GlobalData’s latest report ‘Switchgears for Power Transmission, Update 2022 – Global Market Size, Competitive Landscape and Key Country Analysis to 2026’ reveals that the global switchgears market is likely to grow due to the increasing global demand for electricity. Urbanisation and industrialisation are two factors contributing to the rising power demand. Environmental concerns, fuel resource challenges and a changing technology landscape are influencing changes within the power sector. Renewables and gas are being preferred for new capacity construction; due to the need to reduce emissions and coal supply constraints. Unlike coal or gas, renewable power generation is site-specific, with deployment, based on potential resource sites, which are typically remote with no significant power transmission assets. The intermittent nature of renewable power generation would require the enhancement of the grid to support effective technology integration.

Improving grid reliability and energy security are two major driving forces in well-established power markets. Ageing infrastructure in these markets are inducing safety concerns, leading to significant downtimes, and increasing operations and maintenance costs, thereby impacting the credibility of utilities and grid operators. Developing or under-developed markets have huge potential for grid expansion to sustain the power demand from growing population and industrial activity. The changes in the market would drive the global switchgears market, which is forecast to reach a value of $28.8bn in 2026 at a compound annual growth rate (CAGR) of 3.31% during 2022-26.

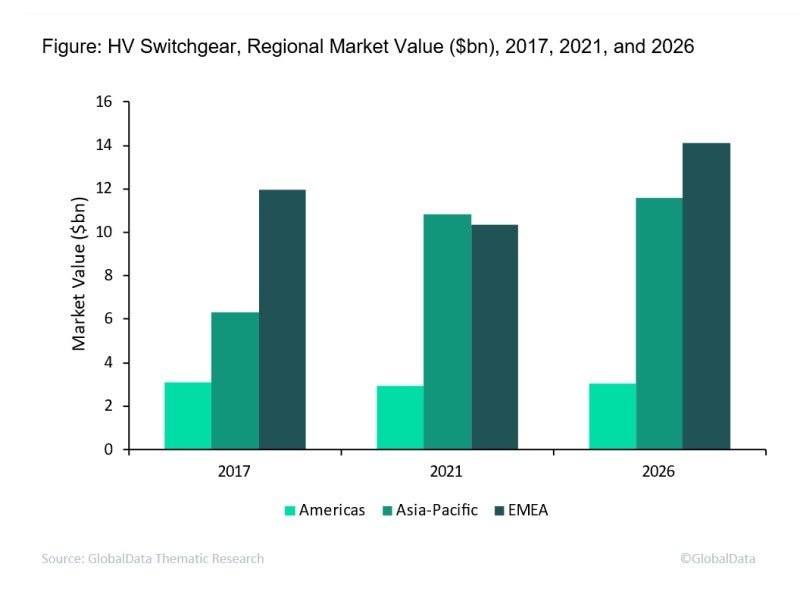

GlobalData’s report finds that policies established to address environmental challenges and capitalise on market opportunities afforded by technologies would notably impact the switchgears market by the end of the forecast period. In terms of high voltage (HV) switchgear market value, EMEA (Europe, Middle East and Africa) is expected to grow at a CAGR of 6.02%, which is higher than the growth in all other regions, during 2022-26. The UK, Germany, Russia and Turkey are the major countries in Europe, with Russia emerging as the biggest market in 2021. Europe is developing a unified grid to achieve energy security, encouraging investments in the transmission sector. Ageing infrastructure and increasing share of renewable energy sources, such as offshore wind, are contributing to the growth of the HV switchgear market in the region. The economic boom in countries in the Middle East led to an increase in demand for power, contributing to the growth of the market. The gas-insulated switchgear (GIS) market in this region benefited from its high functional reliability and equipment protection from extreme environmental conditions, and the growth is expected to continue. Saudi Arabia is a major country in the Middle East, with one of the biggest markets for GIS globally.

In Asia-Pacific, the growth is expected to be nominal during 2022-26, at a CAGR of 1.40%. In 2021, Asia-Pacific was the largest contributor to the global market in terms of market value, at $10.85bn, which is expected to reach $11.61bn in 2026. GIS is widely used in the region as it offers a smaller footprint for substations near urban load centres, where the cost of land is high. China, one of the fastest-growing economies with the largest fleet of transmission substations, topped the global HV switchgear market in 2021, accounting for 32.52% of the global market, and is expected to continue its leadership during the forecast period. The need to build transmission infrastructure to move power from renewable sources in remote regions, the increasing domestic demand for electricity, large-scale renewable energy deployment, projection of considerable growth in the gross domestic product (GDP) and rural electrification initiatives are some of the major factors aiding the growth of the market. The country has a higher potential for GIS in the Asia-Pacific region. The HV switchgear market in the Americas is expected to reach $3.05bn by 2026 as the grid requires upgrades to replace ageing assets and to accommodate the increasing sources of renewable energy. The US ranks second after China in the global HV switchgear market, accounting for 7.49% of the global market. Air-insulated switchgear (AIS) is predominant in the Americas, with a market share of 69% in 2021. Over the forecast period, GIS is expected to register increased adoption, especially in critical substation projects, due to its higher reliability. The HV switchgear market is supported by the increasing investment from investor-owned utilities to upgrade ageing infrastructure and the increasing power generation from renewable energy sources. Owing to a high degree of renewable penetration, especially wind farms, the utilities continue to make substantial investment to make their grid more resilient to accommodate intermittent sources of power. Brazil and Canada are the next largest markets in the Americas.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

GIS AG