GlobalData’s latest report, “Denmark Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape,” discusses the power market structure of Denmark and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

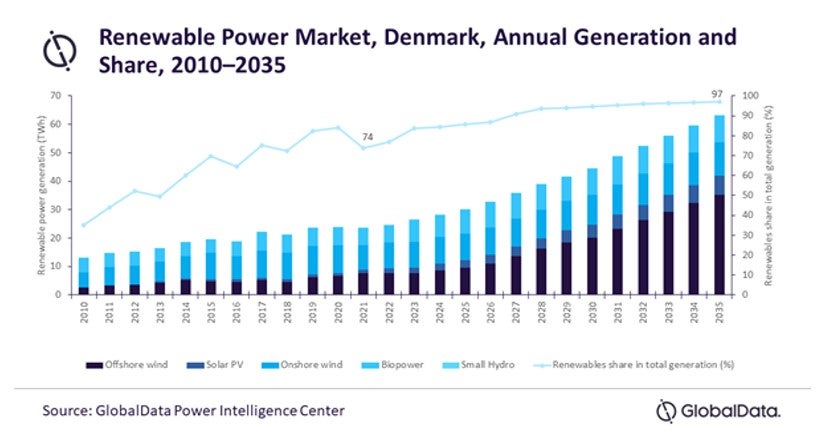

The recent Russia-Ukraine conflict has dented Denmark’s gas supply, as nearly 75% of the country’s gas imports are provided by Russia via a pipeline through Germany. The government’s pledge to step up its renewable development programme by increasing the number of solar photovoltaic (PV) and onshore wind plants by 2030 will secure Denmark’s electricity supply in the long term as 97% of its electricity generation by 2035 will be renewable power.

In the short term, Denmark will look to import gas from its European connections. This predicament arose due to the renovation of the Tyra field in the North Sea. Since its inception in 1984, the gas field has catered to a major portion of Denmark’s gas needs. Its renovation work is expected to be completed by mid-2023, which reduces dependency on gas imports.

Denmark has planned steady investments in offshore wind power, which is expected to become the primary technology in the generation mix of the country by 2026. Currently, the country is expected to continue importing power owing to the intermittent availability of wind energy. It imports power from Sweden and Norway and exports it to Germany. Interconnectivity with neighbouring countries, especially within the Nordic pool, is important within the scheme of supply security. For example, Sweden and Norway are rich in hydropower, while Denmark is a leader in wind and is also making rapid advances in solar power. Exchanges within these countries, therefore, help to enhance supply security.

The European Commission has been under pressure to impose sanctions on Russia. Currently, the EU has agreed to reduce the dependency of its member countries on Russian gas by two-thirds this year. The Danish government was already taking steps to move away from Russian dependence for its natural gas needs.

In April 2022, the EU countries revealed individual plans to reduce their dependence on Russian fossil fuels. Denmark had presented its plan to convert over half of the 380,000 households that are heated through gas power to district heating networks or electric heat pumps by 2028. For other households, the government aims to cater through biogas power. GDP increased from $322 bn in 2010 to $392.7 bn in 2021 at a CAGR of 1.8 % (constant rates). Denmark’s economy took a major hit during the pandemic as there were inevitable logistic constraints which dented its trade. GDP declined by -2.1% in 2020 from 2019. The government took swift measures to recommence trade and transport which resulted in an increase in GDP by 4.7% in 2021 from 2020, with all the above rates being at constant rates.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData