GlobalData’s latest report, ‘Iran Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Iran and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

The Iranian power market has been severely impacted by the series of sanctions that have been imposed by the US, which has made it difficult for Iran’s finance and banking sectors to make payments or secure debt and equity finance for projects as it has become virtually impossible.

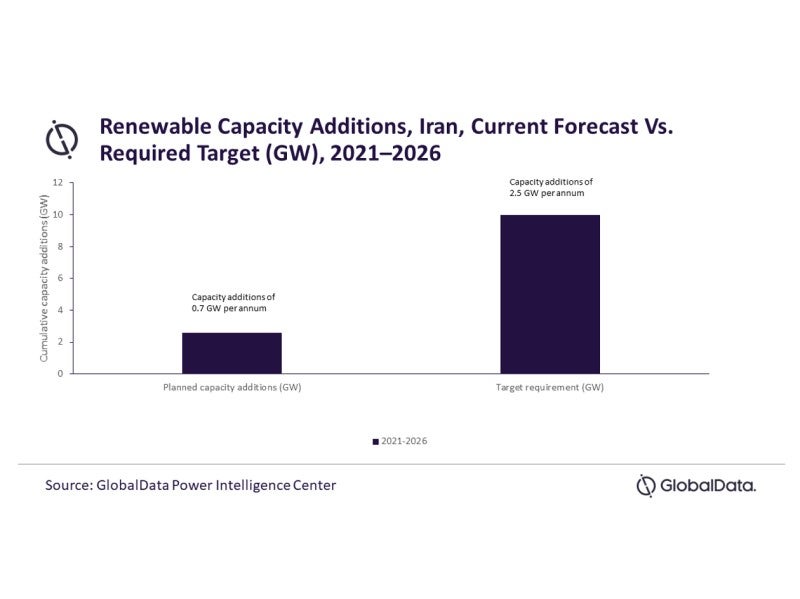

Despite the sanctions, in January 2022, the Iranian Energy Ministry announced plans to add 10GW of renewable capacity (including conventional hydropower) by the end of 2026 to achieve the long-term target of a renewable cumulative capacity of 30GW. The Renewable Energy and Energy Efficiency Organisation (SATBA) signed a Memorandum of Understanding (MOU) with private investors to execute the plan and has indicated that it would allocate around IRR30tn ($71.4m) towards the first set of projects in the upcoming budget. SATBA has revealed that applications have been received for more than 80GW of renewable power projects.

The government also allows custom-duty exceptions for equipment used in the construction of renewable power plants. As well as this, there is an electricity duty placed on electricity bills that are used for the development of renewable power plants. However, this has not been enough to secure the potential development of renewables in the country. The key challenge is the lack of foreign investments in the renewable sector due to the sanctions imposed on Iran.

There have been positive developments in the renewables sector following the commission of the country’s first solar cell factory in early 2022. The initial capacity of the plant is 150MW, and it is situated closely to Khomeini.

There are plans to increase the factory’s photovoltaic (PV) module capacity to 1.5GW by the end of 2023. However, to be able to fully accelerate renewable power development, Iran needs to execute the nuclear deal, which will lift sanctions on the country and bring in more private investments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe removal of the sanctions will provide the boost the Iranian renewable sector requires. According to the current trend, only a quarter of the targeted capacity additions will be achieved by 2026. Foreign investments in the renewable sector and a knowledge transfer of the latest additions in renewable technology will enable stakeholders to exploit the untapped potential of the Iranian renewable market.

Iran’s GDP (at constant prices) increased from $491.1bn in 2010 to $524.6bn in 2021, at a CAGR of 0.6%. The GDP (at constant prices) of the country declined in 2018 after a series of sanctions imposed by the US, dropping from $565.5bn in 2017 to $531.4bn 2018, and further declined to $495.4bn in 2019 at the advent of the pandemic. GDP stabilised in 2021 and is expected to grow at a CAGR of 2% to reach $627.1bn by 2030.

Related Company Profiles

MOU S.A.