In 2006 AES opened a 1,200MW combined-cycle gas turbine (CCGT) plant at El Fangal in Cartagena on Spain’s southeastern coast. The $920m turnkey project is the largest non-recourse financed power investment in Spain. AES owns 71% of the project, and its partners in the project include Gaz de France (GDF, 26%) and Mitsubishi Heavy Industries (MHI, 3%).

The plant is supplying about 300,000 homes in the country. AES Cartagena is buying gas from and selling power to GDF International (GDFI), a subsidiary of Gaz de France, under a 21-year energy agreement.

AES Cartegena CCGT plant operation

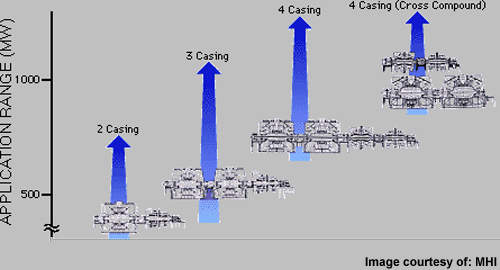

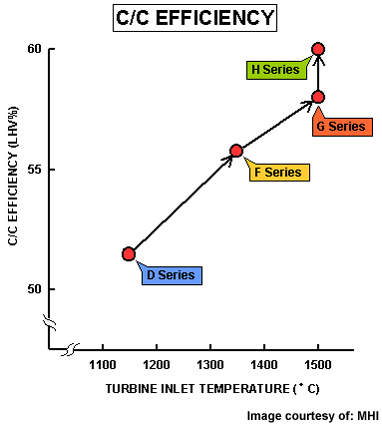

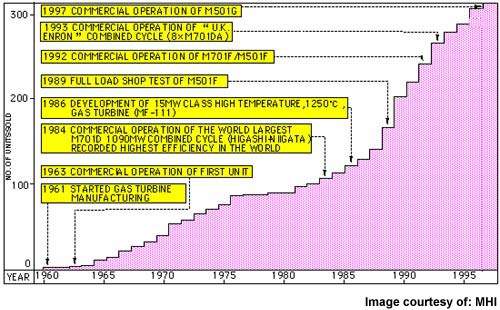

The 1,200MW combined-cycle plant has three 400MW generating modules in a single-shaft configuration. MHI supplied the main equipment: three gas turbines, three steam turbines and (made by Mitsubishi Electric Corporation) three Heat Recovery Steam Generators. Other auxiliary equipment, and installation and construction work was performed by the Spanish engineering partner.

Each combined-cycle power package has a 260MW gas turbine, a heat-recovery boiler and a 140MW steam turbine.

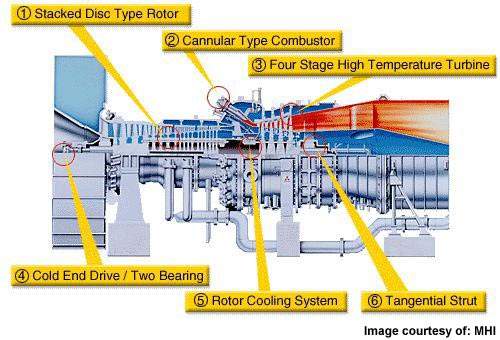

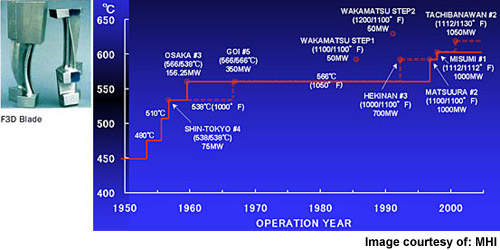

The gas turbine has a 17-stage axial compressor, 20-chamber combustion system, four-stage axial turbine, ignition and flame supervision system, and a cooling system for the turbine hot zone.

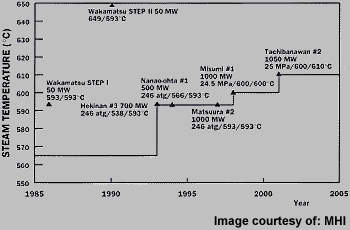

The Mitsubishi HRSG boilers feature a vertical gas passage with natural circulation. Flue gas from the gas turbine enters the HRSG boiler, flowing through superheater, reheater, evaporators and economisers before being expelled. Energy is converted to steam at high, medium and low pressures and passed to the steam turbine which combines high-pressure (HP), medium-pressure (MP) and double-effect low-pressure (LP) stages. Steam is finally cooled in the condenser.

AES used SKF’s asset management system, with sensors on critical equipment being connected to MasCon48 online condition monitoring units. These relay the data to the central computer system.

The facility will operate in base load all year, with electricity being generated at 18kV and raised at the main transformer to 400kV. Three 400kV underground lines connect the plant to the Nueva Escombreras power substation belonging to Red Eléctrica de España, REE. AES Cartagena Operations, S.L. (AESCO) operates and maintains the plant. Mitsubishi Heavy Industries (MHI) will provide maintenance service at the ‘hot end’ of the gas turbine.

Huge pile works were needed for the project, boring through the base of a mountain separating the plant from the sea. Tunnels over 1.5km in length were drilled to circulate the cooling water in both directions. The cooling water intake tunnel works under vacuum conditions.

Cartegena plant funding and development

The Cartagena project is the first undertaking of its kind in Spain to be conducted by a non-European company. It is one of an increasing number of power-generation businesses being operated by foreign companies in Europe in line with power industry liberalisation.

Around 20–30% of funding for IPP projects normally comes from capital investment, with the rest placing the project itself as security. Project development contracts, capital procurement contracts, management contacts, and engineering, procurement and construction (EPC) contracts can make the schemes complex.

AES set up subsidiary AES Energía Cartagena (AESEC) to develop the project. The plant was constructed by a consortium formed by Mitsubishi Corporation, MC Power Project Management, SL and Initec Energia, S. A. Non-recourse financing came from a syndicate of European banks including Societe Generale, Calyon and ABN AMRO Bank as lead arrangers, with subordinated debt facility provided by Societe Generale and Calyon. The financing structure was recognised regionally by Euromoney as "European IPP of the Year 2003".

The order was awarded to MHI by AES in August 2003. MHI’s investment will be approximately ¥500m, representing MHI’s first equity participation in an overseas IPP project.

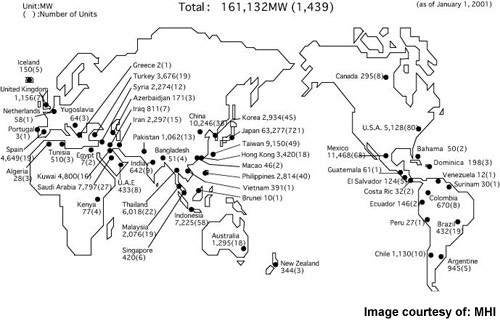

AES has had power facilities in Europe since 1992 when it acquired the AES Kilroot plant in Northern Ireland. Today, the company owns and operates more than 3,500MW of power generating facilities in Europe, including power plants in the Czech Republic, Hungary, Netherlands, Spain and the UK. AES is also constructing the 670MW AES Maritza East 1 project in Bulgaria and has more than 1,300MW of wind projects in active development in Scotland, France and Bulgaria.