From symbolic but disappointing shifts to dramatic trends that skyrocketed, crashed and flattened within the span of a year, 2025 delivered a cascade of twists and turns for the global power industry.

Drawing on data from Power Technology’s parent company, GlobalData, this year-end review traces a year defined by contrasts. Renewables overtook coal in power generation while gas gained renewed interest; the sector registered record transaction values through fewer deals; and jobs ricocheted under the weight of geopolitics.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The picture that emerges is of an industry reshaping itself across capacity, investment and labour.

Capacity and generation: a change in hierarchy

Winners: renewables

If 2024 was the year of cautious optimism for clean energy, 2025 was the year the numbers caught up with the narrative.

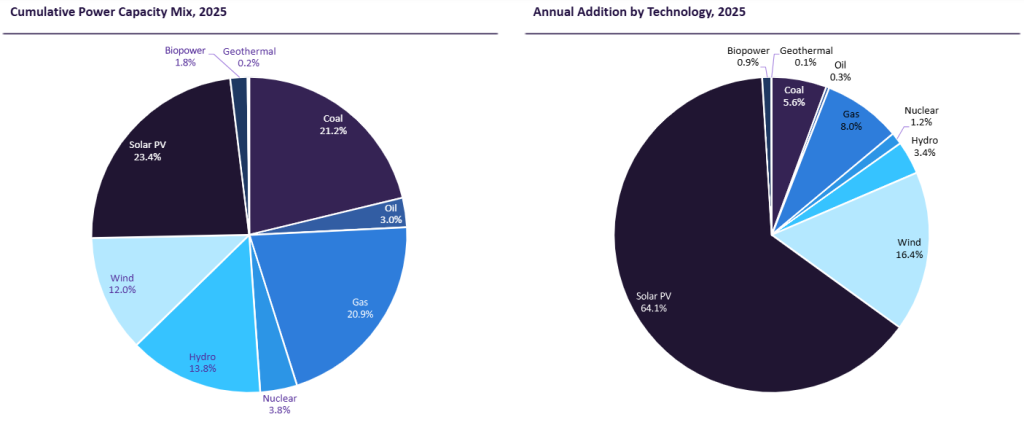

Renewables accounted for nearly half of the cumulative capacity mix this year. Annual capacity additions appeared even more skewed, with 64.1% coming from solar photovoltaic (PV) alone and wind contributing another 16.4% – together, making up a staggering 80%.

Source: GlobalData.

The growth in solar additions this year was “fuelled by robust demand in China, the US, India, Brazil and rapidly expanding markets across the Middle East and Africa (MEA)”, says Harminder Singh, GlobalData’s director of power research and analysis. He points to supportive policy frameworks, climate-aligned national strategies and distributed energy systems as the key drivers but, most of all, the falling costs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe solar supply chain has experienced oversupply, with production capabilities reaching nearly twice the demand for polysilicon, wafers, cells and modules. China has been instrumental as a manufacturing powerhouse, investing more than $50bn (352.74bn yuan) in solar PV supply production between 2011 and 2022 – and now accounts for 80% of global manufacturing capacity. India has also emerged as a new manufacturing hub, boosted by initiatives like the Production Linked Incentive Scheme.

Consequently, solar module prices further decreased, accelerating utility-scale solar deployment. GlobalData reveals that average solar PV project costs have dropped by 81% since 2010 and are expected to fall another 21% over the next five years.

“This, alongside improved grid access for solar PV as many countries invest in their transmission and distribution (T&D) networks, has made solar bankable for investors,” Singh explains.

Solar’s star power is showing no signs of dimming any time soon. GlobalData anticipates global solar capacity will reach nearly 3TW by the end of 2025 and surpass 8TW within the next decade.

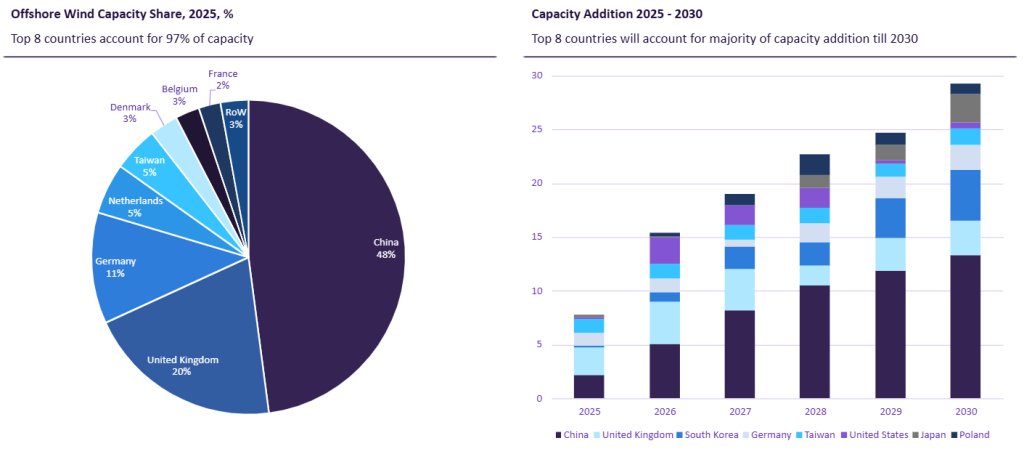

Meanwhile, wind power is expected to register around 1.3TW in 2025, 93% from onshore wind and the remaining from offshore.

This year was particularly challenging for offshore wind. Weighed down by unfavourable US policies and tariff pressures, the sector saw funding pulled and projects paused, postponed or sold off.

However, Singh stresses that this is only “a short-term wobble”; the project pipeline remains strong, with a select number of countries leading the market.

Offshore wind capacity share by country in 2025 and projected capacity additions (GW) between 2025 and 2030 of top eight countries by 2030. Source: GlobalData.

Currently, the top eight countries account for 97% of global offshore wind capacity. This oligopoly is expected to continue in the coming years, but new players – the US, Poland, South Korea and Japan – will take the place of Denmark, Belgium, France and the Netherlands in the top rankings.

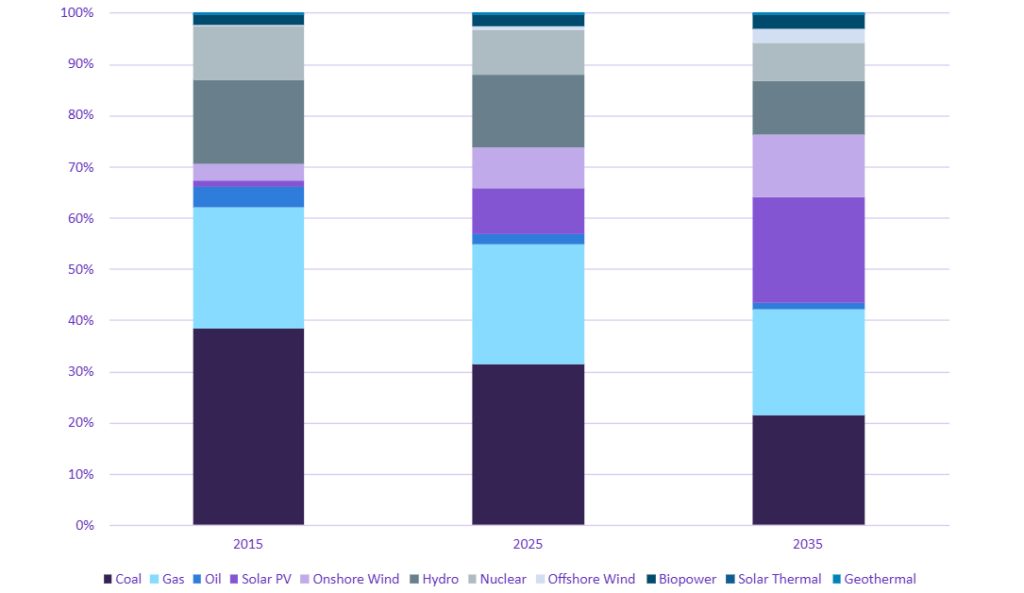

Renewables’ most symbolic achievement this year is overtaking coal in terms of power generation for the first time. In 2025, solar, wind and hydropower combined accounted for 34% of generation, edging out coal at 31%.

