Renewable energy’s new best friend: energy storage

The threat of climate change, geopolitical turmoil, and fuel supply issues are all factors that are speeding up the deployment of renewables as a significant source of power.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

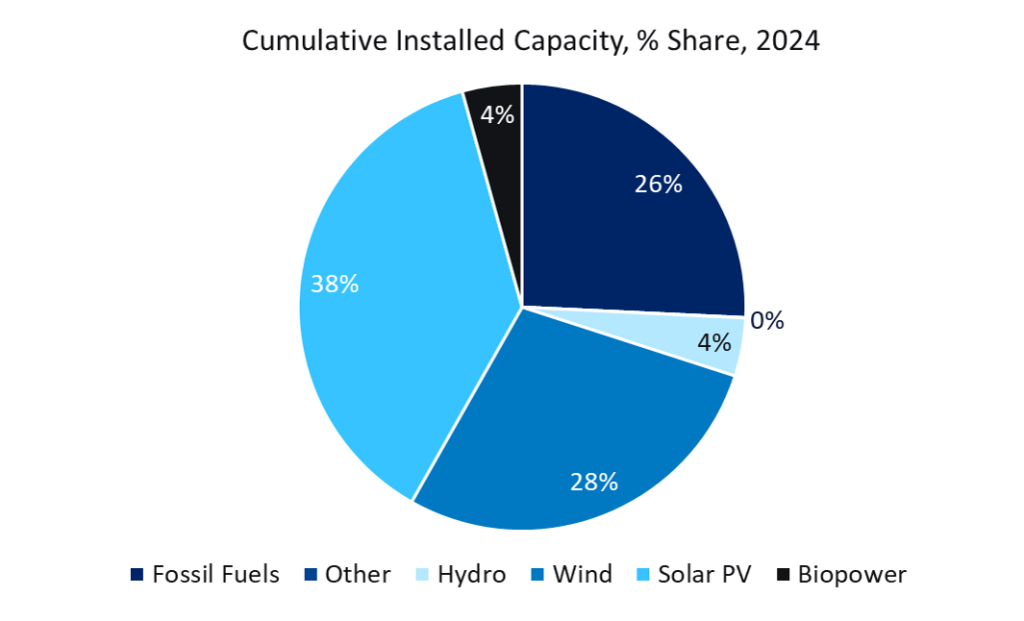

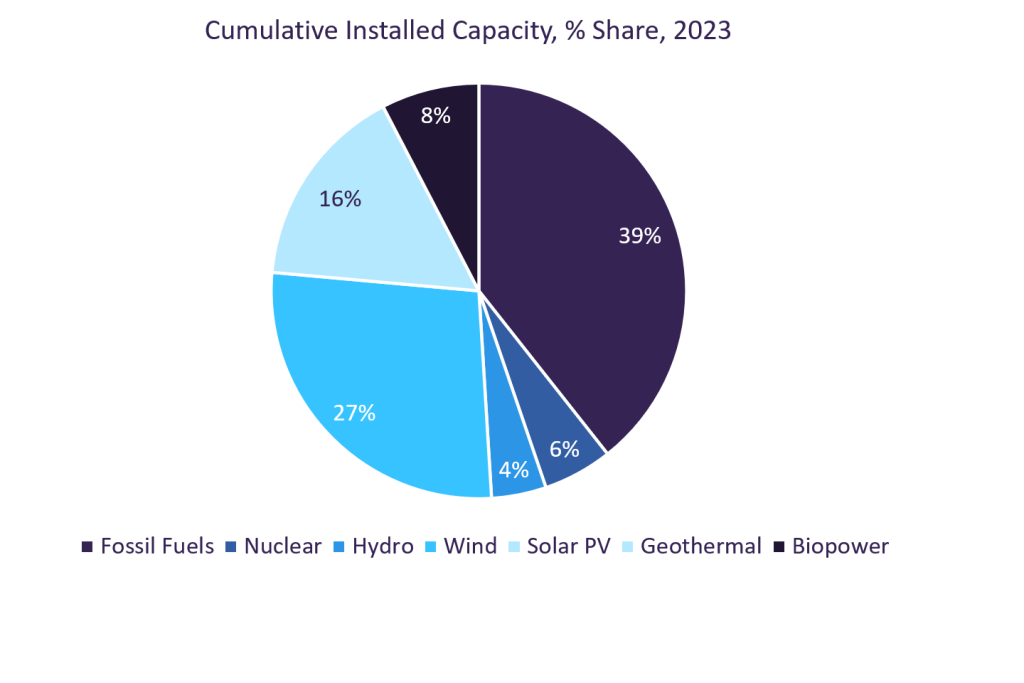

By GlobalDataSolar photovoltaic and wind turbines are dominating the market with a cumulative installed capacity of 2,412GW combined, and $422.5bn of new investment in 2023.

However, the lack of widespread storage infrastructure to support these technologies means that they are not always efficient.

Their intermittent nature often leads to a lack of alignment between the energy supplied and the energy demanded.

See Also:

The solution is an integration of technologies capable of sustaining flexible grid operations by normalising frequency and voltage variations, and reducing the demand placed on generation, transport, and distribution infrastructure.

By building storage systems, excess energy could be stored and utilised when the supply decreases.

This would also drive down prices, as energy storage reduces costs by storing electricity obtained at off-peak times, when retail prices are lower, and using the stored electricity during peak hours when the price of grid electricity is high.

Equally, strong storage capacity also offers energy price stability for renewable developers, avoiding a situation of price cannibalisation that has undermined renewable projects in the past.

Energy storage can be classified into different technologies, but electrochemical storage remains the most prominent technology and battery energy storage (BES) in particular forms a large component of this.

Battery energy storage systems: the technology of tomorrow

The market for battery energy storage systems (BESS) is rapidly expanding, and it is estimated to grow to $14.8bn by 2027.

In 2023, the total installed capacity of BES stood at 45.4GW and is set to increase to 372.4GW in 2030.

According to the World Economic Forum, $5bn was invested in BESS in 2022 globally and the figure is set to grow to a staggering $120bn-$150bn by 2030.

Several factors are enabling this progress, including a fall in battery technology prices, an increasing need for grid stability, and an interest in electric vehicle (EV) technologies.

Additionally, there is a growing desire for consumers to become energy self-sufficient, and for governments to acquire energy security.

As geopolitical tensions continue to rise globally, gaining independence from other countries’ energy supply has become a priority.

Investing in energy storage technologies could be key for governments to avoid the precarity of overreliance.

A BES technology that has evolved into large-scale market production is the lithium-ion (Li-ion) battery.

It has high energy density and efficiency, as it can remain charged for longer than other battery types.

China takes the lead: Has the rest of the world missed the boat?

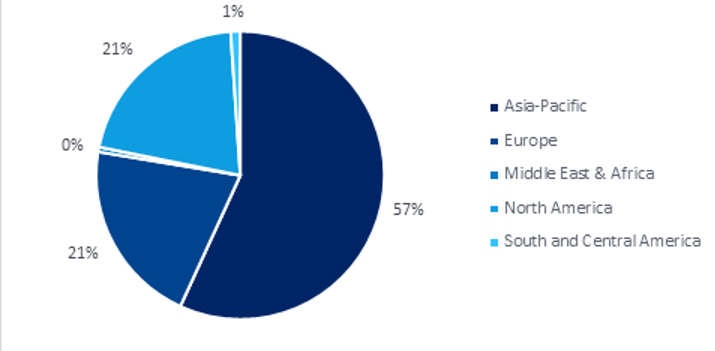

As shown by the featured graph, most Li-ion plants are in the Asia-Pacific region, with China contributing to 61.5% of them.

These figures are set to swiftly increase, as, in the last year, 27 new Li-ion plant projects reached the planning stage, with 59% of them based in Asia-Pacific (16), half of which are in China (8).

China is the leading country for the production of BESS, with a cumulative installed capacity of 10.4GW (2023), which is predicted to reach a staggering 195.7GW in 2030.

These statistics are interesting given that China only holds less than 7% of the world’s lithium reserves.

According to the Observer Research Foundation, China is the world’s largest importer, refiner, and consumer of lithium.

In fact, since 2018, Chinese companies have been acquiring some of the largest lithium mines across the world, including two in Argentina, three in Canada, two in Australia, one in Zimbabwe, and one in the Democratic Republic of the Congo.

Through this acquisition strategy, together with its own production, China has been supplying 70% of the world’s lithium production, primarily to its domestic lithium battery manufacturers.

This is the result of generous government incentives, specifically engineered to achieve supremacy over the lithium supply chain, ahead of the curve of global demand for the raw material.

In fact, according to a report from the White House, it is estimated that the Chinese government funnelled $100bn in subsidies, rebates, and tax exemptions to Chinese companies and consumers between 2009 and 2019.

A few other countries have also been heavily investing in Li-ion storage plants, namely, South Korea, Germany, and the US, which respectively had a cumulative installed capacity of 6.8GW, 6.6GW, and 6GW in 2023.

France too is in the race, with one of its renewable energy companies Neoen, a key subsidiary of Impala, which boasts a total storage capacity of 2.2GW, with plants operating in South and Central America, Europe, and Asia-Pacific.

For the rest of the world, the outlook is less optimistic, with many countries falling behind.

Whether for the storage of renewable energy, or the development of EVs, BESS will be a key technology in the decades ahead.

Governments should act now, and incentivise public and private companies to either purchase, produce, or recycle more lithium, if they do not wish to expose their supply chains to significant geopolitical risk.