GlobalData’s latest thematic report, ‘Hydrogen in Power’, provides an overview of the unfolding of hydrogen as a theme and its potential applications areas. It provides a detailed analysis of the hydrogen value chain, participation of leading players and hydrogen policies of key countries around the world.

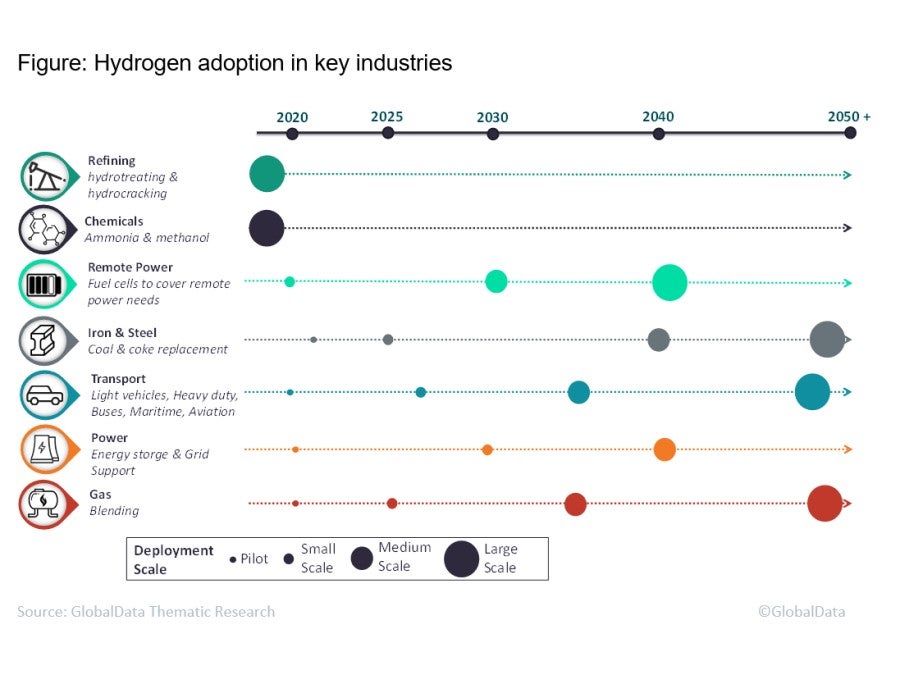

Hydrogen, specifically green hydrogen, has been a topic of interest for the renewable energy economy for a very long time. Hydrogen remains one of the most abundantly available and commonly known elements in the world, and it will become a gamechanger with its noteworthy contribution to clean energy transitions. Hydrogen is light, storable, energy-heavy and does not produce direct carbon emissions or greenhouse gases (GHG). Sectors such as oil refining and ammonia, methanol, and steel production have been using hydrogen extensively. Hydrogen will play a critical role in the transition to clean energy with the advancement of its applications in sectors such as transportation (fuel cell vehicles), buildings (hydrogen blending) and power generation.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHydrogen technology is now reaping the benefits of unprecedented political and business momentum, with many strategies, policies and hydrogen projects worldwide expanding swiftly. Globally, countries are striving to hasten the development and use of hydrogen technology to tackle environmental concerns and enhance energy security. Formulating a cost-effective and well-regulated transition is a complex issue, and the cost of producing hydrogen from renewable energy sources is currently expensive. However, the momentum that has been built along the entire value chain is accelerating the cost reduction in hydrogen production, transmission, distribution, retail and end-applications. Now is the time to scale up low-carbon technologies and lower their costs, so that hydrogen technology can be widely utilised.

Currently, in the power industry, hydrogen plays a minimal role and accounts for less than 0.2% of electricity generation. But a change is highly possible in the near future, as the mixing of ammonia can decrease the impact of carbon in existing conventional coal-fired power plants, hydrogen gas turbines and combined-cycle gas turbines (CCGT). When it comes to long-term and large-scale energy storage, hydrogen (in the form of compressed gas, ammonia (NH₃) or synthetic methane) has a role to play in balancing seasonal variations in electricity supply and demand from renewable energy sources.

