GlobalData’s latest report, ‘Bangladesh Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Bangladesh and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

Bangladesh is set to increase the coal-based power generation capacity to ensure supply security at a time when many other countries are focussing on the development of renewables and cutting dependency on thermal power to achieve climate goals. The country’s move to expand coal power comes as challenges remain for renewables development, including inadequate grid infrastructure, lack of robust policies, and incentives or subsidies except net metering, which has also been only moderately successful.

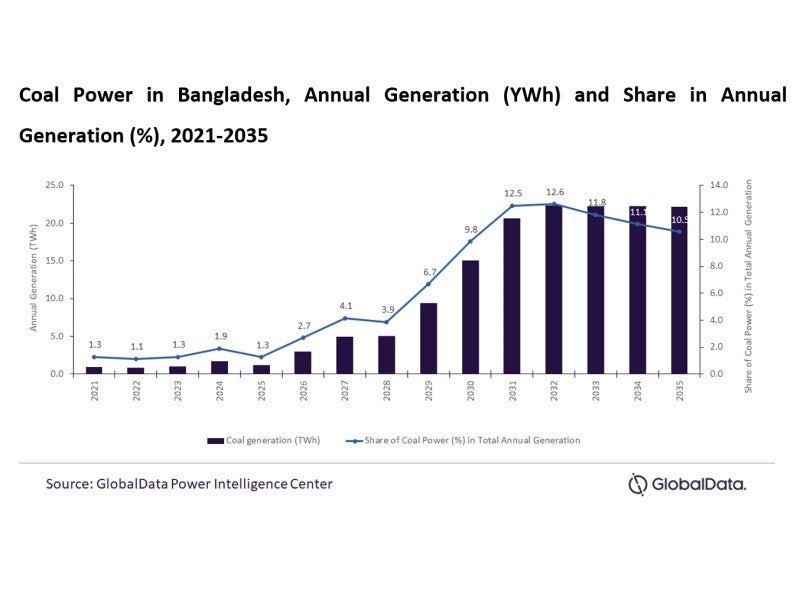

The share of coal power in the total annual generation in the country is estimated to reach 12.6% in 2032. In September 2022, the Bangladeshi Government announced plans to add around 4.3GW of coal-based thermal power to address frequent blackouts, which caused a major strain on industries, especially the garment industry, which accounts for more than 80% of the country’s exports.

The cost of electricity generation is also high in the country, which has burdened power generation companies. The government has increased electricity imports from India over the years since it has proved to be a cheaper option. To overcome cost challenges, Bangladesh plans to nearly triple its electricity imports, which will mostly come from thermal power generation from India.

Though Bangladesh’s measures provide temporary relief to secure supply, they do not provide a long-time solution. Moreover, this steers the country away from its unconditional target to reduce greenhouse gas (GHG) emissions by 27.56Mt CO₂e (6.73%) below business-as-usual (BAU) levels in 2030. The rise in electricity demand has led to an increase in gas-based generation over the years.

In 2021, gas-based generation accounted for 66.4% of total annual generation. It is estimated that the country’s natural gas reserves will be depleted in ten to 12 years based on the current usage. The increase in global energy prices makes importing natural gas an unattractive option.

Bangladesh has lagged in the development of renewable energy sources, with only 537MW of total renewable installed capacity in 2021, accounting for 2.5% of the country’s capacity mix. Among renewables, solar PV accounted for 98.6% of the renewable installed capacity, with onshore wind, biopower and small hydro accounting for the rest of the share.

There are no major utility-scale renewable power plants in the country and the grid infrastructure is not equipped to streamline renewable power generation on a large scale. The country’s preference towards coal-based thermal power development and imports may only be a temporary measure to overcome these challenges.

In the long term, the country should look at incentivising renewable power plants to encourage adoption, invest in upgrading the grid, and focus on development of energy storage to overcome dependency on thermal power and meet its climate goals.