“Despite tariffs, supply chain tensions and geopolitical headwinds in 2025, renewables kept expanding because their underlying economics and policy support are now deeply entrenched,” says GlobalData senior power analyst Pavan Vyakaranam. “Wind and solar remain among the cheapest new power sources, and long-term policy frameworks like the US Inflation Reduction Act (IRA) and EU Green Deal created durable project pipelines.”

Losers: thermal power

Despite the milestone, Singh caveats that “reliance on coal is still going strong”, and the demand for thermal power overall is “easing much more slowly than what the global headlines may suggest”.

Contrary to what the numbers imply, coal decommissioning does not always equate to thermal-to-renewable substitution. Instead, it is gas that has stepped in to take its fossil fuel counterpart’s place in several markets.

GlobalData forecasts that 2033 stands as the decisive tipping point when renewable generation overtakes all thermal generation (coal, gas and oil) combined, with solar PV and onshore wind at the forefront.

However, even then Singh says coal will remain the single largest source of electricity, “showcasing how deep-rooted coal is in many power systems across the world”. In South Africa, for instance, coal is projected to contribute 85% of the power mix in 2025 and remain at 59% even by 2035, underscoring the uneven pace of the transition despite promising milestones at the global level.

Gas-based power also remains pertinent in the power landscape. Long seen as a cost-effective and reliable source, gas attracted renewed attention this year for a different appeal: its ability to meet data centres’ soaring power needs.

Because gas power plants can be built in one to two years – broadly aligning with data centre construction timelines – they have become an attractive solution for developers facing immediate capacity constraints. That demand has translated into a wave of new gas projects commissioned in 2025, even pushing turbine suppliers into sizeable order backlogs.

In the US, where data centre power demand is most concerning, natural gas is expected to supply 40% of power generation in 2025, compared to 28% from all renewables combined, according to GlobalData. Although gas’ share is projected to drop to 32% in the next decade, the country still has more than 45GW of gas-fired capacity due to come online between 2025 and 2031.

The US serves as a reminder that gas continues to act as a key stabiliser, filling the flexibility gap left by coal until energy storage, grid modernisation and interconnection capacity catches up.

Gas and coal accounted for modest shares (8% and 5.5%, respectively) of new capacity additions in 2025. The reality is: thermal power is losing ground. Equally true, however, is that it is still far from gone. For now, gas power in particular will retain a foothold as a lower-emission fossil option that can balance power systems as they race to modernise.

Winners: nuclear

The story of nuclear is one of a slow burn. Its share in the global capacity mix this year was small – only 3.8% with around 399GW – but the pipeline and prospects tell a different tale.

GlobalData projects nuclear investments will reach $41.8bn by 2030, reflecting its growing role in the energy transition. There are 63 reactors currently under construction, set to add another 66.2GW, but the real excitement surrounds small modular reactors (SMRs).

Alongside gas power, SMRs are emerging as a key source for data centre energy needs. In addition to “the synergies of nuclear power generation and the load profile of data centres”, Singh says, their smaller size allows for on-site deployment, minimising risks of transmission loss.

With 110 SMRs totalling 15GW in development, the next decade anticipates a slew of modular deployments.

Beyond SMRs, emerging reactor designs and next-generation technologies including molten salt reactors and nuclear fusion are reviving global interest in the energy source.

Losers: hydrogen

This year spelled trouble for low-carbon hydrogen due to project delays, downsizing and policy uncertainty. According to GlobalData’s project tracker, cumulative 2030 capacity projections fell 10% from last year’s forecast.

The drop is even starker when the analysis is extended to 2035, with expected capacity to come online falling 28% and 26% year on year (YoY) for high and low-case scenarios, respectively. Reflecting the revisions in project scale and timelines announced this year, forecasted average capacity from projects starting between 2031 and 2035 declined from 1.35 million tonnes per annum (tpa) to 300,000tpa.

These setbacks, combined with ongoing controversies around greenwashing and feasibility, are raising questions as to whether it will come to the fore as an emission reduction technology before 2040 – if at all.