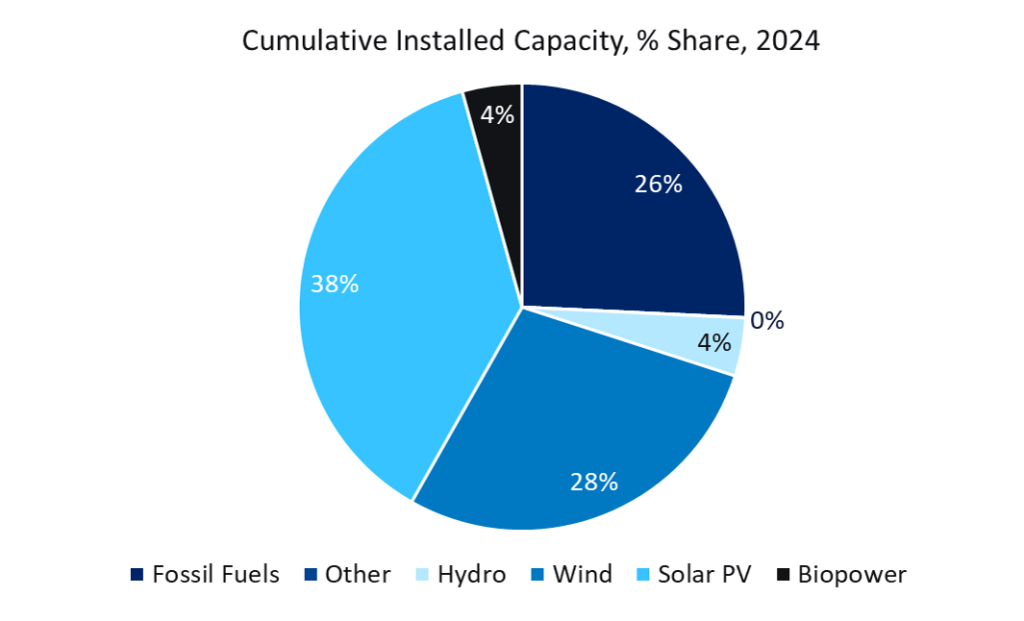

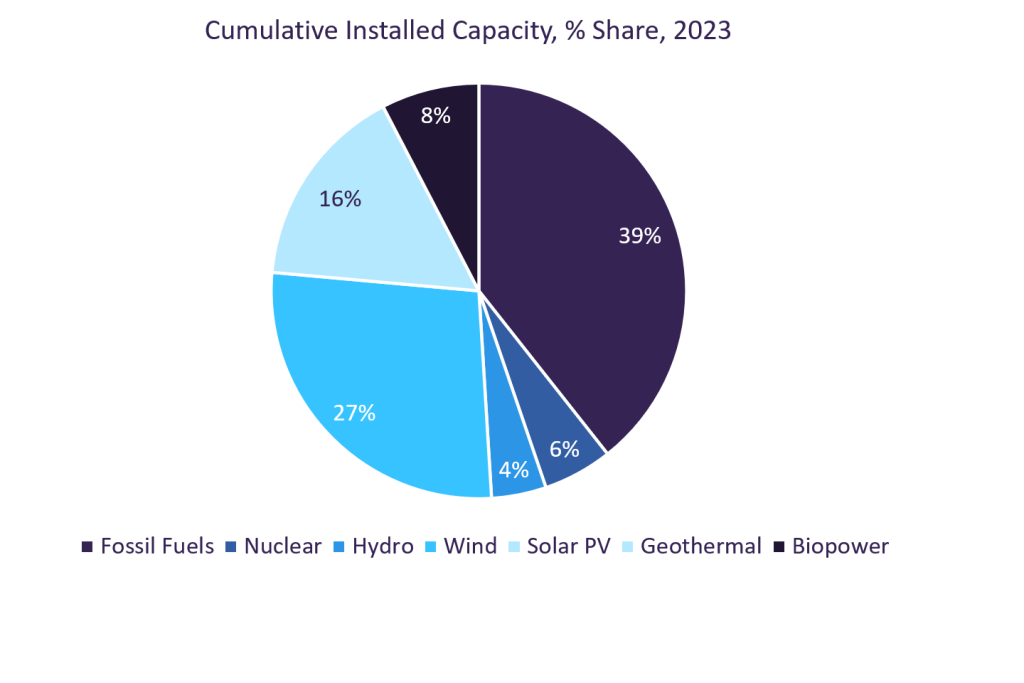

Hydrogen can also be used to cover remote power needs, which can be met by generating electricity from hydrogen fuels cells in regions or areas where electric infrastructure is not available, and locations that might not be connected to the grid. Electricity storage comes as part of the integration of Renewable Energy Sources (RES), which might be difficult to achieve in remote areas. Hydrogen-based fuel cells aim to ensure daily and seasonal electric needs, without relying on diesel or any other fossil fuel power generator, and to enable remote locations to become energy self-sufficient while contributing to climate change goals. The prospects of the hydrogen economy are rooted in the fact that it is a clean-burning fuel and that it is abundantly available. Hydrogen can work in tandem with renewable energy from solar, wind and other sources, and it can take the role of an energy carrier for renewable energy when deployed for electrification purposes. RES, such as wind and solar power, are expected to be a building block for the realisation of a green hydrogen economy. Therefore, the economics of renewable power generation is critical for the growth of green hydrogen adoption. According to Lazard’s Levelised Cost of Energy (LCOE) analysis, in 2020 technologies, including onshore wind and utility-scale solar, have become increasingly competitive with the marginal cost of existing conventional generation technologies. The cost of energy from renewables, particularly new wind and solar projects commissioned in 2021, fell below the costs of more than 800GW of existing coal-fired power plants globally.

See Also:

The technological advancements in wind power such as larger wind turbines and longer wind turbine rotor blades; along with the increasing efficiency of solar photovoltaic (PV) cells would prove beneficial for green hydrogen project deployments. The costs of new solar PV projects have fallen below $1,000 per kWh, while average new wind projects costs have fallen to about $1,400 per kWh. This improves the levelised costs of green hydrogen projects.

Newer strategies, such as power-to-hydrogen-to-power plants and power-to-X, are possible because of the declining costs of renewable power generation. In power generation applications new hydrogen gas turbines are being developed by vendors such as Siemens Energy, GE and Baker Hughes. Power-to-X strategies are also expected to get streamlined with time and may shape the role of hydrogen as a fuel and/or an energy carrier.

Governments are allowing tax breaks and subsidies to encourage fast adoption of the hydrogen economy – China, the US and some European countries have been at the forefront of the development of the hydrogen economy, thereby advancing their decarbonisation objectives.

Historically, hydrogen has been a key element in the manufacturing of several key industrial chemicals, such as methanol and ammonia; but it is predominantly used as an ingredient in crude oil refining applications. The so-called ‘hydrogen economy’ seeks to disrupt these conventions and utilise hydrogen as a fuel. With global leaders in the energy industry in search of solutions that help them achieve decarbonisation or enhance energy security, hydrogen seems to be on track to becoming an energy vector and its use is gathering momentum.

Related Company Profiles

Renewable Energy Sources LLC

Baker Hughes Co

Siemens Energy AG