Argentina is one of the prominent countries in Latin America that continues to suffer from the ongoing Covid-19 pandemic. With a section of the country still under lockdown, power sector dynamics have been disrupted and construction and development of renewable energy assets have stalled. According to Central Puerto, one of the largest power producers in the country, the demand for power has declined and project construction schedules are affected, with other challenges emerging such as payment collection and asset optimisation. In addition, the pandemic has further compounded the nation’s economic crisis, which is likely to deter the country’s renewable market outlook.

On 20 March 2020, the government instituted stringent lockdown measures that strictly permitted only the movement of goods and people pertaining to essential services. Consequently, the closure of industries and large commercial entities led to a decline in power demand and shifted load profiles. According to the wholesale electricity market administrator CAMMESA, the demand for electricity slide to 8,470GWh, down by 11.5% year-on-year, with the demand from large users dropping by 26% year-on-year, during the month of April. Moreover, distribution utilities are witnessing payment disruptions, which in turn is affecting pay-outs made to power generators. On the development front, several wind and solar projects by companies such as Goldwind and Power China, Genneia, and Petroquímica Comodoro Rivadavia (PCR) and interconnection efforts for the 312MW Cauchari Solar Park have been forced to come to a halt, as a result of the quarantine. Although the government proceeded to include the construction of private sector energy infrastructure in the list of exempted activities, supply chain disruptions, logistical challenges, and increase in capital costs will impact sector development momentum.

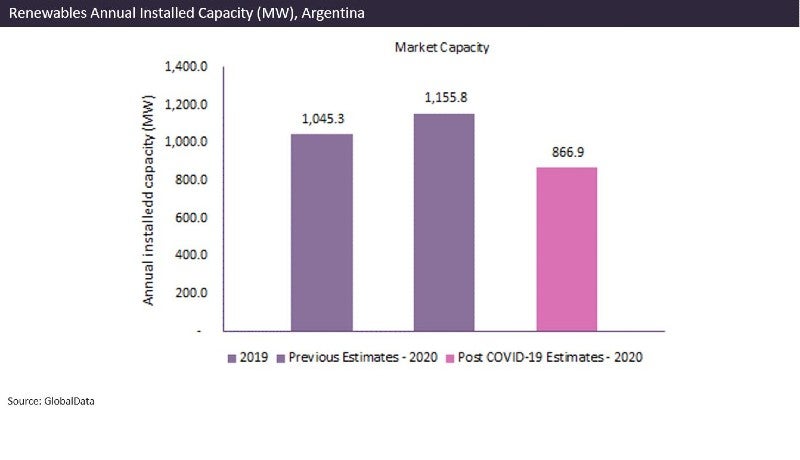

The power sector in Argentina is dominated by thermal power, which accounted for nearly 64% of the total installed capacity and 65% of the electricity generated in 2019. Thermal plants fuelled by natural gas are the leading source of electricity generation in Argentina. The country has substantial oil and gas reserves and was a key supplier of fuel to countries in the region. Until 2010, the nation was a power exporting country; however, growing domestic consumption along with a decline in developing new power projects and in the extraction of natural gas forced Argentina to import power and natural gas from neighbouring countries. To support diversification and enhance energy security, the country introduced a renewable energy law, which proposed to increase the share of renewable energies to 20% of power demand by 2025. Simultaneously a fund was created, FODER (the government Renewable Energy Fund), as well as other fiscal incentives, and competitive and transparent market rules established to attract international investors. Since its introduction in 2017, the country’s competitive bidding program RenovAr has been instrumental in promoting the development of renewables in the country. Despite the strong support, market development has faced challenges from poor economic conditions and underinvestment in supportive infrastructure, which are expected to worsen, following the outbreak of Covid-19. Pre-Covid-19, the sector was estimated to witness an annual installed capacity of 1.1GW of renewables but post-Covid-19, the annual installed capacity is likely to decline to 0.87GW in 2020.

Economic crisis

The Economic Commission for Latin America and the Caribbean (ECLAC) has predicted a fall in GDP of over 5% in Latin America. Argentina, which is currently renegotiating its massive external debt from foreign creditors, could suffer a steeper drop in GDP of 6.5% or more. Prior to the Covid-19 outbreak, the political uncertainty and debt crisis impacted the flow of capital into the country for renewable development. The country relies significantly on foreign markets for capital and therefore, rampant inflation and decline in local currency value have resulted in an increase in capital costs for mid-stage projects. Developers who have managed to procure financing will face strong currency volatility, which impacts their profitability and liquidity. The ballooning interest component on debt and imposition of control measures to prevent the sharp depreciation of Peso value, the local currency, have created uncertainty and financing barriers for investors. Several developers such as Pampa Energía, Aluar, and Genneia have suspended project development, due to the high rates being quoted by lenders. Others such as Arauco, Scatec, and Equinor, have seen credit tranches delayed, as concerns emerge over the rising debt repayments. The Covid-19 pandemic has exacerbated the worsening macroeconomic conditions and the uncertainty over debt negotiations and potential default will only make investors wary, to provide any fiscal support.

Supply chain and logistic challenges

Since 20 March, the government instituted a strict lockdown that restricted the flow of goods and people. The temporary closure of businesses and halt in commercial activity has affected asset development. During the initial phase, the construction of energy infrastructure was not included, but was later added to the exemption list on 7 April. Consequently, the construction of several projects resumed, only after all the necessary precautions were taken. Projects such as La Genoveva I wind farm and Terminal 6-San Lorenzo new plant resumed operations on 9 April and on 27 April respectively. Ongoing construction activities are taking place with limited workforce, as in the case of the Terminal 6 project, with one third of the personnel working now, prior to the quarantine. Additionally, the project is also affected by travel restrictions placed on international specialists, who are involved in the development phase. With respect to La Genoveva I, Vestas, the supplier of the wind turbines for the project, claimed that the Covid-19 outbreak has affected its manufacturing activities, causing delays in the delivery of certain Chinese origin manufacturing components required for wind turbine fabrication. Although, China has resumed manufacturing, logistical restrictions remain that will continue to hamper construction.

Other constraints

The existing transmission infrastructure in the country is saturated and would require additional investments to support new generation capacity deployment. It is reported that in the last four years, investments in renewables have not been matched by investments in networks and the lack of capacity could deter new projects from taking off. Renewables are capital intensive and developers are reliant on cash flows from existing projects to fund their future endeavours. Distribution utilities in Argentina have been requested to continue servicing defaulting customers and to provide payment deferrals, which is likely to significantly impact the chain of pay-outs. The drop in revenues would mean that distribution utilities, in the short term, are likely to stop paying CAMMESA, who in turn would be unable to pay power generators. There is a high risk of debt accumulation for involved stakeholders, with power generators exposed to unstable cash flows and liquidity risks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe emergence of Covid-19 in Argentina has exacerbated the existing macro-economic conditions and inadvertently created significant barriers for renewable energy development. In the long term, the debt crisis and the impasse in repayment negotiations will make it difficult for developers to access foreign capital. The closure of global credit lines could see several awarded projects being delayed or stranded. Furthermore, the instituted fiscal changes and currency depreciation are eroding the viability of projects and increasing risks. In the short term, the imposed restrictions will slow development and with a decline in power demand likely, new projects could be deemed unnecessary.