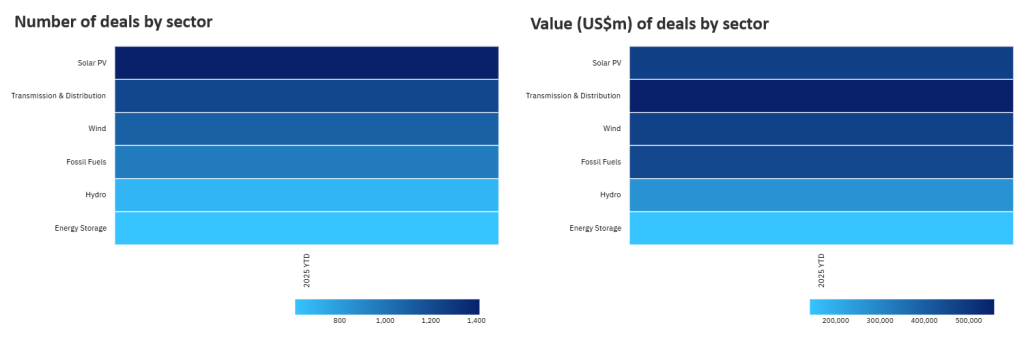

Deals: North America takes the reign

According to GlobalData, the global power industry recorded 16% fewer deals in 2025 compared to 2024 but experienced a 15% surge in total deal value.

Deal values jumped across most deal types, with mergers and acquisitions (M&A) leading the way. Acquisitions value grew 23.96% YoY (2024 compared to 2025 year-to-date, 9 December 2025) and mergers a whopping 123.43%, registering a total M&A value of $391.47bn.

Every region saw fewer transactions this year but not less value. North America dominated with 1,659 deals worth $780.5bn, surging 31.61% YoY in value. Compare this to the more modest gains seen in Asia-Pacific (9%) and MEA (1%), and it is clear that the region is sustaining its momentum following the 55.9% YoY growth it registered last year.

The US alone recorded $689.43bn in total power sector deals, followed by India ($93.88bn), China (85.52bn), the UK ($82.46bn), Japan ($81.94bn) and Canada ($81.53bn).

Asia-Pacific had a few hundred more deals than North America, which totalled only half the value at $394.7bn.

“This data reflects North America’s multiple megadeals in 2025, such as Essential Utilities’ $30bn merger with American Water Works, which significantly lifted its aggregate deal value,” explains Vyakaranam, pointing to Constellation Energy’s $16.4bn acquisition of Calpine, NRG Energy’s £12bn purchase of LS Power’s Premier Power Portfolio and Blackstone Infrastructure’s £11.5bn acquisition of TXNM Energy as primary examples.

Europe recorded $342.7bn, moderately behind Asia-Pacific, via a number of deals similar to that of North America. South and Central America and MEA both had under 200 deals worth less than $50bn.

In terms of sector, solar PV deals came out on top with 1,412 transactions totalling roughly $480.2bn. However, the largest share of capital ($557.3bn) flowed into T&D, which saw fewer deals (1,223), reflecting the large-scale and capital-intensive nature of T&D projects, as well as the vitalised global focus on upgrading grid infrastructure.

Deal activity in wind, fossil fuels, hydropower and energy storage remained steady, ranking above other sectors like nuclear and biopower in both numbers and value.

Looking ahead, Vyakaranam says “deal activity in 2026 will be shaped by rapid expansion of renewable energy and storage, the growing role of digital infrastructure such as AI and data centres, and focused initiatives to strengthen supply chain resilience and grid reliability”.

Jobs: peaks, troughs and expertise shifts

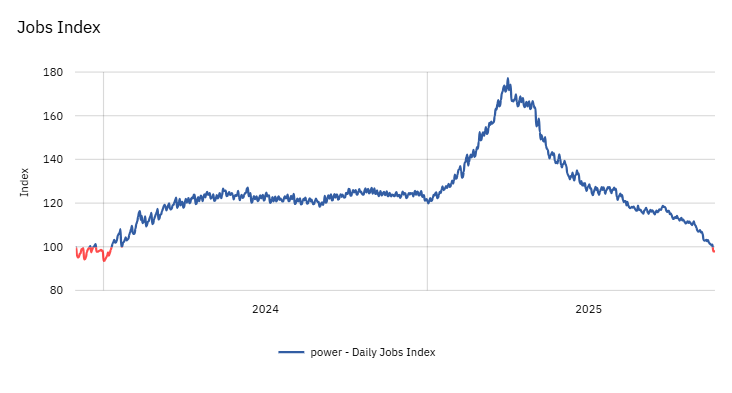

No part of the power sector illustrated 2025’s volatility more than employment. During a rollercoaster of a year, hiring across the global power sector spiked dramatically in the first quarter (Q1), reaching record highs, only to collapse in Q2 and decline gradually throughout Q3 and Q4.

