GlobalData’s latest report, ‘Japan Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations and Competitive Landscape’, discusses the power market structure of Japan and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

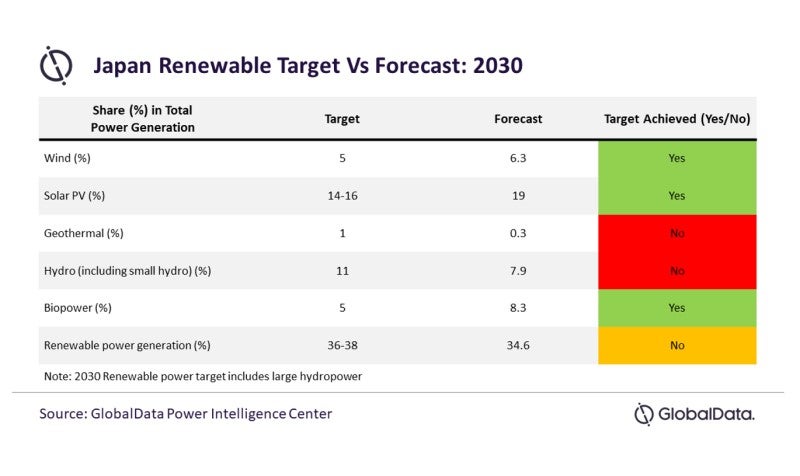

Japan is focusing on the rapid development of renewable energy to fill the void created by the Fukushima nuclear power plant disaster. Japan released the Sixth Strategic Energy Plan in October 2021, which increased the country’s renewable power (including hydropower) generation target from the previous 22%-24% to 36%-38% by 2030. According to the current trend, renewable power is set to account for 34.6% of the generation mix in 2030, which is close to the target.

Historically, the proliferation of renewable power projects has been hindered by the difficulty of getting such projects connected to the grid. Since the grid is in the hands of various local utilities, connection charges are high. This is compounded by the fact that the rules for setting up renewable projects are cumbersome, and it takes three or four years to clear all regulatory hurdles. Very few developers have sufficient funds or patience to see their projects through this process.

Consequently, the government has decided to reduce the waiting period for the approval of renewable power projects to less than two years. In addition, the establishment of a centrally operated grid may finally allow renewable projects to be set up faster, encouraging the sector to grow into a significant part of Japan’s power network. The implementation of an approval process for renewable projects through auctions will hopefully change the system and increase the speed at which projects are commissioned.

Another challenge that the country faces in the renewable sector’s expansion is a lack of space. Japan’s quest to replace thermal power with renewables will not be possible, mainly because it will need to cover virtually all its free land with solar panels to fully power the country.

Offshore wind is an option, and the country is also experimenting with floating solar power. These resources were expensive but are now more economical with improvements in technology. Again, Japan’s efforts to implement a public tendering system to approve new renewable power projects will be able to take advantage of the falling prices of newer technologies.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataJapan’s GDP (at constant prices) increased from $5,759.1bn in 2010 to $6,095.6bn in 2021, at a CAGR of 0.5%. The GDP (at constant prices) of the country declined sharply from $6,275.0bn in 2019 to $5,987.2bn in 2020 because of the Covid-19 pandemic. After the recommencement of regular industrial and trade activities, the GDP grew marginally by 1.8% in 2021 from 2020. The GDP is expected to cross pre-pandemic levels by 2023.