-year jump in the total value of deals advised by it during the reporting period.

“Eight of the 13 deals advised by JP Morgan during Q1-Q3 2025 were billion-dollar deals, which also included three mega deals valued more than $10 billion. The involvement in these big-ticket deals helped JP Morgan register a massive jump in terms of value.”

In the value table, Lazard got the second spot by advising on $39.2bn worth of deals, followed by Goldman Sachs with $38.7bn, Morgan Stanley with $34.7bn and Evercore with $33.9bn.

Lazard took second place in terms of volume with 14 deals. Although JP Morgan and Ernst & Young secured 13 deals each, JP Morgan claimed third place as it clocked in higher value in deals. Ernst & Young ranked fourth, followed by Nomura in fifth place with 12 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.