According to Vyakaranam: “Power sector employment in 2025 swung sharply due to overlapping policy, seasonal and weather-related pressures.”

He explains: “Jobs surged in Q1, benefitting from strong late‑2024 economic momentum, as companies accelerated hiring ahead of tighter clean energy tax credit rules under the IRA, front-loaded recruitment for spring and summer construction seasons, and in anticipation of rising demand from data centres and industry.

“But in Q2, hiring fell abruptly as new ‘Foreign Entity of Concern’ requirements disrupted supply chains and delayed projects, while unusually early and prolonged monsoon conditions in key markets like India slowed construction activity and dampened electricity demand.”

In the latter half of the year, he says employment stagnated as companies “focused on adapting to the new regulatory environment, reassessing demand, and prioritising efficiency and digitalisation over large-scale expansion”, resulting in more targeted, specialised recruitment over broad workforce growth.

One expertise area was singled out: tariffs. According to GlobalData, tariff-related job postings in the power sector grew 657% from last year, illustrating the impact of US trade policies on the global energy market.

Going into 2026, Vyakaranam expects the recruitment landscape to remain highly specialised, with companies prioritising expertise in “grid planning and reliability, energy storage, regulatory and tax strategy, supply‑chain risk management, and digital and analytics functions to support smart grids and asset optimisation”.

Frequently asked questions

-

What were the biggest power capacity and generation shifts in 2025?

Renewables took nearly half the share of global cumulative capacity, with new additions dominated by solar PV and wind. But the standout milestone was in generation: solar, wind and hydropower together reached 34%, edging past coal at 31% for the first time. Despite this, coal and gas still underpin many systems, and GlobalData expects renewables to overtake all thermal generation combined around 2033.

-

What happened to solar PV in 2025?

Solar drove the year’s build-out, delivering 64.1% of new capacity additions, a 5% growth from 2024. Overproduction across the solar supply chain pushed module prices down, improving project economics and investor confidence. Falling costs and better grid access helped accelerate utility-scale deployment, with GlobalData expecting global solar capacity to near 3TW by end-2025.

-

What happened to wind power in 2025?

Offshore wind had a difficult year, hit by unfavourable US policy signals and tariff pressures. Funding was pulled from some developments, and multiple projects were paused, postponed or sold. Even so, the longer-term pipeline remains strong and concentrated: a small group of countries still holds almost all global offshore capacity, though new entrants are expected to reshape the top rankings.

-

Why did natural gas see renewed interest this year?

Gas regained attention largely because it can be built quickly and deliver firm power on timelines similar to data centre construction. As data centres’ electricity demand surged, developers looked for near-term capacity solutions, triggering new gas projects and creating turbine order backlogs. In the US, gas remains a major stabiliser while storage, grids and interconnection capacity catch up.

-

What happened to hydrogen in 2025?

Low-carbon hydrogen struggled. Delays, downsizing and policy uncertainty reduced projected cumulative 2030 capacity by about 10% year-on-year. Looking further out, expected capacity coming online by 2035 dropped sharply in both high and low scenarios, reflecting weaker confidence in timelines and scale. The setbacks have fuelled fresh doubts about whether hydrogen will meaningfully cut emissions before 2040.

-

How did the power job market change in 2025?

Hiring swung dramatically: a record spike in Q1 was followed by a sharp drop in Q2, then gradual weakening through Q3 and Q4. Policy changes, new construction and weather all played a part. Recruitment became more targeted towards specialised expertise, especially in tariffs. The sector see specialised recruitment growing in areas like grid reliability, storage, regulatory strategy and digital analytics.