GlobalData’s latest report, ‘Angola Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Angola and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

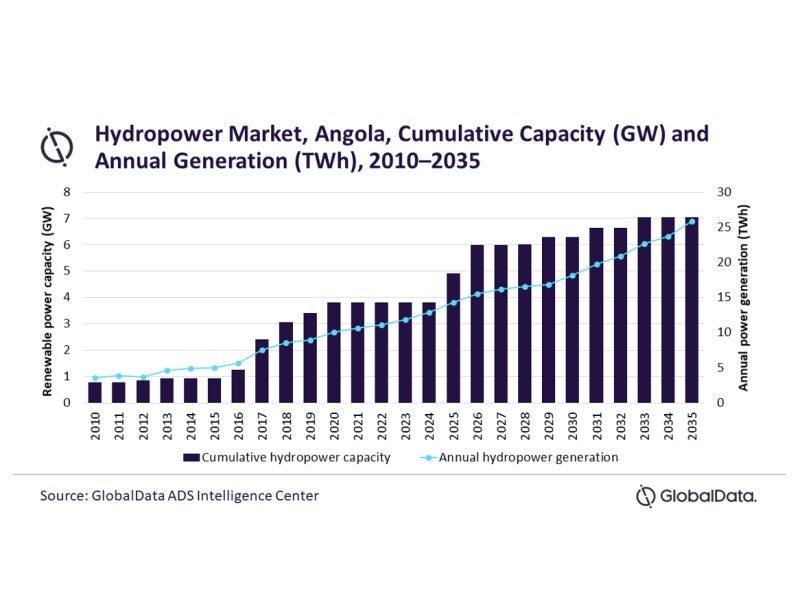

With hydropower being the primary source of power generation in Angola and potential likely to be exhausted, hydropower is expected to come down from 71.3% in 2021 to a share of 65.5% in 2035 in its total annual generation. However, the government has set a target of 9.9GW of total installed capacity, with a 60% electrification rate by 2025. It is expected that hydropower capacity will account for 6.6GW of the total target. Hence, Angola needs a well-planned infrastructure plan to meet the demand. It was estimated that the country has a potential of 18GW in hydropower throughout.

Angola’s energy demand is expected to witness a growing trend, based on the electrification rate in provincial capitals, municipal townships and communal townships. The country is planning to give priority to grid extension so that the maximum number of municipal and commune townships are electrified. To ensure a safe power supply, the country is increasing power capacity in all sub-systems and through a strong reliance on hydro and partially on gas and oil.

Increasing electric power availability to diversify the economy and meet the increasing energy demand of a growing population is among the Angolan Government’s highest stated priorities. To achieve the targeted 9.9GW of total installed capacity and a 60% electrification rate by 2025, the government has instituted an ambitious infrastructure plan. Current electrification rates are estimated at 43% in most cities and less than 10% in rural areas.

Angola introduced the National Adaptation Programme of Action (NAPA) as early as 2011. The plan estimated the country’s low-cost hydroelectric energy potential to be around 18,000GWh and estimated to meet its current and future needs, also exporting the surplus power to the region. The programme also acknowledged the potential of reducing deforestation, clean energy solution and small and micro-scale power plants. By 2020, nearly two-thirds of Angola’s electricity was generated through hydropower. Hydropower will contribute 6.6GW out of 9.9GW of planned capacity, as part of ‘Long Term Strategy Angola 2025’.

Real GDP (USD, 2010 prices) declined from $83.8bn in 2010 to $93.01bn in 2021, increasing at a CAGR of 1.0%. The GDP observed a fall in 2021 due to the Covid-19 pandemic. The Angola Government implemented national lockdowns to curb the spread of Covid-19, which resulted in reduced overall demand. Between 2021 and 2030, the economy is expected to grow at a CAGR of 2.8%, reaching $119.04bn in 2030.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData