GlobalData’s latest report, ‘India Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of India and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

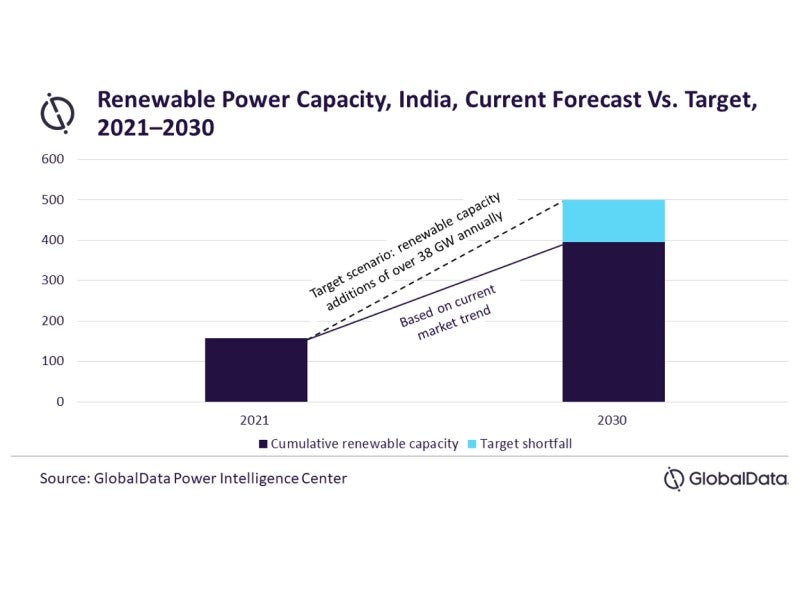

India announced new renewable energy goals last year to increase non-fossil power capacity to 500GW and meet 50% of the country’s electricity needs through renewables by 2030. However, after including large hydro under the definition of renewables, the country is likely to achieve its 2022 target but may miss out on the solar-specific target, and subsequently fall short of the 2030 target.

The target also includes achieving net-zero emissions by 2070. India mainly plans to achieve these long-term climate goals through capacity additions in solar and exploring its offshore wind potential.

India has already begun to focus on rooftop solar installations along with large ground-mounted solar PV projects. As part of the plan, India approved 45 solar parks with a total capacity of 37GW under its solar park scheme in September 2021.

India is situated in the solar belt and gets a significant amount of solar diffused horizontal irradiance (DNI) and global horizontal irradiance (GHI). The top solar power-rich states are Rajasthan, Karnataka, Gujarat, Andhra Pradesh, Telangana and Maharashtra. Regulatory bodies in India have drafted attractive policies and schemes to boost the renewable energy sector. For instance, the Ministry of New and Renewable Energy (MNRE) provides custom and excise duty benefits to the solar rooftop sector to propel growth.

The government has also been promoting wind power projects by providing various fiscal and promotional incentives. Some of the most important support schemes include accelerated depreciations, excise duty exemptions to manufacturers, concessional import duties on certain components of wind electricity generators, and a tax holiday on income generated from wind power projects. These are expected to encourage the private sector participation in renewable power projects.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTo achieve these targets, the country needs to add more than 38GW of renewable capacity annually during 2022-2030. Easing out approval processes, pre-identifying land spaces for the development of renewable power, enhancing the grid to be able to seamlessly connect renewable power plants, investing in battery storage and micro-grids in remote areas, holding renewable auctions without delays, enforcing renewable portfolio standard (RPS) mechanisms strongly, and educating the end-consumers on the adoption of small-scale systems, such as rooftop solar PV, will drive capacity additions in India in future. According to the current market scenario and growth trend, India is likely to fall short of the 2030 target by more than 104GW.

Related Company Profiles

GHI